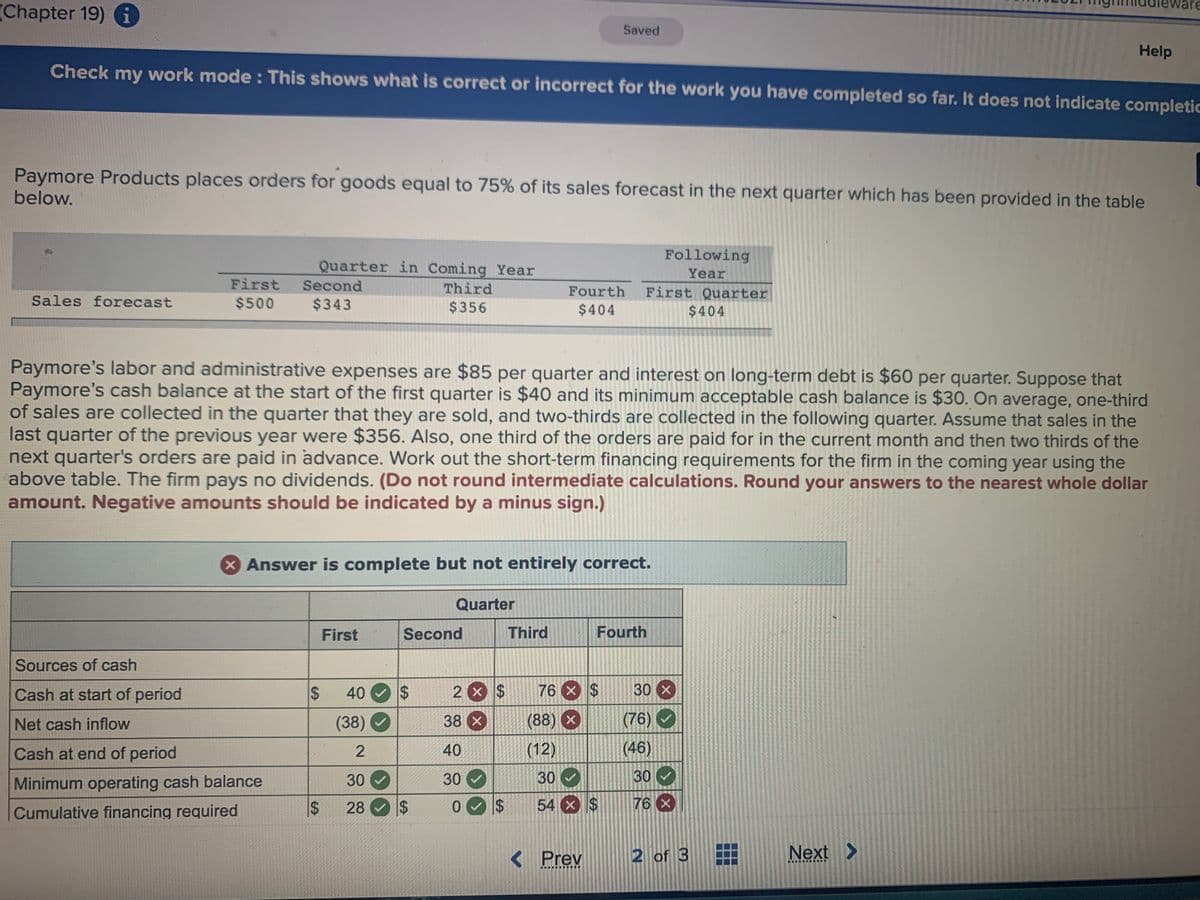

Paymore Products places orders for goods equal to 75% of its sales forecast in the next quarter which has been provided in the table below. Following Quarter in Coming Year Third Year First Second Fourth First Quarter $404 Sales forecast $500 $343 $356 $404 Paymore's labor and administrative expenses are $85 per quarter and interest on long-term debt is $60 per quarter. Suppose that Paymore's cash balance at the start of the first quarter is $40 and its minimum acceptable cash balance is $30. On average, one-third of sales are collected in the quarter that they are sold, and two-thirds are collected in the following quarter. Assume that sales in the last quarter of the previous year were $356. Also, one third of the orders are paid for in the current month and then two thirds of the next quarter's orders are paid in advance. Work out the short-term financing requirements for the firm in the coming year using the above table. The firm pays no dividends. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. Negative amounts should be indicated by a minus sign.)

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Please help if possible! Thanks

Budgeting -

Budgeting is the process of estimating future operations based on past performance. % are estimated and collections are estimated based on past performance.

Budgeting helps to control the operations from getting excess over its budgeted figures.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images