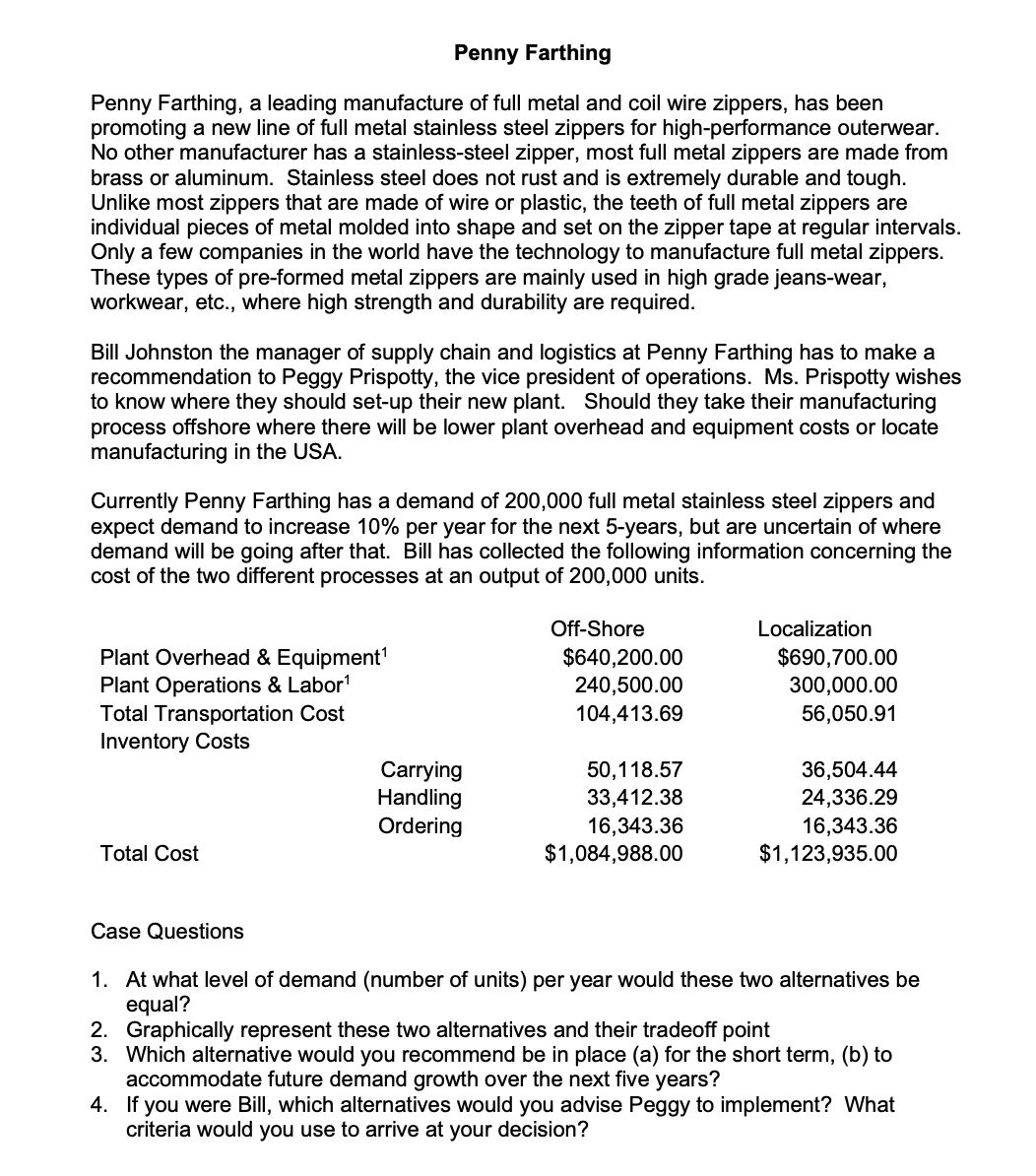

Penny Farthing, a leading manufacture of full metal and coil wire zippers, has been promoting a new line of full metal stainless steel zippers for high-performance outerwear. No other manufacturer has a stainless-steel zipper, most full metal zippers are made from prass or aluminum. Stainless steel does not rust and is extremely durable and tough. Unlike most zippers that are made of wire or plastic, the teeth of full metal zippers are ndividual pieces of metal molded into shape and set on the zipper tape at regular intervals. Only a few companies in the world have the technology to manufacture full metal zippers. These types of pre-formed metal zippers are mainly used in high grade jeans-wear, workwear, etc., where high strength and durability are required. Bill Johnston the manager of supply chain and logistics at Penny Farthing has to make a recommendation to Peggy Prispotty, the vice president of operations. Ms. Prispotty wishes o know where they should set-up their new plant. Should they take their manufacturing process offshore where there will be lower plant overhead and equipment costs or locate manufacturing in the USA. Currently Penny Farthing has a demand of 200,000 full metal stainless steel zippers and expect demand to increase 10% per year for the next 5-years, but are uncertain of where demand will be going after that. Bill has collected the following information concerning the cost of the two different processes at an output of 200,000 units. Plant Overhead & Equipment¹ Plant Operations & Labor¹ Total Transportation Cost Inventory Costs Total Cost Carrying Handling Ordering Off-Shore $640,200.00 240,500.00 104,413.69 50,118.57 33,412.38 16,343.36 $1,084,988.00 Localization $690,700.00 300,000.00 56,050.91 36,504.44 24,336.29 16,343.36 $1,123,935.00

Penny Farthing, a leading manufacture of full metal and coil wire zippers, has been promoting a new line of full metal stainless steel zippers for high-performance outerwear. No other manufacturer has a stainless-steel zipper, most full metal zippers are made from prass or aluminum. Stainless steel does not rust and is extremely durable and tough. Unlike most zippers that are made of wire or plastic, the teeth of full metal zippers are ndividual pieces of metal molded into shape and set on the zipper tape at regular intervals. Only a few companies in the world have the technology to manufacture full metal zippers. These types of pre-formed metal zippers are mainly used in high grade jeans-wear, workwear, etc., where high strength and durability are required. Bill Johnston the manager of supply chain and logistics at Penny Farthing has to make a recommendation to Peggy Prispotty, the vice president of operations. Ms. Prispotty wishes o know where they should set-up their new plant. Should they take their manufacturing process offshore where there will be lower plant overhead and equipment costs or locate manufacturing in the USA. Currently Penny Farthing has a demand of 200,000 full metal stainless steel zippers and expect demand to increase 10% per year for the next 5-years, but are uncertain of where demand will be going after that. Bill has collected the following information concerning the cost of the two different processes at an output of 200,000 units. Plant Overhead & Equipment¹ Plant Operations & Labor¹ Total Transportation Cost Inventory Costs Total Cost Carrying Handling Ordering Off-Shore $640,200.00 240,500.00 104,413.69 50,118.57 33,412.38 16,343.36 $1,084,988.00 Localization $690,700.00 300,000.00 56,050.91 36,504.44 24,336.29 16,343.36 $1,123,935.00

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

Transcribed Image Text:Penny Farthing

Penny Farthing, a leading manufacture of full metal and coil wire zippers, has been

promoting a new line of full metal stainless steel zippers for high-performance outerwear.

No other manufacturer has a stainless-steel zipper, most full metal zippers are made from

brass or aluminum. Stainless steel does not rust and is extremely durable and tough.

Unlike most zippers that are made of wire or plastic, the teeth of full metal zippers are

individual pieces of metal molded into shape and set on the zipper tape at regular intervals.

Only a few companies in the world have the technology to manufacture full metal zippers.

These types of pre-formed metal zippers are mainly used in high grade jeans-wear,

workwear, etc., where high strength and durability are required.

Bill Johnston the manager of supply chain and logistics at Penny Farthing has to make a

recommendation to Peggy Prispotty, the vice president of operations. Ms. Prispotty wishes

to know where they should set-up their new plant. Should they take their manufacturing

process offshore where there will be lower plant overhead and equipment costs or locate

manufacturing in the USA.

Currently Penny Farthing has a demand of 200,000 full metal stainless steel zippers and

expect demand to increase 10% per year for the next 5-years, but are uncertain of where

demand will be going after that. Bill has collected the following information concerning the

cost of the two different processes at an output of 200,000 units.

Plant Overhead & Equipment¹

Plant Operations & Labor¹

Total Transportation Cost

Inventory Costs

Total Cost

Case Questions

Carrying

Handling

Ordering

Off-Shore

$640,200.00

240,500.00

104,413.69

50,118.57

33,412.38

16,343.36

$1,084,988.00

Localization

$690,700.00

300,000.00

56,050.91

36,504.44

24,336.29

16,343.36

$1,123,935.00

1. At what level of demand (number of units) per year would these two alternatives be

equal?

2. Graphically represent these two alternatives and their tradeoff point

3. Which alternative would you recommend be in place (a) for the short term, (b) to

accommodate future demand growth over the next five years?

4. If you were Bill, which alternatives would you advise Peggy to implement? What

criteria would you use to arrive at your decision?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education