Please answer this question as soon as possible.

Q: Please help me answer this question, VAT - 15%

A: Owners Equity The calculation of owners equity is to the beginning balance of equity plus net income…

Q: e missing amounts.

A: We know that Revenue - Cost of Goods sold = Gross Profit Gross Profit - Expenses = Operating…

Q: Please helped me answer 1 and 2. Thank you.

A: Note receivable refers to the amount that the company is supposed to be collected from their…

Q: Could you please finish the remaining questions?

A: The breakeven point (break-even price) of a transaction or investment is determined by comparing the…

Q: Can someone please explain how I answer this question? It's question number 3

A: As per 2022 table, CPP is 5.7% of gross pay subject to basic personal exemption of $ 3500 and the…

Q: IF YOU ARE GIVEN OPPORTUNITY TO CHOOSE TO OPEN AN ACCOUNT, WHICH WILL YOU PREFER AND WHY?

A: A bank account is the account in which a person can deposit and withdraw his or her money. In order…

Q: kindly ans

A: Calculation of Lease Liability Years Lease Rental PVF @ 12% Present Value 2020 575000 0.89286…

Q: Sir please help me urgently

A: Calculation of net profit Particulars Amount Sale price 85 Variable cost (58) Contribution…

Q: Please answer this question with brief solution. I need the answer ASAP thank you!

A: Depreciation is a cost charged over the fixed assets for over a period of time. Fixed Assets are the…

Q: please help me

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: Please answer a,b and c.... Please answer all.. thank you

A: The capital budgeting is a technique that helps to analyze the profitability of the project.

Q: Can someone explain to me how to make a T account?

A: In financial accounting, all the transactions or the events should be first recorded in the general…

Q: Sir please help urgently

A: Loan Instalment 773000 773000 Interest Rate 14% 3% Life 41 years 41 years Date of loan…

Q: at are those? Please Explain?

A: Definition :- A closing entry may be a journal entry that's made at the top of an accounting period…

Q: Please answer this question correctly ASAP. Thank you

A: Annual return = (Current value / Past value)^(1/Time) - 1

Q: ase hel

A: Long service leaves provision expense refers to the Act established in 1955, which provides the…

Q: if someone can answer quickly i will give a thumbs up!

A: Variable Costing: The amount at any given volume of output by which aggregate variable cost are…

Q: Write a response to Cory. Explain your position.

A: Bonus is the amount which is given to the employee which is usually based on certain conditions and…

Q: need answers thank you.

A: The question is based on the concept of Financial Accounting.

Q: please answer this thank you

A: In this question, we have to find out the taxable income of Kagura under different circumstances.

Q: lease help me to solve this problem

A: A budget is used in forecasting to determine supplier payments, and receipts from customers which in…

Q: his question is asking amount that Ding would receive instead the answer states what Tillman would…

A: A partnership refers to an agreement made between the 2 or more individuals who promise to operate a…

Q: e adjusting entries

A: Prepaid expenses are expenses paid in advance. These are not actually incurred. Hence, they have to…

Q: Please help me

A: Mixed costs: These have high initial costs as a whole due to the presence of some fixed element in…

Q: A document that (given the required elements) provides direction and allows another to make…

A: The correct option is B The living will is advance directive will which allows other persons…

Q: Please tell answer as soon as possible

A: The closing entries refer to the journal entries passed at the end of the reporting period to…

Q: er the required part: the letters a,b,c and d. Please answer it with complete solutions with…

A: Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: kindly post the solution to the question thanks

A: Total cost of the product comprises of material cost, direct labor cost, variable as well as fixed…

Q: please help me answer this I promise to like your answer please

A: “Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Please answer properly

A: The depreciation expense is charged on fixed assets as reduction in the value of the fixed assets…

Q: Notify the applicant of the decision and provide the name and phone numl

A: A credit check refers to the score shown for evaluating the value of the credit a person takes. It…

Q: ne please answer this quickly? Thank

A: Inflation destroys the purchasing power of the future bond of the bond. Simply put, when the current…

Q: Please answer all parts of the question

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts.…

Q: SANTA ROSA

A:

Q: ase answer all pro

A: Given information : Time period 23 Par value $1,000 Coupon interest rate 9% Yield to…

Q: Please see below. I need help with this asap

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: Find the age of the youngest boy

A: As given, the total age of three boys = 45 years

Q: Help me asap!!

A: Net present value : Net present value is the difference between initial cash outflow and the present…

Q: PLEASE HELP ASAP!

A: Journal Entry: Journal entry is the act of keeping records of transactions. Transactions are listed…

Q: %

A: Rate of interest refers to the amount earned over the investments made by the investors expressed…

Q: please answer letter b and explain thoroughly

A: Cost of goods sold is actual cost of goods that are being sold by the business to the customers. It…

Q: Please assist me with the last question

A: Statement of income shows all the income(s) earned by the organization. There are certain ways for…

Q: Please send me answer as soon as possible

A: Income statement is the statement which shows all incomes and expenses in the business and at the…

Q: ed eamings Tota ng stockhol

A: The dividend can be issued either via Cash or via Stock, However Both ways dividend is paid…

Q: Help me answer the letter d and e *with solution thank you

A: Degree of Financial leverage = EBIT/EBT Degree of combined Leverage = Operating Leverage x Financial…

Q: can someone help me to journalize the opening entry ?

A: Step 1 Journal is the part of book keeping.

Please answer this question as soon as possible.

Thankyou!

Step by step

Solved in 2 steps

- On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501. e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012. g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307. i. Received and paid the heating bill, 248, Ck. No. 504. j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128. k. Sold catering services for cash for the remainder of the month, 2,649. l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.In October, A. Nguyen established an apartment rental service. The account headings are presented below. Transactions completed during the month of October follow. a. Nguyen deposited 25,000 in a bank account in the name of the business. b. Paid the rent for the month, 1,200, Ck. No. 2015. c. Bought supplies on account, 225. d. Bought a truck for 18,000, paying 1,000 in cash and placing the remainder on account e. Bought Insurance for the truck for the yean 1,400, Ck. No. 2016. f. Sold services on account 5,000. g. Bought office equipment on account from Henry Office Supply, 2,300. h. Sold services for cash for the first half of the month, 6,050. i. Received and paid the bill for utilities, 150, Ck. No. 2017. j. Received a bill for gas and oil for the truck. 80. k. Paid wages to the employees, 1,400, Ck Nos. 20182020. l. Sold services for cash for the remainder of the month, 4,200. m. Nguyen withdrew cash for personal use, 2,000, Ck. No. 2021. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, reanalyze each transaction.On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow. a. Gervais deposited 25,000 in a bank account in the name of the business. b. Bought a truck from Kelly Motors for 26,329, paying 8,000 in cash and placing the balance on account, Ck. No. 500. c. Bought catering equipment on account from Luigis Equipment, 3,795. d. Paid the rent for the month, 1,255, Ck. No. 501 (Rent Expense). e. Bought insurance for the truck for one year, 400, Ck. No. 502. f. Sold catering services for cash for the first half of the month, 3,012 (Catering Income). g. Bought supplies for cash, 185, Ck. No. 503. h. Sold catering services on account, 4,307 (Catering Income). i. Received and paid the heating bill, 248, Ck. No. 504 (Utilities Expense). j. Received a bill from GC Gas and Lube for gas and oil for the truck, 128 (Gas and Oil Expense). k. Sold catering services for cash for the remainder of the month, 2,649 (Catering Income). l. Gervais withdrew cash for personal use, 1,550, Ck. No. 505. m. Paid the salary of the assistant, 1,150, Ck. No. 506 (Salary Expense). Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

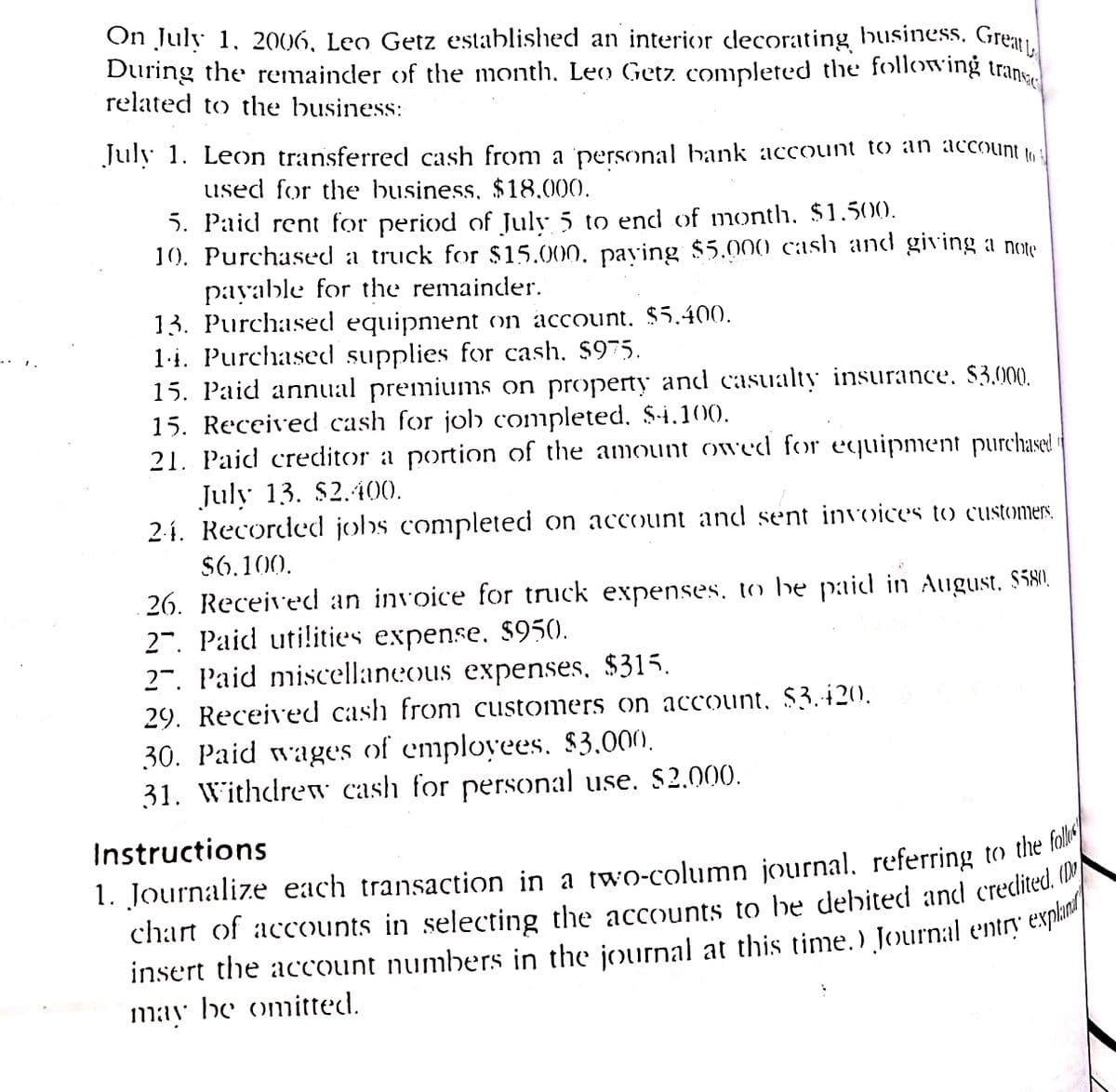

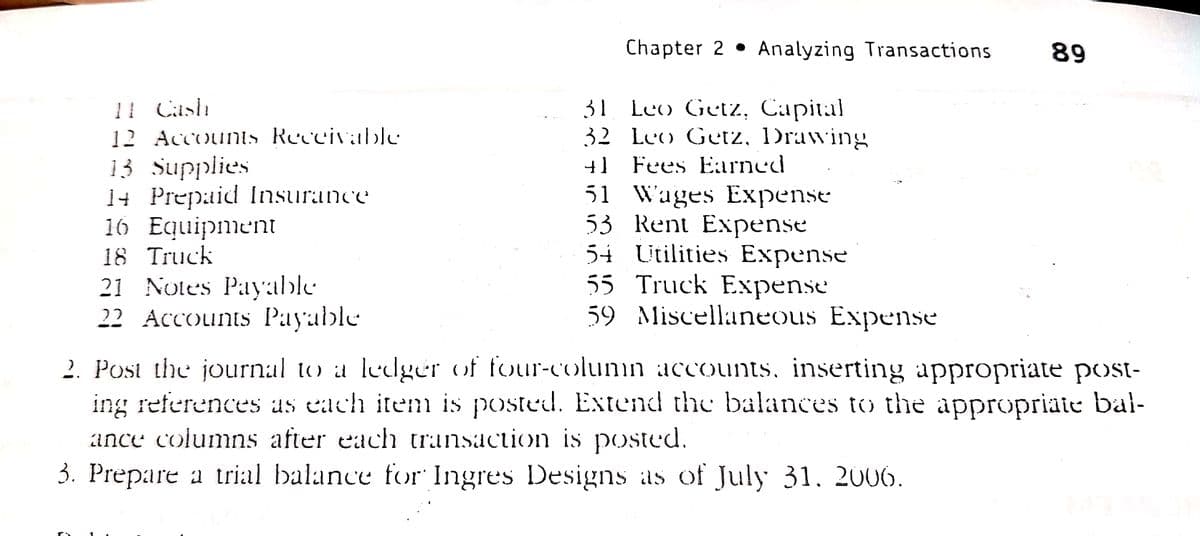

- On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?In April, J. Rodriguez established an apartment rental service. The account headings are presented below. Transactions completed during the month of April follow. a. Rodriguez deposited 70,000 in a bank account in the name of the business. b. Paid the rent for the month, 2,000, Ck. No. 101 (Rent Expense). c. Bought supplies on account, 150. d. Bought a truck for 23,500, paying 2,500 in cash and placing the remainder on account. e. Bought insurance for the truck for the year, 2,400, Ck. No. 102. f. Sold services on account, 4,700 (Service Income). g. Bought office equipment on account from Stern Office Supply, 1,250. h. Sold services for cash for the first half of the month, 8,250 (Service Income). i. Received and paid the bill for utilities, 280, Ck. No. 103 (Utilities Expense). j. Received a bill for gas and oil for the truck, 130 (Gas and Oil Expense). k. Paid wages to the employees, 2,680, Ck. Nos. 104106 (Wages Expense). l. Sold services for cash for the remainder of the month, 3,500 (Service Income). m. Rodriguez withdrew cash for personal use, 4,000, Ck. No. 107. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001 (Rent Expense). e. Sold services for cash for the first half of the month, 6,927 (Service Income). f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004 (Utilities Expense). i. Received a bill for gas and oil for the truck, 218 (Gas and Oil Expense). j. Sold services on account, 3,603 (Service Income). k. Sold services for cash for the remainder of the month, 4,612 (Service Income). l. Paid wages to the employees, 3,958, Ck. Nos. 30053007 (Wages Expense). m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- On July 1 of this year, R. Green established the Green Rehab Clinic. The organizations account headings are presented below. Transactions completed during the month of July follow. a. Green deposited 30,000 in a bank account in the name of the business. b. Paid the office rent for the month, 1,800, Ck. No. 2001 (Rent Expense). c. Bought supplies for cash, 362, Ck. No. 2002. d. Bought professional equipment on account from Rehab Equipment Company, 18,000. e. Bought office equipment from Hi-Tech Computers, 2,890, paying 890 in cash and placing the balance on account, Ck. No. 2003. f. Sold professional services for cash, 4,600 (Professional Fees). g. Paid on account to Rehab Equipment Company, 700, Ck. No. 2004. h. Received and paid the bill for utilities, 367, Ck. No. 2005 (Utilities Expense). i. Paid the salary of the assistant, 1,150, Ck. No. 2006 (Salary Expense). j. Sold professional services for cash, 3,868 (Professional Fees). k. Green withdrew cash for personal use, 1,800, Ck. No. 2007. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.In July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.In October, A. Nguyen established an apartment rental service. The account headings are presented below. Transactions completed during the month of October follow. a. Nguyen deposited 25,000 in a bank account in the name of the business. b. Paid the rent for the month, 1,200, Ck. No. 2015 (Rent Expense). c. Bought supplies on account, 225. d. Bought a truck for 18,000, paying 1,000 in cash and placing the remainder on account. e. Bought insurance for the truck for the year, 1,400, Ck. No. 2016. f. Sold services on account, 5,000 (Service Income). g. Bought office equipment on account from Henry Office Supply, 2,300. h. Sold services for cash for the first half of the month, 6,050 (Service Income). i. Received and paid the bill for utilities, 150, Ck. No. 2017 (Utilities Expense). j. Received a bill for gas and oil for the truck, 80 (Gas and Oil Expense). k. Paid wages to the employees, 1,400, Ck. Nos. 20182020 (Wages Expense). l. Sold services for cash for the remainder of the month, 4,200 (Service Income). m. Nguyen withdrew cash for personal use, 2,000, Ck. No. 2021. Required 1. In the equation, write the owners name above the terms Capital and Drawing. 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses. 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

- In March, T. Carter established Carter Delivery Service. The account headings are presented below. Transactions completed during the month of March follow. a. Carter deposited 25,000 in a bank account in the name of the business. b. Bought a used truck from Degroot Motors for 15,140, paying 5,140 in cash and placing the remainder on account. c. Bought equipment on account from Flemming Company, 3,450. d. Paid the rent for the month, 1,000, Ck. No. 3001. e. Sold services for cash for the first half of the month, 6,927. f. Bought supplies for cash, 301, Ck. No. 3002. g. Bought insurance for the truck for the year, 1,200, Ck. No. 3003. h. Received and paid the bill for utilities, 349, Ck. No. 3004. i. Received a bill for gas and oil for the truck, 218. j. Sold services on account, 3,603. k. Sold services for cash for the remainder of the month, 4,612. l. Paid wages to the employees, 3,958, Ck. Nos. 30053007. m. Carter withdrew cash for personal use, 1,250, Ck. No. 3008. Required 1. Record the transactions and the balance after each transaction 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.On July 1 of this year, R. Green established the Green Rehab Clinic. The organizations account headings are presented below. Transactions completed during the month of July follow. a. Green deposited 30,000 in a bank account in the name of the business. b. Paid the office rent for the month, 1,800, Ck. No. 2001. c. Bought supplies for cash, 362, Ck. No. 2002. d. Bought professional equipment on account from Rehab Equipment Company, 18,000. e. Bought office equipment from Hi-Tech Computers, 2,890, paying 890 in cash and placing the balance on account, Ck. No. 2003. f. Sold professional services for cash, 4,600. g. Paid on account to Rehab Equipment Company, 700, Ck. No. 2004. h. Received and paid the bill for utilities, 367, Ck. No. 2005. i. Paid the salary of the assistant, 1,150, Ck. No. 2006. j. Sold professional services for cash, 3,868. k. Green withdrew cash for personal use, 1,800, Ck. No. 2007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.S. Davis, a graphic artist, opened a studio for her professional practice on August 1. The account headings are presented below. Transactions completed during the month follow. a. Davis deposited 20,000 in a bank account in the name of the business. b. Bought office equipment on account from Starkey Equipment Company, 4,120. c. Davis invested her personal photographic equipment, 5,370, in the business. d. Paid the rent for the month, 1,500, Ck. No. 1000. e. Bought supplies for cash, 215, Ck. No. 1001. f. Bought insurance for two years, 1,840, Ck. No. 1002. g. Sold graphic services for cash, 3,616. h. Paid the salary of the part-time assistant, 982, Ck. No. 1003. i. Received and paid the bill for telephone service, 134, Ck. No. 1004. j. Paid cash for minor repairs to graphics equipment, 185, Ck. No. 1005. k. Sold graphic services for cash, 3,693. l. Paid on account to Starkey Equipment Company, 650, Ck. No. 1006. m. Davis withdrew cash for personal use, 1,800, Ck. No. 1007. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.