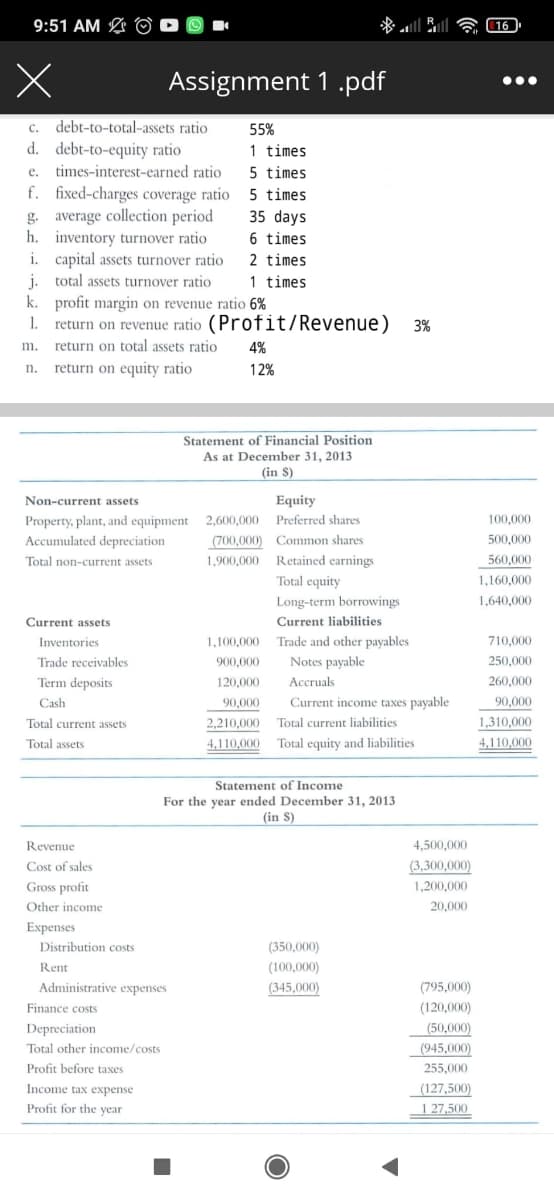

9:51 AM O 16 Assignment 1 .pdf •.. debt-to-total-assets ratio 55% C. d. debt-to-equity ratio 1 times times-interest-earned ratio f. fixed-charges coverage ratio g. average collection period h. inventory turnover ratio i. capital assets turnover ratio i. total assets turnover ratio 5 times 5 times 35 days e. 6 times 2 times 1 times k. profit margin on revenue ratio 6% 1. return on revenue ratio (Profit/Revenue) 3% return on total assets ratio 4% m. n. return on equity ratio 12% Statement of Financial Position As at December 31, 2013 (in S) Non-current assets Equity 100,000 Property, plant, and equipment Accumulated depreciation 2,600,000 Preferred shares (700,000) Common shares 500,000 Total non-current assets 1,900,000 Retained earnings 560,000 Total equity 1,160,000 Long-term borrowings 1,640,000 Current assets Current liabilities Trade and other payables Notes payable Inventories 1,100,000 710,000 Trade receivables 900,000 250,000 Term deposits 120,000 Accruals 260,000 Cash 90,000 Current income taxes payable 90,000 Total current assets 2,210,000 Total current liabilities 1,310,000 Total assets 4,110,000 Total equity and liabilities 4,110,000 Statement of Income For the year ended December 31, 2013 (in S) Revenue 4,500,000 Cost of sales (3,300,000) Gross profit 1,200,000 Other income 20,000 Expenses Distribution costs (350,000) Rent (100,000) Administrative expenses (345,000) (795,000) Finance costs (120,000) Depreciation (50,000) Total other income/costs (945,000) Profit before taxes 255,000 Income tax expense (127,500) Profit for the year 1 27,500

9:51 AM O 16 Assignment 1 .pdf •.. debt-to-total-assets ratio 55% C. d. debt-to-equity ratio 1 times times-interest-earned ratio f. fixed-charges coverage ratio g. average collection period h. inventory turnover ratio i. capital assets turnover ratio i. total assets turnover ratio 5 times 5 times 35 days e. 6 times 2 times 1 times k. profit margin on revenue ratio 6% 1. return on revenue ratio (Profit/Revenue) 3% return on total assets ratio 4% m. n. return on equity ratio 12% Statement of Financial Position As at December 31, 2013 (in S) Non-current assets Equity 100,000 Property, plant, and equipment Accumulated depreciation 2,600,000 Preferred shares (700,000) Common shares 500,000 Total non-current assets 1,900,000 Retained earnings 560,000 Total equity 1,160,000 Long-term borrowings 1,640,000 Current assets Current liabilities Trade and other payables Notes payable Inventories 1,100,000 710,000 Trade receivables 900,000 250,000 Term deposits 120,000 Accruals 260,000 Cash 90,000 Current income taxes payable 90,000 Total current assets 2,210,000 Total current liabilities 1,310,000 Total assets 4,110,000 Total equity and liabilities 4,110,000 Statement of Income For the year ended December 31, 2013 (in S) Revenue 4,500,000 Cost of sales (3,300,000) Gross profit 1,200,000 Other income 20,000 Expenses Distribution costs (350,000) Rent (100,000) Administrative expenses (345,000) (795,000) Finance costs (120,000) Depreciation (50,000) Total other income/costs (945,000) Profit before taxes 255,000 Income tax expense (127,500) Profit for the year 1 27,500

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter4: Completing The Accounting Cycle

Section: Chapter Questions

Problem 4.3CP: Financial statements Assume that you recently accepted a position with Five Star National Bank ...

Related questions

Question

Transcribed Image Text:9:51 AM L O

16

Assignment 1 .pdf

C.

debt-to-total-assets ratio

55%

d. debt-to-equity ratio

1 times

5 times

5 times

35 days

e.

times-interest-earned ratio

f. fixed-charges coverage ratio

g. average collection period

h. inventory turnover ratio

i. capital assets turnover ratio

j. total assets turnover ratio

6 times

2 times

1 times

k. profit margin on revenue ratio 6%

1. return on revenue ratio (Profit/Revenue)

return on total assets ratio

3%

m.

4%

return on equity ratio

12%

n.

Statement of Financial Position

As at December 31, 2013

(in S)

Non-current assets

Equity

Property, plant, and equipment

2.600,000 Preferred shares

100,000

Accumulated depreciation

(700,000) Common shares

500,000

Total non-current assets

1,900,000 Retained earnings

560,000

Total equity

1,160,000

Long-term borrowings

1,640,000

Current assets

Current liabilities

Inventories

1,100,000 Trade and other payables

710,000

Trade receivables

900,000

Notes payable

250,000

Term deposits

120,000

Accruals

260,000

Cash

90,000

Current income taxes payable

90,000

Total current assets

2,210,000

Total current liabilities

1,310,000

Total assets

4,110,000

Total equity and liabilities

4,110,000

Statement of Income

For the year ended December 31, 2013

(in S)

Revenue

4,500,000

Cost of sales

(3,300,000)

Gross profit

1,200,000

Other income

20,000

Expenses

Distribution costs

(350,000)

Rent

(100,000)

Administrative expenses

(345,000)

(795,000)

Finance costs

(120,000)

Depreciation

(50,000)

Total other income/costs

(945,000)

Profit before taxes

255,000

Income tax expense

(127,500)

Profit for the year

1 27,500

Transcribed Image Text:9:50 AM L O

16

Assignment 1 .pdf

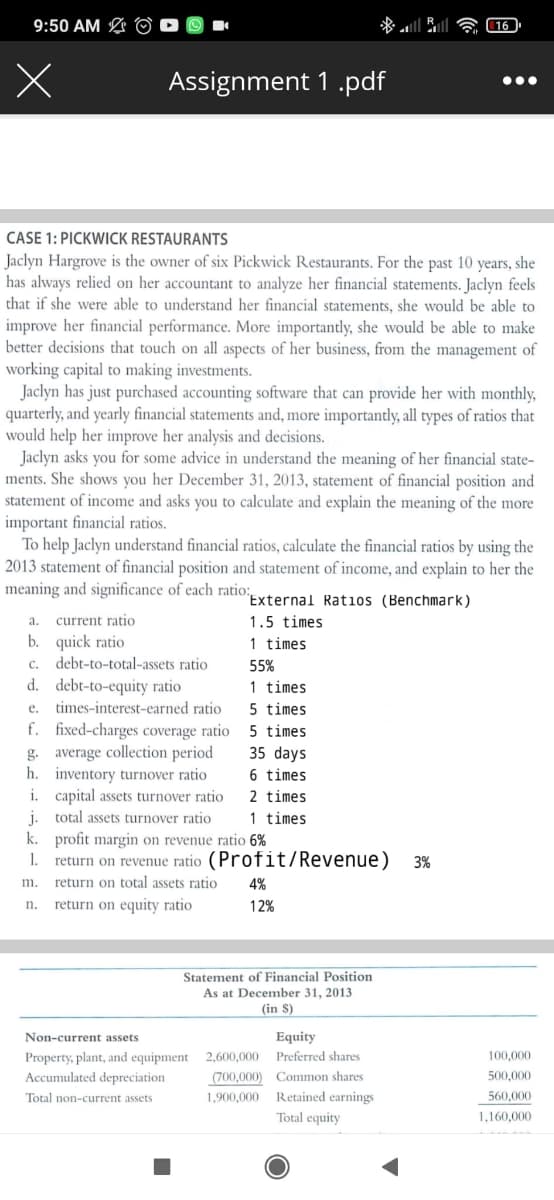

CASE 1: PICKWICK RESTAURANTS

Jaclyn Hargrove is the owner of six Pickwick Restaurants. For the past 10 years, she

has always relied on her accountant to analyze her financial statements. Jaclyn feels

that if she were able to understand her financial statements, she would be able to

improve her financial performance. More importantly, she would be able to make

better decisions that touch on all aspects of her business, from the management of

working capital to making investments.

Jaclyn has just purchased accounting software that can provide her with monthly,

quarterly, and yearly financial statements and, more importantly, all types of ratios that

would help her improve her analysis and decisions.

Jaclyn asks you for some advice in understand the meaning of her financial state-

ments. She shows you her December 31, 2013, statement of financial position and

statement of income and asks you to calculate and explain the meaning of the more

important financial ratios.

To help Jaclyn understand financial ratios, calculate the financial ratios by using the

2013 statement of financial position and statement of income, and explain to her the

meaning and significance of each ratio:,

"External Ratios (Benchmark)

current ratio

1.5 times

1 times

b. quick ratio

c. debt-to-total-assets ratio

d. debt-to-equity ratio

55%

1 times

e. times-interest-earned ratio

f. fixed-charges coverage ratio

g. average collection period

h.

5 times

5 times

35 days

inventory turnover ratio

i. capital assets turnover ratio

6 times

2 times

j. total assets turnover ratio

1 times

k. profit margin on revenue ratio 6%

1. return on revenue ratio (Profit/Revenue) 3%

m.

return on total assets ratio

4%

n.

return on equity ratio

12%

Statement of Financial Position

As at December 31, 2013

(in S)

Non-current assets

Equity

2,600,000 Preferred shares

100,000

Property, plant, and equipment

Accumulated depreciation

(700,000) Common shares

500,000

Total non-current assets

1,900,000 Retained earnings

560,000

Total equity

1,160,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Can you provide me the full answer for this quiestion

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning