per is given by TC = 500Q + 300,000. Assume that the firm maximises profits and is the only company selling in the market. a. What is the level of production, price, and total profit per week? If +h tax :1 000

per is given by TC = 500Q + 300,000. Assume that the firm maximises profits and is the only company selling in the market. a. What is the level of production, price, and total profit per week? If +h tax :1 000

Chapter19: Externalities And Public Goods

Section: Chapter Questions

Problem 19.1P: A firm in a perfectly competitive industry has patented a newprocess for making widgets. The new...

Related questions

Question

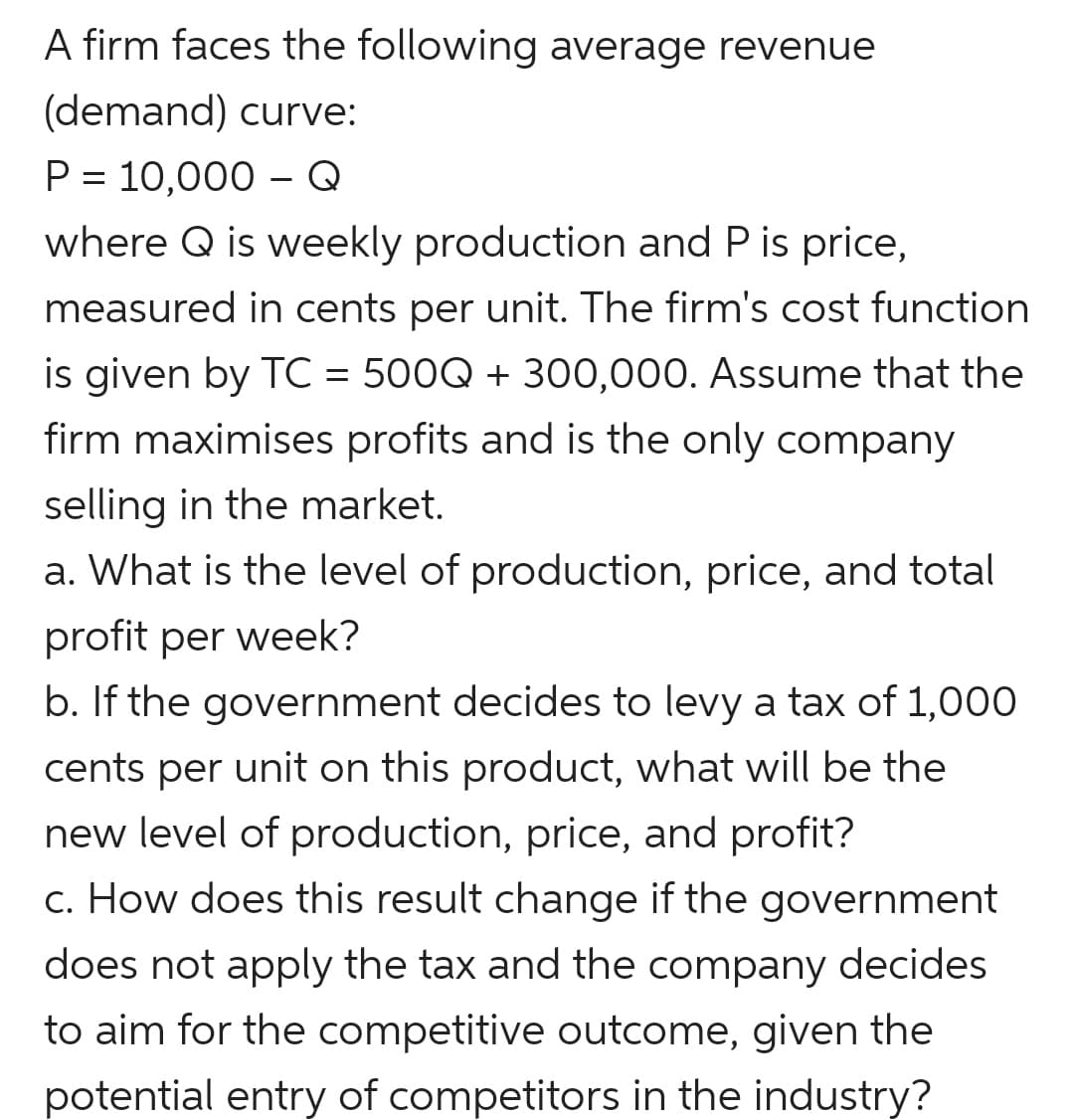

Transcribed Image Text:A firm faces the following average revenue

(demand) curve:

P = 10,000 – Q

where Q is weekly production and P is price,

measured in cents per unit. The firm's cost function

is given by TC = 500Q + 300,000. Assume that the

firm maximises profits and is the only company

selling in the market.

a. What is the level of production, price, and total

profit per week?

b. If the government decides to levy a tax of 1,000

cents per unit on this product, what will be the

new level of production, price, and profit?

c. How does this result change if the government

does not apply the tax and the company decides

to aim for the competitive outcome, given the

potential entry of competitors in the industry?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc