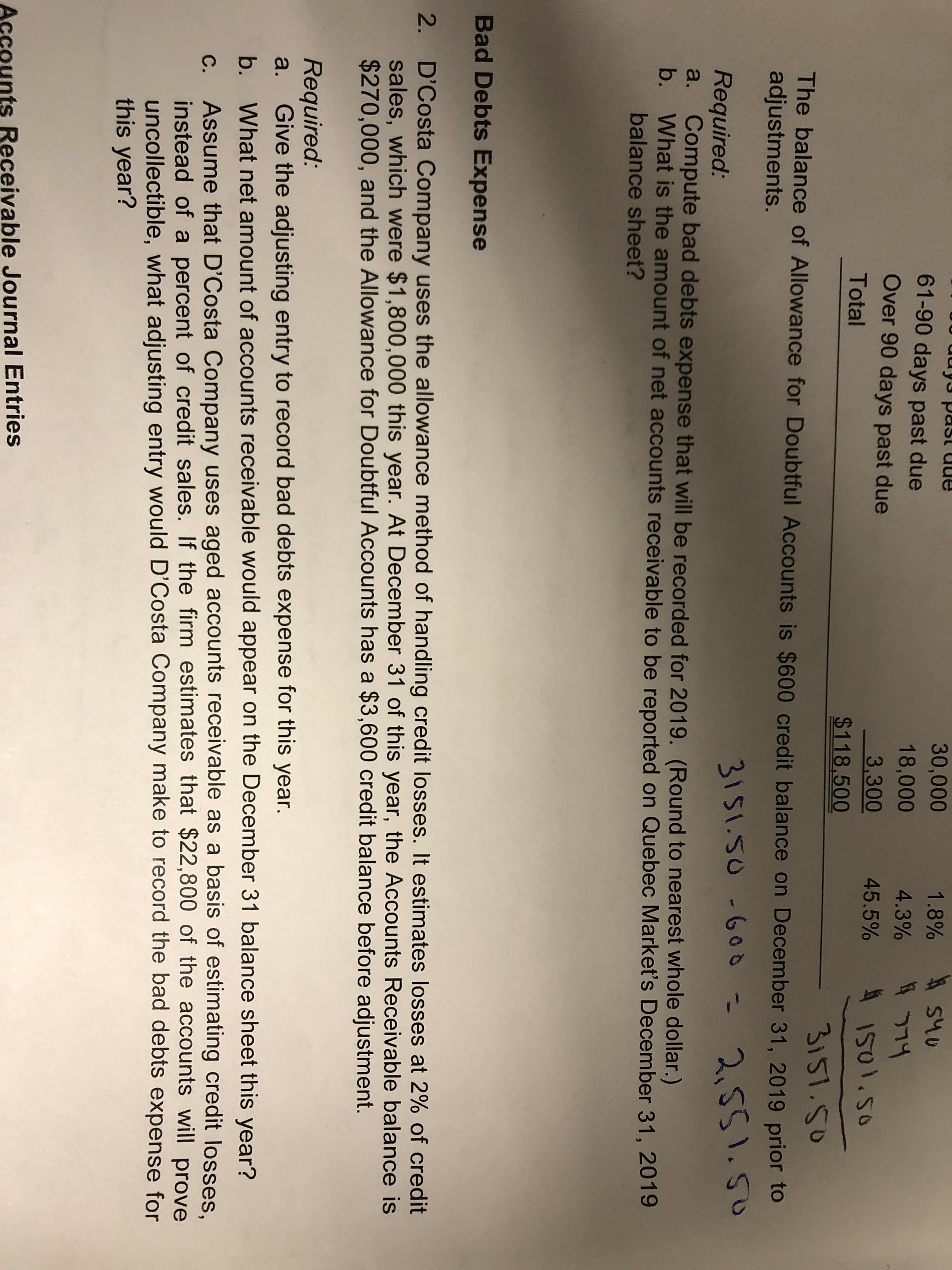

Past e 30,000 1.8% 61-90 days past due Over 90 days past due 18,000 4.3% 3,300 45.5% IS01.50 Total $118,500 3IS1.SO The balance of Allowance for Doubtful Accounts is $600 credit balance on December 31, 2019 prior to adjustments. 31SI.SO -60d 2.551.50 Required: Compute bad debts expense that will be recorded for 2019. (Round to nearest whole dollar.) b. What is the amount of net accounts receivable to be reported on Quebec Market's December 31, 2019 balance sheet? a. Bad Debts Expense 2. D'Costa Company uses the allowance method of handling credit losses. It estimates losses at 2 % of credit sales, which were $1,800,000 this year. At December 31 of this year, the Accounts Receivable balance is $270,000, and the Allowance for Doubtful Accounts has a $3,600 credit balance before adjustment. Required: Give the adjusting entry to record bad debts expense for this year. b. What net amount of accounts receivable would appear on the December 31 balance sheet this year? Assume that D'Costa Company uses aged accounts receivable as a basis of estimating credit losses. instead of a percent of credit sales. If the firm estimates that $22,800 of the accounts will prove uncollectible, what adjusting entry would D'Costa Company make to record the bad debts expense for this year? a. С. Acco ounts Receivable Journal Entries

Past e 30,000 1.8% 61-90 days past due Over 90 days past due 18,000 4.3% 3,300 45.5% IS01.50 Total $118,500 3IS1.SO The balance of Allowance for Doubtful Accounts is $600 credit balance on December 31, 2019 prior to adjustments. 31SI.SO -60d 2.551.50 Required: Compute bad debts expense that will be recorded for 2019. (Round to nearest whole dollar.) b. What is the amount of net accounts receivable to be reported on Quebec Market's December 31, 2019 balance sheet? a. Bad Debts Expense 2. D'Costa Company uses the allowance method of handling credit losses. It estimates losses at 2 % of credit sales, which were $1,800,000 this year. At December 31 of this year, the Accounts Receivable balance is $270,000, and the Allowance for Doubtful Accounts has a $3,600 credit balance before adjustment. Required: Give the adjusting entry to record bad debts expense for this year. b. What net amount of accounts receivable would appear on the December 31 balance sheet this year? Assume that D'Costa Company uses aged accounts receivable as a basis of estimating credit losses. instead of a percent of credit sales. If the firm estimates that $22,800 of the accounts will prove uncollectible, what adjusting entry would D'Costa Company make to record the bad debts expense for this year? a. С. Acco ounts Receivable Journal Entries

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 15P: Comprehensive Receivables Problem Blackmon Corporations December 31, 2018, balance sheet disclosed...

Related questions

Question

Can you please help with all of number 2? I’m struggling with this chapter and want to make sure I’m excited doing this right?

Transcribed Image Text:Past

e

30,000

1.8%

61-90 days past due

Over 90 days past due

18,000

4.3%

3,300

45.5%

IS01.50

Total

$118,500

3IS1.SO

The balance of Allowance for Doubtful Accounts is $600 credit balance on December 31, 2019 prior to

adjustments.

31SI.SO -60d

2.551.50

Required:

Compute bad debts expense that will be recorded for 2019. (Round to nearest whole dollar.)

b. What is the amount of net accounts receivable to be reported on Quebec Market's December 31, 2019

balance sheet?

a.

Bad Debts Expense

2. D'Costa Company uses the allowance method of handling credit losses. It estimates losses at 2 % of credit

sales, which were $1,800,000 this year. At December 31 of this year, the Accounts Receivable balance is

$270,000, and the Allowance for Doubtful Accounts has a $3,600 credit balance before adjustment.

Required:

Give the adjusting entry to record bad debts expense for this year.

b. What net amount of accounts receivable would appear on the December 31 balance sheet this year?

Assume that D'Costa Company uses aged accounts receivable as a basis of estimating credit losses.

instead of a percent of credit sales. If the firm estimates that $22,800 of the accounts will prove

uncollectible, what adjusting entry would D'Costa Company make to record the bad debts expense for

this year?

a.

С.

Acco

ounts Receivable Journal Entries

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning