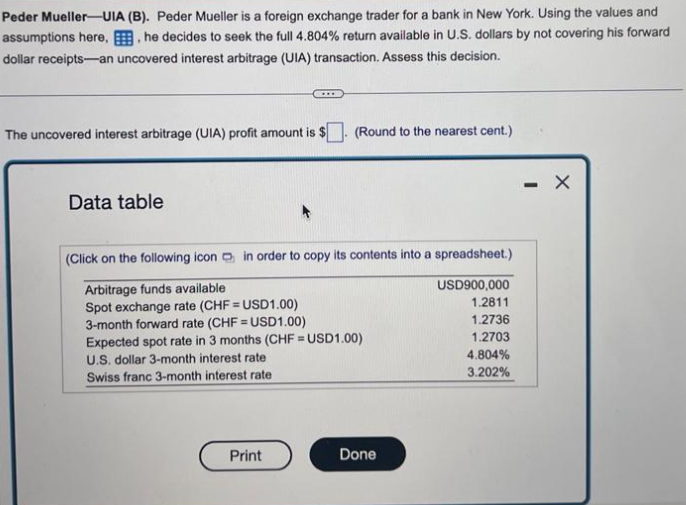

Peder Mueller-UIA (B). Peder Mueller is a foreign exchange trader for a bank in New York. Using the values and assumptions here, he decides to seek the full 4.804% return available in U.S. dollars by not covering his forward dollar receipts-an uncovered interest arbitrage (UIA) transaction. Assess this decision. . The uncovered interest arbitrage (UIA) profit amount is $ Data table ... Print (Round to the nearest cent.) (Click on the following icon in order to copy its contents into a spreadsheet.) Arbitrage funds available Spot exchange rate (CHF = USD1.00) 3-month forward rate (CHF = USD1.00) Expected spot rate in 3 months (CHF = USD1.00) U.S. dollar 3-month interest rate Swiss franc 3-month interest rate Done USD900,000 1.2811 1.2736 1.2703 4.804% 3.202% - X

Peder Mueller-UIA (B). Peder Mueller is a foreign exchange trader for a bank in New York. Using the values and assumptions here, he decides to seek the full 4.804% return available in U.S. dollars by not covering his forward dollar receipts-an uncovered interest arbitrage (UIA) transaction. Assess this decision. . The uncovered interest arbitrage (UIA) profit amount is $ Data table ... Print (Round to the nearest cent.) (Click on the following icon in order to copy its contents into a spreadsheet.) Arbitrage funds available Spot exchange rate (CHF = USD1.00) 3-month forward rate (CHF = USD1.00) Expected spot rate in 3 months (CHF = USD1.00) U.S. dollar 3-month interest rate Swiss franc 3-month interest rate Done USD900,000 1.2811 1.2736 1.2703 4.804% 3.202% - X

Chapter7: International Arbitrage And Interest Rate Parity

Section: Chapter Questions

Problem 1BIC

Related questions

Question

Ee 123.

Transcribed Image Text:Peder Mueller-UIA (B). Peder Mueller is a foreign exchange trader for a bank in New York. Using the values and

assumptions here,, he decides to seek the full 4.804% return available in U.S. dollars by not covering his forward

dollar receipts-an uncovered interest arbitrage (UIA) transaction. Assess this decision.

The uncovered interest arbitrage (UIA) profit amount is $

Data table

***

Print

(Round to the nearest cent.)

(Click on the following icon in order to copy its contents into a spreadsheet.)

Arbitrage funds available

Spot exchange rate (CHF = USD1.00)

3-month forward rate (CHF = USD1.00)

Expected spot rate in 3 months (CHF = USD1.00)

U.S. dollar 3-month interest rate

Swiss franc 3-month interest rate

Done

USD900,000

1.2811

1.2736

1.2703

4.804%

3.202%

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you