Payment of insurance premiums in advance gives rise to Accrued expense O Prepaid expense Unearned income Accrued income A sole proprietor settles the rental expenses of the entity amounting to P10,000 through his personal bank account. The journal entry should be (Debit account/Credit account): O Dr. Rent Expense . Cr. Capital. O Dr. Rent Expense . Cr. PSBank. O Dr. Rent Expense . Cr. Cas. Dr. Rent Expense. Cr. Drawings.

Payment of insurance premiums in advance gives rise to Accrued expense O Prepaid expense Unearned income Accrued income A sole proprietor settles the rental expenses of the entity amounting to P10,000 through his personal bank account. The journal entry should be (Debit account/Credit account): O Dr. Rent Expense . Cr. Capital. O Dr. Rent Expense . Cr. PSBank. O Dr. Rent Expense . Cr. Cas. Dr. Rent Expense. Cr. Drawings.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 11PA: Prepare journal entries to record the following transactions. Create a T-account for Prepaid...

Related questions

Question

ASAP answer the subquestions

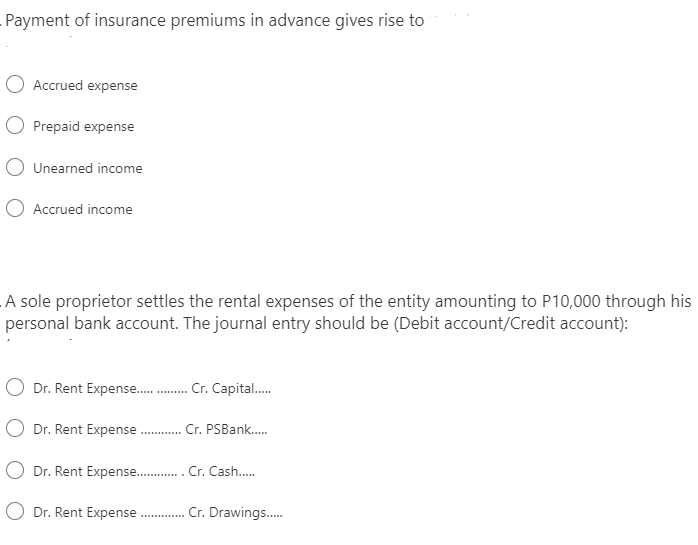

Transcribed Image Text:Payment of insurance premiums in advance gives rise to

Accrued expense

O Prepaid expense

Unearned income

Accrued income

A sole proprietor settles the rental expenses of the entity amounting to P10,000 through his

personal bank account. The journal entry should be (Debit account/Credit account):

O Dr. Rent Expense . Cr. Capital.

O Dr. Rent Expense . Cr. PSBank.

O Dr. Rent Expense . Cr. Cash.

O Dr. Rent Expense.

Cr. Drawings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning