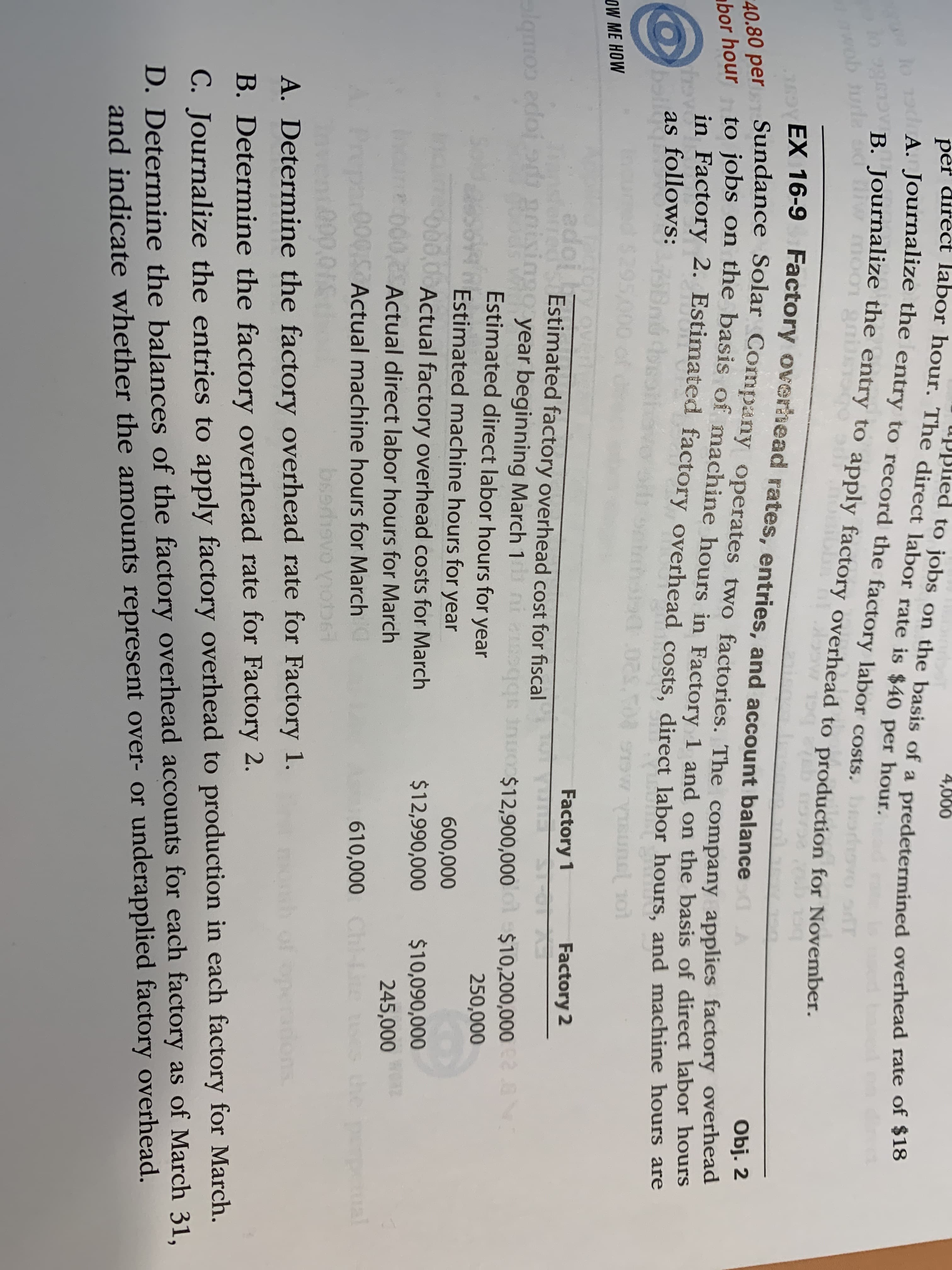

per direct labor hour. The direct labor rate is $40 per hour. A. Journalize the entry to record the factory labor costs. 4,000 upplied to jobs on the basis of a predetermined overhead rate of 320 B. Journalize the entry to apply factory overhead to production for November. wob turle EX 16-9 Factory overhead rates, entries, and account balance 40.80 per Sundance Solar Company operates two factories. The company applies factory overhead Obj. 2 to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are bor hour as follows: ballgn $29 1:10202 w VISUnel 10l OW ME HOW adope oned lamon edoj gnisingo year beginning March 1 Factory 1 Factory 2 Estimated factory overhead cost for fiscal ni esqqs inuo$12,900,000 o b b $10,200,0002.8 Estimated direct labor hours for year 250,000 Estimated machine hours for year 600,000 000,0 Actual factory overhead costs for March 000,2 Actual direct labor hours for March $12,990,000 $10,090,000 245,000 A Prepar00QI Actual machine hours for March 610,000 Ch-ite the peual 0,0111 bsedh A. Determine the factory overhead rate for Factory 1. B. Determine the factory overhead rate for Factory 2. C. Journalize the entries to apply factory overhead to production in each factory for March. D. Determine the balances of the factory overhead accounts for each factory as of March 31, and indicate whether the amounts represent over- or underapplied factory overhead.

per direct labor hour. The direct labor rate is $40 per hour. A. Journalize the entry to record the factory labor costs. 4,000 upplied to jobs on the basis of a predetermined overhead rate of 320 B. Journalize the entry to apply factory overhead to production for November. wob turle EX 16-9 Factory overhead rates, entries, and account balance 40.80 per Sundance Solar Company operates two factories. The company applies factory overhead Obj. 2 to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are bor hour as follows: ballgn $29 1:10202 w VISUnel 10l OW ME HOW adope oned lamon edoj gnisingo year beginning March 1 Factory 1 Factory 2 Estimated factory overhead cost for fiscal ni esqqs inuo$12,900,000 o b b $10,200,0002.8 Estimated direct labor hours for year 250,000 Estimated machine hours for year 600,000 000,0 Actual factory overhead costs for March 000,2 Actual direct labor hours for March $12,990,000 $10,090,000 245,000 A Prepar00QI Actual machine hours for March 610,000 Ch-ite the peual 0,0111 bsedh A. Determine the factory overhead rate for Factory 1. B. Determine the factory overhead rate for Factory 2. C. Journalize the entries to apply factory overhead to production in each factory for March. D. Determine the balances of the factory overhead accounts for each factory as of March 31, and indicate whether the amounts represent over- or underapplied factory overhead.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter26: Manufacturing Accounting: The Job Order Cost System

Section: Chapter Questions

Problem 5SEA: PREDETERMINED FACTORY OVERHEAD RATE Millerlile Enterprises calculates a predetermined factory...

Related questions

Question

Financial and

Transcribed Image Text:per direct labor hour. The direct labor rate is $40 per hour.

A. Journalize the entry to record the factory labor costs.

4,000

upplied to jobs on the basis of a predetermined overhead rate of 320

B. Journalize the entry to apply factory overhead to production for November.

wob turle

EX 16-9 Factory overhead rates, entries, and account balance

40.80 per Sundance Solar Company operates two factories. The company applies factory overhead

Obj. 2

to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours

in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are

bor hour

as follows:

ballgn

$29

1:10202 w VISUnel 10l

OW ME HOW

adope

oned

lamon edoj gnisingo year beginning March 1

Factory 1

Factory 2

Estimated factory overhead cost for fiscal

ni esqqs inuo$12,900,000 o

b b

$10,200,0002.8

Estimated direct labor hours for year

250,000

Estimated machine hours for year

600,000

000,0 Actual factory overhead costs for March

000,2 Actual direct labor hours for March

$12,990,000

$10,090,000

245,000

A Prepar00QI Actual machine hours for March

610,000 Ch-ite

the

peual

0,0111

bsedh

A. Determine the factory overhead rate for Factory 1.

B. Determine the factory overhead rate for Factory 2.

C. Journalize the entries to apply factory overhead to production in each factory for March.

D. Determine the balances of the factory overhead accounts for each factory as of March 31,

and indicate whether the amounts represent over- or underapplied factory overhead.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning