plain what happens to (ii) MS and (iii) interest tes hen the real economy expands (Y rises), the emand for money expands. As a result, ouseholds hold more cash and the supply of oney expands. gree or Disagree mpact on MS Choose... Choose... remain unchanged decrease Disagree Agree O O O

plain what happens to (ii) MS and (iii) interest tes hen the real economy expands (Y rises), the emand for money expands. As a result, ouseholds hold more cash and the supply of oney expands. gree or Disagree mpact on MS Choose... Choose... remain unchanged decrease Disagree Agree O O O

Chapter25: Money, Banking, And The Federal Reserve System

Section: Chapter Questions

Problem 13P

Related questions

Question

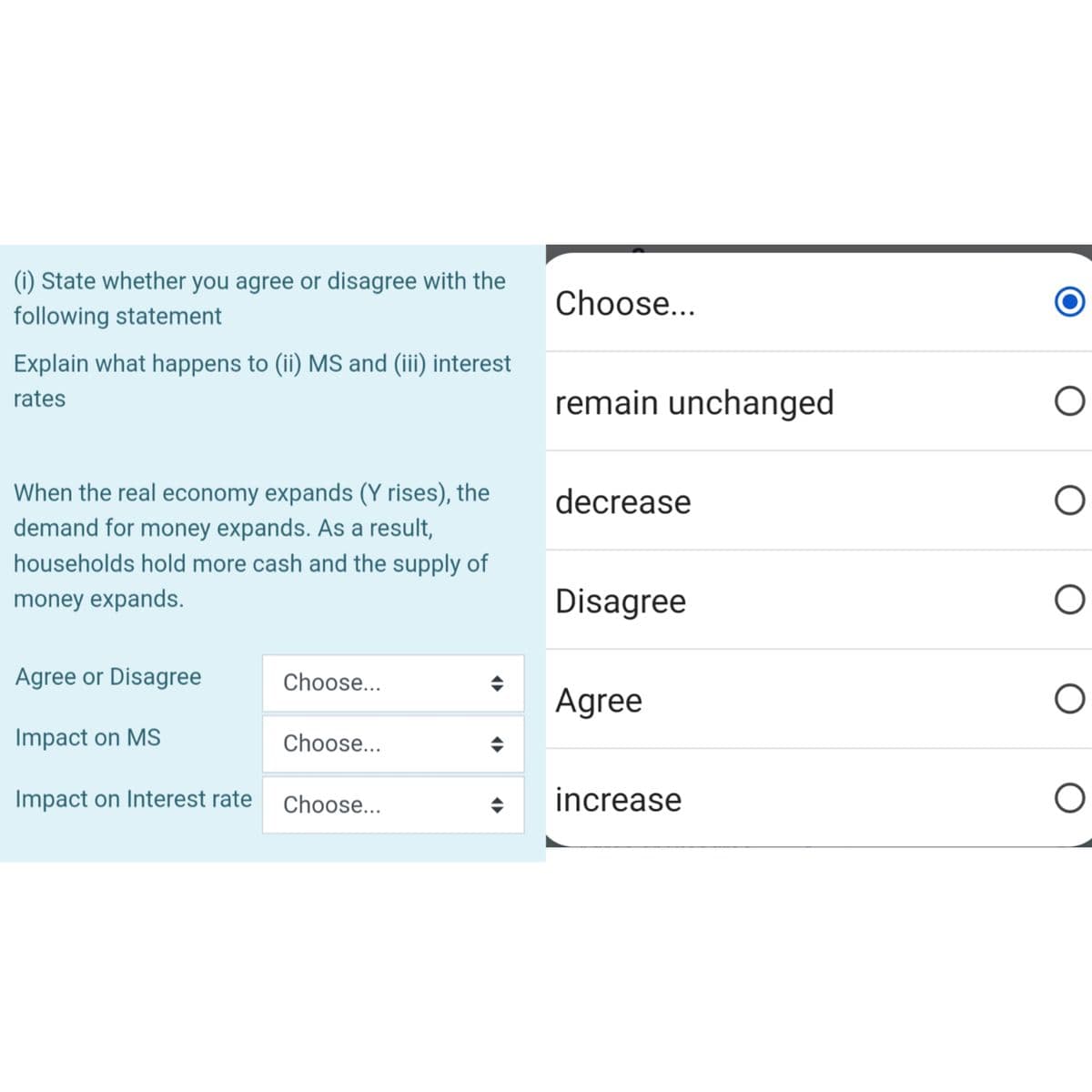

Transcribed Image Text:(i) State whether you agree or disagree with the

following statement

Explain what happens to (ii) MS and (iii) interest

rates

When the real economy expands (Y rises), the

demand for money expands. As a result,

households hold more cash and the supply of

money expands.

Agree or Disagree

Impact on MS

Impact on Interest rate

Choose...

Choose...

Choose...

(▶►

Choose...

remain unchanged

decrease

Disagree

Agree

increase

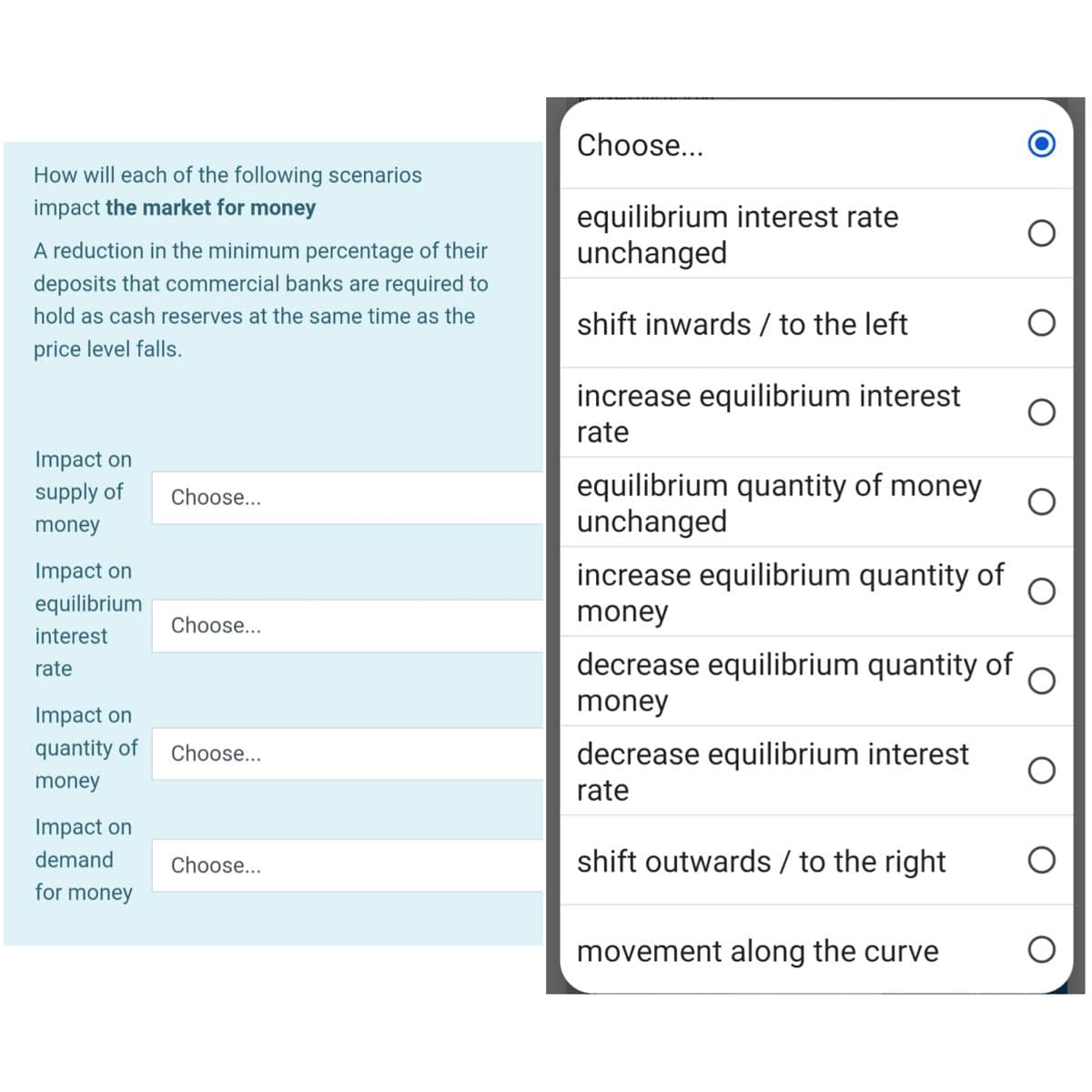

Transcribed Image Text:How will each of the following scenarios

impact the market for money

A reduction in the minimum percentage of their

deposits that commercial banks are required to

hold as cash reserves at the same time as the

price level falls.

Impact on

supply of

money

Impact on

equilibrium

interest

rate

Choose...

Impact on

demand

for money

Choose...

Impact on

quantity of Choose...

money

Choose...

Choose...

equilibrium interest rate

unchanged

shift inwards / to the left

increase equilibrium interest

rate

equilibrium quantity of money

unchanged

increase equilibrium quantity of

money

decrease equilibrium quantity of

money

decrease equilibrium interest

rate

shift outwards / to the right

movement along the curve

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning