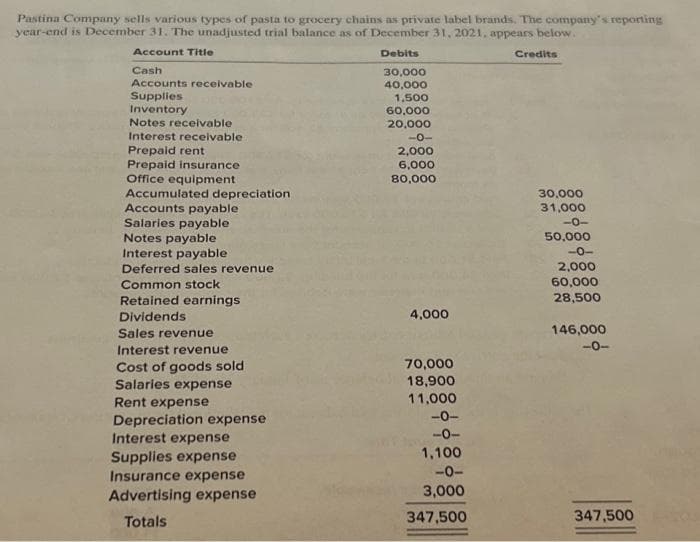

Pastina Company sells various types of pasta to grocery chains as private label brands. The company's reporting ear-end is December 31. The unadjusted trial balance as of December 31, 2021, appears below. Account Title Debits Cash Accounts receivable Supplies Inventory Notes receivable Interest receivable Prepaid rent Prepaid insurance. Office equipment Accumulated depreciation Accounts payable Salaries payable Notes payable Interest payable Deferred sales revenue Common stock Retained earnings Dividends Sales revenue Interest revenue Cost of goods sold Salaries expense Rent expense Depreciation expense Interest expense Supplies expense 30,000 40,000 1,500 60,000 20,000 -01 2,000 6,000 80,000 4,000 70,000 18,900 11,000 -0- -0- 1,100 Credits 30,000 31,000 -0- 50,000 -0- 2,000 60,000 28,500 146,000 -0-

Pastina Company sells various types of pasta to grocery chains as private label brands. The company's reporting ear-end is December 31. The unadjusted trial balance as of December 31, 2021, appears below. Account Title Debits Cash Accounts receivable Supplies Inventory Notes receivable Interest receivable Prepaid rent Prepaid insurance. Office equipment Accumulated depreciation Accounts payable Salaries payable Notes payable Interest payable Deferred sales revenue Common stock Retained earnings Dividends Sales revenue Interest revenue Cost of goods sold Salaries expense Rent expense Depreciation expense Interest expense Supplies expense 30,000 40,000 1,500 60,000 20,000 -01 2,000 6,000 80,000 4,000 70,000 18,900 11,000 -0- -0- 1,100 Credits 30,000 31,000 -0- 50,000 -0- 2,000 60,000 28,500 146,000 -0-

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 1PB: The trial balance of Jillson Company as of December 31, the end of its current fiscal year, is as...

Related questions

Question

Required:

Prepare the necessary December 31, 2021, adjusting

Refer to P2−3and complete the following steps:

Step 1: Enter the unadjusted balances from the trial balance into T-accounts.

Step 2: Post the adjusting entries prepared in P 2-3 to the accounts.

Step 3: Prepare an adjusted trial balance.

Step 4: Prepare an income statement and a statement of shareholders equity for the year ended December 31.2021 . and a classified balance sheet as of December 31, 2021. Assume that no common stock was issued during the year and that$ 4,000 in cash dividends were paid to shareholders during the year.

Step 5: Prepare closing entries and post to the accounts

Step 6: Prepare a post-closing trial balance.

i need help with all of this

Transcribed Image Text:Pastina Company sells various types of pasta to grocery chains as private label brands. The company's reporting

year-end is December 31. The unadjusted trial balance as of December 31, 2021, appears below.

Account Title

Debits

Cash

Accounts receivable

Supplies

Inventory

Notes receivable

Interest receivable

Prepaid rent

Prepaid insurance

Office equipment

Accumulated depreciation

Accounts payable

Salaries payable

Notes payable

Interest payable

Deferred sales revenue

Common stock

Retained earnings

Dividends

Sales revenue

Interest revenue

Cost of goods sold

Salaries expense

Rent expense

Depreciation expense

Interest expense

Supplies expense

Insurance expense

Advertising expense

Totals

30,000

40,000

1,500

60,000

20,000

-0-

2,000

6,000

80,000

4,000

70,000

18,900

11,000

-0-

-0-

1,100

-0-

3,000

347,500

Credits

30,000

31,000

-0-

50,000

-0-

2,000

60,000

28,500

146,000

-0-

347,500

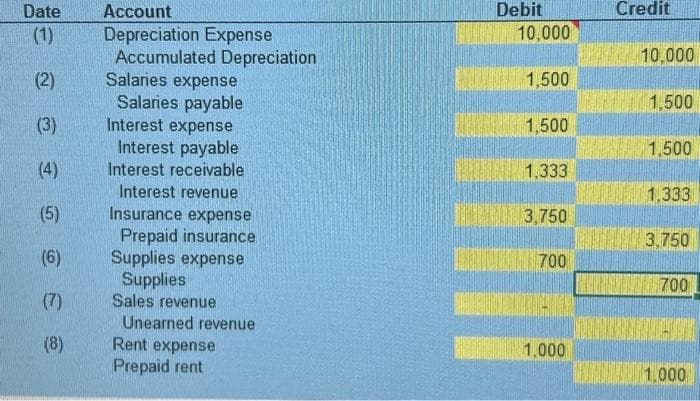

Transcribed Image Text:Date

(1)

(2)

(3)

#

(5)

(6)

(7)

(8)

Account

Depreciation Expense

Accumulated Depreciation

Salaries expense

Salaries payable

Interest expense

Interest payable

Interest receivable

Interest revenue

Insurance expense

Prepaid insurance

Supplies expense

Supplies

Sales revenue

Unearned revenue

Rent expense

Prepaid rent

Debit

10,000

1,500

1,500

1,333

3,750

700

1,000

Credit

10,000

1,500

1,500

1,333

3.750

700

-

1,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College