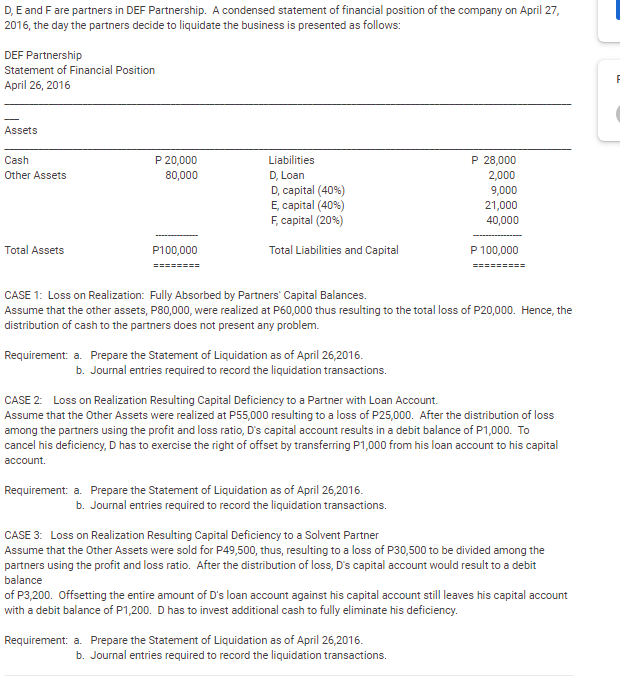

D, E and F are partners in DEF Partnership. A condensed statement of financial position of the company on April 27, 2016, the day the partners decide to liquidate the business is presented as follows: DEF Partnership Statement of Financial Position April 26, 2016 Assets P 20,000 80,000 P 28,000 2,000 9,000 Cash Liabilities Other Assets D, Loan D, capital (40%) E, capital (40%) F, capital (20%) 21,000 40,000 Total Assets P100,000 Total Liabilities and Capital P 100,000 ======== CASE 1: Loss on Realization: Fully Absorbed by Partners' Capital Balances. Assume that the other assets, P80,000, were realized at P60,000 thus resulting to the total loss of P20,000. Hence, the distribution of cash to the partners does not present any problem. Requirement: a. Prepare the Statement of Liquidation as of April 26,2016. b. Journal entries required to record the liquidation transactions.

D, E and F are partners in DEF Partnership. A condensed statement of financial position of the company on April 27, 2016, the day the partners decide to liquidate the business is presented as follows: DEF Partnership Statement of Financial Position April 26, 2016 Assets P 20,000 80,000 P 28,000 2,000 9,000 Cash Liabilities Other Assets D, Loan D, capital (40%) E, capital (40%) F, capital (20%) 21,000 40,000 Total Assets P100,000 Total Liabilities and Capital P 100,000 ======== CASE 1: Loss on Realization: Fully Absorbed by Partners' Capital Balances. Assume that the other assets, P80,000, were realized at P60,000 thus resulting to the total loss of P20,000. Hence, the distribution of cash to the partners does not present any problem. Requirement: a. Prepare the Statement of Liquidation as of April 26,2016. b. Journal entries required to record the liquidation transactions.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 14E

Related questions

Question

prepare the requirements on case 1

Transcribed Image Text:D, E and Fare partners in DEF Partnership. A condensed statement of financial position of the company on April 27,

2016, the day the partners decide to liquidate the business is presented as follows:

DEF Partnership

Statement of Financial Position

April 26, 2016

Assets

Cash

P 20,000

Liabilities

P 28,000

D, Loan

D, capital (40%)

E, capital (40%)

F, capital (20%)

2,000

9,000

21,000

Other Assets

80,000

40,000

Total Assets

P100,000

Total Liabilities and Capital

P 100,000

========

========I

CASE 1: Loss on Realization: Fully Absorbed by Partners' Capital Balances.

Assume that the other assets, P80,000, were realized at P60,000 thus resulting to the total loss of P20,000. Hence, the

distribution of cash to the partners does not present any problem.

Requirement: a. Prepare the Statement of Liquidation as of April 26,2016.

b. Journal entries required to record the liquidation transactions.

CASE 2: Loss on Realization Resulting Capital Deficiency to a Partner with Loan Account.

Assume that the Other Assets were realized at P55,000 resulting to a loss of P25,000. After the distribution of loss

among the partners using the profit and loss ratio, D's capital account results in a debit balance of P1,000. To

cancel his deficiency, D has to exercise the right of offset by transferring P1,000 from his loan account to his capital

account.

Requirement: a. Prepare the Statement of Liquidation as of April 26,2016.

b. Journal entries required to record the liquidation transactions.

CASE 3: Loss on Realization Resulting Capital Deficiency to a Solvent Partner

Assume that the Other Assets were sold for P49,500, thus, resulting to a loss of P30,500 to be divided among the

partners using the profit and loss ratio. After the distribution of loss, D's capital account would result to a debit

balance

of P3,200. Offsetting the entire amount of D's loan account against his capital account still leaves his capital account

with a debit balance of P1,200. D has to invest additional cash to fully eliminate his deficiency.

Requirement: a. Prepare the Statement of Liquidation as of April 26,2016.

b. Journal entries required to record the liquidation transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College