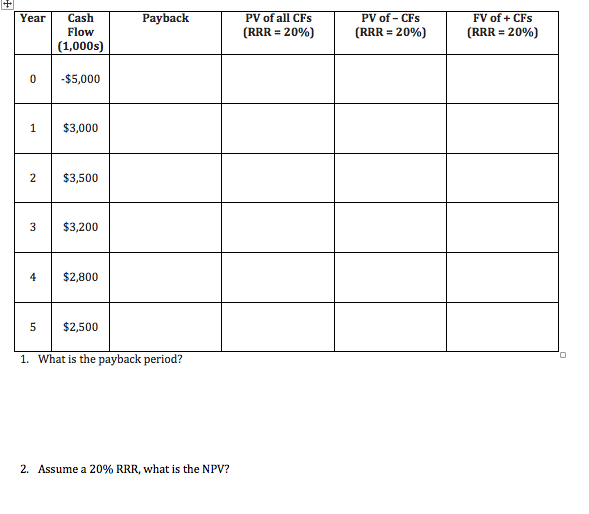

Payback PV of all CFs (RRR = 20%) PV of - CFs (RRR = 20%) Cash FV of + CFs Year Flow (RRR = 20%) %3D (1,000s) -$5,000 $3,000 $3,500 2 $3,200 $2,800 4 $2,500 1. What is the payback period? 2. Assume a 20% RRR, what is the NPV?

Payback PV of all CFs (RRR = 20%) PV of - CFs (RRR = 20%) Cash FV of + CFs Year Flow (RRR = 20%) %3D (1,000s) -$5,000 $3,000 $3,500 2 $3,200 $2,800 4 $2,500 1. What is the payback period? 2. Assume a 20% RRR, what is the NPV?

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter12: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 17P: EQUIVALENT ANNUAL ANNUITY A firm has two mutually exclusive investment projects to evaluate. The...

Related questions

Question

Please explain, I don't understand.

Transcribed Image Text:Payback

PV of all CFs

(RRR = 20%)

PV of - CFs

(RRR = 20%)

Cash

FV of + CFs

Year

Flow

(RRR = 20%)

%3D

(1,000s)

-$5,000

$3,000

$3,500

2

$3,200

$2,800

4

$2,500

1. What is the payback period?

2. Assume a 20% RRR, what is the NPV?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning