Please help me answer this question, VAT - 15%

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 8PA: Serene Company purchases fountains for its inventory from Kirkland Inc. The following transactions...

Related questions

Question

Please help me answer this question,

VAT - 15%

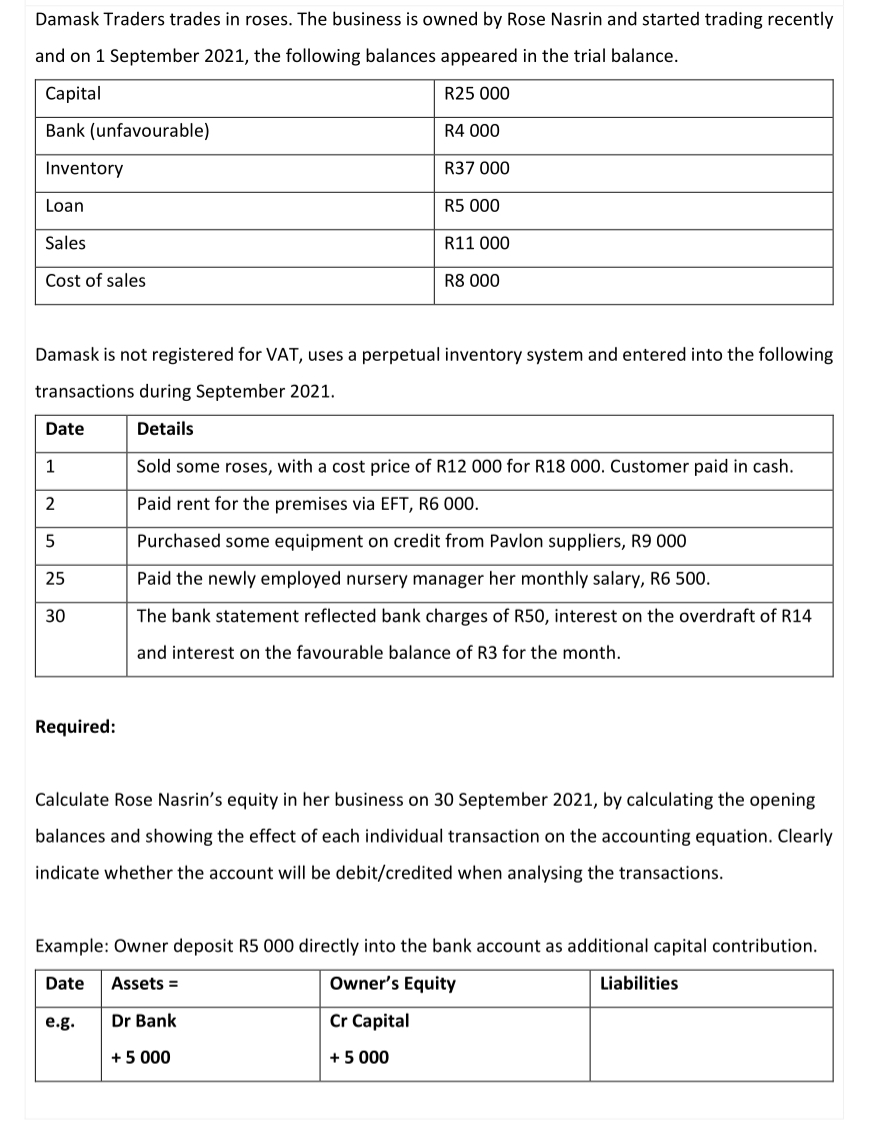

Transcribed Image Text:Damask Traders trades in roses. The business is owned by Rose Nasrin and started trading recently

and on 1 September 2021, the following balances appeared in the trial balance.

Capital

R25 000

Bank (unfavourable)

R4 000

Inventory

R37 000

Loan

R5 000

Sales

R11 000

Cost of sales

R8 000

Damask is not registered for VAT, uses a perpetual inventory system and entered into the following

transactions during September 2021.

Date

Details

1

Sold some roses, with a cost price of R12 000 for R18 000. Customer paid in cash.

2

Paid rent for the premises via EFT, R6 000.

Purchased some equipment on credit from Pavlon suppliers, R9 000

25

Paid the newly employed nursery manager her monthly salary, R6 500.

30

The bank statement reflected bank charges of R50, interest on the overdraft of R14

and interest on the favourable balance of R3 for the month.

Required:

Calculate Rose Nasrin's equity in her business on 30 September 2021, by calculating the opening

balances and showing the effect of each individual transaction on the accounting equation. Clearly

indicate whether the account will be debit/credited when analysing the transactions.

Example: Owner deposit R5 000 directly into the bank account as additional capital contribution.

Date

Assets =

Owner's Equity

Liabilities

е.g.

Dr Bank

Cr Capital

+ 5 000

+ 5 000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,