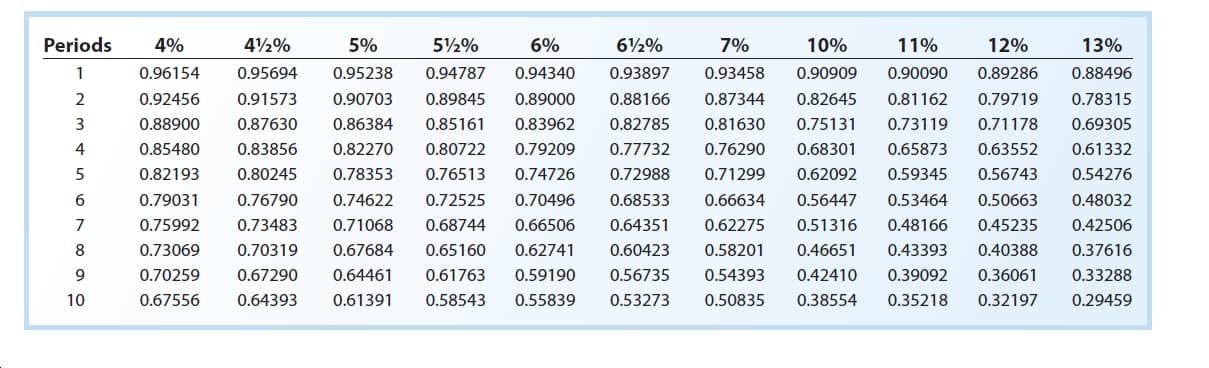

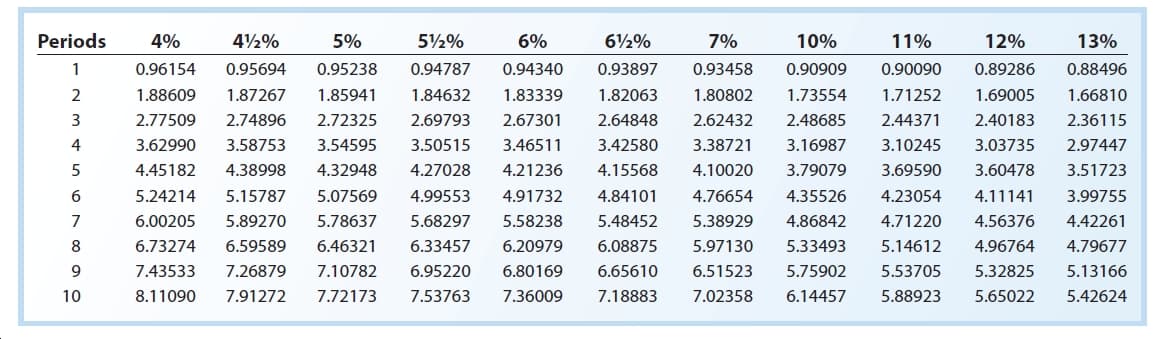

Periods 52% 4% 42% 5% 6% 7% 10% 11% 12% 13% 0.96154 0.95694 0.94787 0.94340 0.93897 0.93458 0.90909 0.89286 0.95238 0.90090 0.88496 0.91573 0.90703 0.89000 0.88166 0.92456 0.89845 0.87344 0.82645 0.81162 0.79719 0.78315 3 0.88900 0.87630 0.86384 0.85161 0.83962 0.82785 0.81630 0.75131 0.73119 0.71178 0.69305 0.80722 0.68301 0.85480 0.83856 0.82270 0.79209 0.77732 0.76290 0.65873 0.63552 0.61332 0.78353 0.76513 0.71299 0.54276 0.82193 0.80245 0.74726 0.72988 0.62092 0.59345 0.56743 0.79031 0.74622 0.72525 0.68533 0.66634 0.50663 0.76790 0.70496 0.56447 0.53464 0.48032 0.75992 0.73483 0.71068 0.68744 0.66506 0.64351 0.62275 0.51316 0.48166 0.45235 0.42506 0.65160 0.60423 0.58201 0.40388 8 0.73069 0.70319 0.67684 0.62741 0.46651 0.43393 0.37616 0.36061 0.70259 0.64461 0.59190 0.54393 0.67290 0.61763 0.56735 0.42410 0.39092 0.33288 0.64393 10 0.67556 0.61391 0.58543 0.55839 0.53273 0.50835 0.38554 0.35218 0.32197 0.29459 Periods 4% 42% 5½% 6% 7% 10% 11% 12% 13% 0.94340 0.96154 0.95694 0.95238 0.94787 0.93897 0.93458 0.90909 0.90090 0.89286 0.88496 1.82063 1.73554 1.69005 1.88609 1.87267 1.85941 1.84632 1.83339 1.80802 1.71252 1.66810 2.72325 3 2.77509 2.74896 2.69793 2.67301 2.64848 2.62432 2.48685 2.44371 2.40183 2.36115 3.62990 3.50515 2.97447 4 3.58753 3.54595 3.46511 3.42580 3.38721 3.16987 3.10245 3.03735 4.38998 4.45182 4.32948 4.27028 4.21236 4.15568 4.10020 3.79079 3.69590 3.60478 3.51723 5.15787 5.07569 5.24214 4.99553 4.91732 4.84101 4.76654 4.35526 4.23054 4.11141 3.99755 6.00205 5.89270 5.78637 5.68297 5.58238 5.48452 5.38929 4.86842 4.71220 4.56376 4.42261 6.73274 6.59589 6.46321 6.33457 6.20979 6.08875 5.97130 5.33493 5.14612 4.96764 4.79677 6.51523 9. 7.43533 7.26879 7.10782 6.95220 6.80169 6.65610 5.75902 5.53705 5.32825 5.13166 7.91272 7.53763 7.18883 7.02358 10 8.11090 7.72173 7.36009 6.14457 5.88923 5.65022 5.42624

Periods 52% 4% 42% 5% 6% 7% 10% 11% 12% 13% 0.96154 0.95694 0.94787 0.94340 0.93897 0.93458 0.90909 0.89286 0.95238 0.90090 0.88496 0.91573 0.90703 0.89000 0.88166 0.92456 0.89845 0.87344 0.82645 0.81162 0.79719 0.78315 3 0.88900 0.87630 0.86384 0.85161 0.83962 0.82785 0.81630 0.75131 0.73119 0.71178 0.69305 0.80722 0.68301 0.85480 0.83856 0.82270 0.79209 0.77732 0.76290 0.65873 0.63552 0.61332 0.78353 0.76513 0.71299 0.54276 0.82193 0.80245 0.74726 0.72988 0.62092 0.59345 0.56743 0.79031 0.74622 0.72525 0.68533 0.66634 0.50663 0.76790 0.70496 0.56447 0.53464 0.48032 0.75992 0.73483 0.71068 0.68744 0.66506 0.64351 0.62275 0.51316 0.48166 0.45235 0.42506 0.65160 0.60423 0.58201 0.40388 8 0.73069 0.70319 0.67684 0.62741 0.46651 0.43393 0.37616 0.36061 0.70259 0.64461 0.59190 0.54393 0.67290 0.61763 0.56735 0.42410 0.39092 0.33288 0.64393 10 0.67556 0.61391 0.58543 0.55839 0.53273 0.50835 0.38554 0.35218 0.32197 0.29459 Periods 4% 42% 5½% 6% 7% 10% 11% 12% 13% 0.94340 0.96154 0.95694 0.95238 0.94787 0.93897 0.93458 0.90909 0.90090 0.89286 0.88496 1.82063 1.73554 1.69005 1.88609 1.87267 1.85941 1.84632 1.83339 1.80802 1.71252 1.66810 2.72325 3 2.77509 2.74896 2.69793 2.67301 2.64848 2.62432 2.48685 2.44371 2.40183 2.36115 3.62990 3.50515 2.97447 4 3.58753 3.54595 3.46511 3.42580 3.38721 3.16987 3.10245 3.03735 4.38998 4.45182 4.32948 4.27028 4.21236 4.15568 4.10020 3.79079 3.69590 3.60478 3.51723 5.15787 5.07569 5.24214 4.99553 4.91732 4.84101 4.76654 4.35526 4.23054 4.11141 3.99755 6.00205 5.89270 5.78637 5.68297 5.58238 5.48452 5.38929 4.86842 4.71220 4.56376 4.42261 6.73274 6.59589 6.46321 6.33457 6.20979 6.08875 5.97130 5.33493 5.14612 4.96764 4.79677 6.51523 9. 7.43533 7.26879 7.10782 6.95220 6.80169 6.65610 5.75902 5.53705 5.32825 5.13166 7.91272 7.53763 7.18883 7.02358 10 8.11090 7.72173 7.36009 6.14457 5.88923 5.65022 5.42624

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Current Liabilities And Payroll

Section: Chapter Questions

Problem 10.23EX

Related questions

Concept explainers

Question

100%

Moss Co. issued $42,000,000 of five-year, 11% bonds, with interest payable semiannually, at a market (effective) interest rate of 9%. Determine the present

Exhibits 8 and 10 Attached

Transcribed Image Text:Periods

52%

4%

42%

5%

6%

7%

10%

11%

12%

13%

0.96154

0.95694

0.94787

0.94340

0.93897

0.93458

0.90909

0.89286

0.95238

0.90090

0.88496

0.91573

0.90703

0.89000

0.88166

0.92456

0.89845

0.87344

0.82645

0.81162

0.79719

0.78315

3

0.88900

0.87630

0.86384

0.85161

0.83962

0.82785

0.81630

0.75131

0.73119

0.71178

0.69305

0.80722

0.68301

0.85480

0.83856

0.82270

0.79209

0.77732

0.76290

0.65873

0.63552

0.61332

0.78353

0.76513

0.71299

0.54276

0.82193

0.80245

0.74726

0.72988

0.62092

0.59345

0.56743

0.79031

0.74622

0.72525

0.68533

0.66634

0.50663

0.76790

0.70496

0.56447

0.53464

0.48032

0.75992

0.73483

0.71068

0.68744

0.66506

0.64351

0.62275

0.51316

0.48166

0.45235

0.42506

0.65160

0.60423

0.58201

0.40388

8

0.73069

0.70319

0.67684

0.62741

0.46651

0.43393

0.37616

0.36061

0.70259

0.64461

0.59190

0.54393

0.67290

0.61763

0.56735

0.42410

0.39092

0.33288

0.64393

10

0.67556

0.61391

0.58543

0.55839

0.53273

0.50835

0.38554

0.35218

0.32197

0.29459

Transcribed Image Text:Periods

4%

42%

5½%

6%

7%

10%

11%

12%

13%

0.94340

0.96154

0.95694

0.95238

0.94787

0.93897

0.93458

0.90909

0.90090

0.89286

0.88496

1.82063

1.73554

1.69005

1.88609

1.87267

1.85941

1.84632

1.83339

1.80802

1.71252

1.66810

2.72325

3

2.77509

2.74896

2.69793

2.67301

2.64848

2.62432

2.48685

2.44371

2.40183

2.36115

3.62990

3.50515

2.97447

4

3.58753

3.54595

3.46511

3.42580

3.38721

3.16987

3.10245

3.03735

4.38998

4.45182

4.32948

4.27028

4.21236

4.15568

4.10020

3.79079

3.69590

3.60478

3.51723

5.15787

5.07569

5.24214

4.99553

4.91732

4.84101

4.76654

4.35526

4.23054

4.11141

3.99755

6.00205

5.89270

5.78637

5.68297

5.58238

5.48452

5.38929

4.86842

4.71220

4.56376

4.42261

6.73274

6.59589

6.46321

6.33457

6.20979

6.08875

5.97130

5.33493

5.14612

4.96764

4.79677

6.51523

9.

7.43533

7.26879

7.10782

6.95220

6.80169

6.65610

5.75902

5.53705

5.32825

5.13166

7.91272

7.53763

7.18883

7.02358

10

8.11090

7.72173

7.36009

6.14457

5.88923

5.65022

5.42624

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning