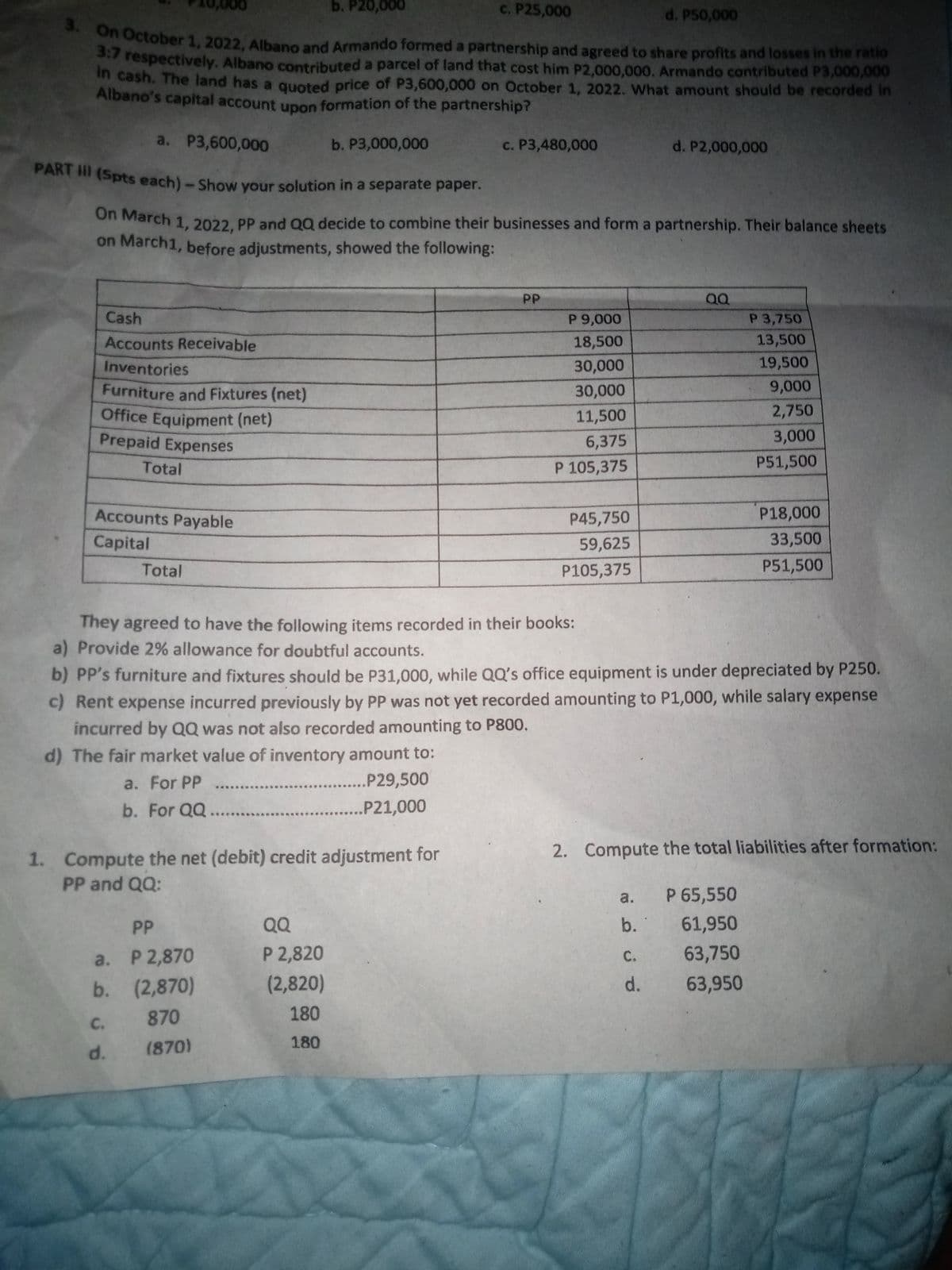

PART III (Spts each)-Show your solution in a separate paper. On March 1, 2022, PP and QQ decide to combine their businesses and form a partnership. Their balance sheets on March1, before adjustments, showed the following: Cash Accounts Receivable Inventories Furniture and Fixtures (net) Office Equipment (net) Prepaid Expenses Total Accounts Payable Capital Total C. d. 1. Compute the net (debit) credit adjustment for PP and QQ: PP a. P 2,870 b. (2,870) 870 (870) .P29,500 .P21,000 QQ P 2,820 (2,820) 180 180 PP P 9,000 18,500 30,000 30,000 11,500 6,375 P 105,375 They agreed to have the following items recorded in their books: a) Provide 2% allowance for doubtful accounts. b) PP's furniture and fixtures should be P31,000, while QQ's office equipment is under depreciated by P250. c) Rent expense incurred previously by PP was not yet recorded amounting to P1,000, while salary expense incurred by QQ was not also recorded amounting to P800. d) The fair market value of inventory amount to: a. For PP b. For QQ P45,750 59,625 P105,375 a. QQ b. P 3,750 13,500 19,500 9,000 2,750 3,000 P51,500 2. Compute the total liabilities after formation: P 65,550 61,950 63,750 63,950 C. d. P18,000 33,500 P51,500

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Pa help po

Step by step

Solved in 4 steps with 2 images