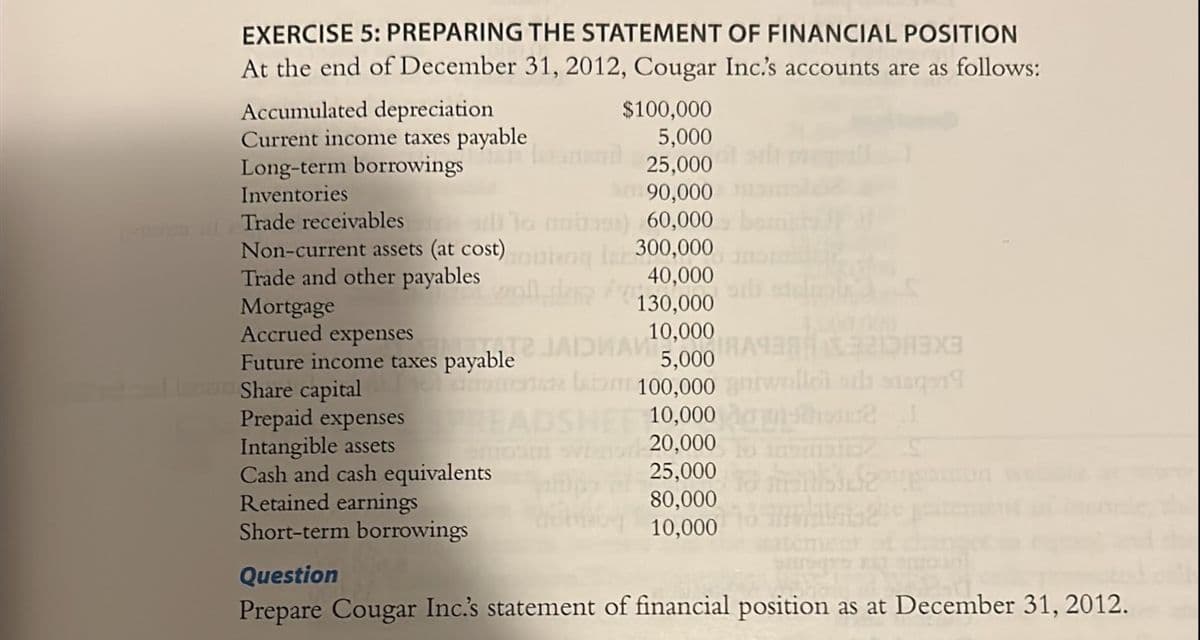

EXERCISE 5: PREPARING THE STATEMENT OF FINANCIAL POSITION At the end of December 31, 2012, Cougar Inc.'s accounts are as follows: Accumulated depreciation Current income taxes payable Long-term borrowings Inventories Trade receivables al Non-current assets (at cost) Trade and other payables Mortgage Accrued expenses Future income taxes payable Share capital $100,000 5,000 25,000 90,000 is) 60,000 300,000 40,000 130,000 10,000 T JADWAN 5,000 nomaalatan 100,000 Prepaid expenses Intangible assets Cash and cash equivalents PREADSHEE 10,000 20,000 Retained earnings Short-term borrowings 25,000 80,000 10,000 130220033 home nisi fe Question Prepare Cougar Inc.'s statement of financial position as at December 31, 201

EXERCISE 5: PREPARING THE STATEMENT OF FINANCIAL POSITION At the end of December 31, 2012, Cougar Inc.'s accounts are as follows: Accumulated depreciation Current income taxes payable Long-term borrowings Inventories Trade receivables al Non-current assets (at cost) Trade and other payables Mortgage Accrued expenses Future income taxes payable Share capital $100,000 5,000 25,000 90,000 is) 60,000 300,000 40,000 130,000 10,000 T JADWAN 5,000 nomaalatan 100,000 Prepaid expenses Intangible assets Cash and cash equivalents PREADSHEE 10,000 20,000 Retained earnings Short-term borrowings 25,000 80,000 10,000 130220033 home nisi fe Question Prepare Cougar Inc.'s statement of financial position as at December 31, 201

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 61E: Recording Various Liabilities Glenview Hardware had the following transactions that produced...

Related questions

Question

I need help with preparing a balance sheet as well as

Transcribed Image Text:EXERCISE 5: PREPARING THE STATEMENT OF FINANCIAL POSITION

At the end of December 31, 2012, Cougar Inc.'s accounts are as follows:

Accumulated depreciation

Current income taxes payable

Long-term borrowings

Inventories

Trade receivables

Non-current assets (at cost)

Trade and other payables

Mortgage

Accrued expenses

$100,000

5,000

25,000

90,000

to mabass) 60,000

300,000

40,000

130,000

10,000

MITTE JADWAN

30X320133

olanomatare Istam 100,000 gniwallol ads sinqer

PREADSH

10,000 m2 1

20,000

25,000

80,000

10,000

Future income taxes payable

Share capital

Prepaid expenses

Intangible assets

Cash and cash equivalents

Retained earnings

Short-term borrowings

Question

Prepare Cougar Inc.'s statement of financial position as at December 31, 2012.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning