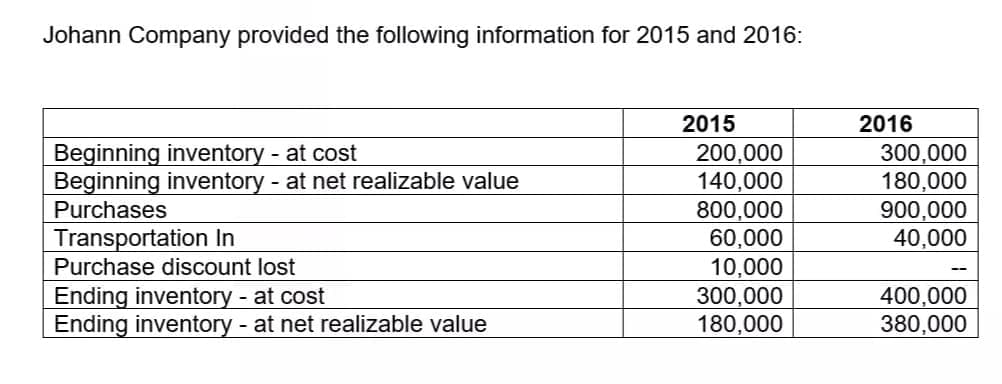

Please refer to the picture below for the information. Please show the complete solution and kinldy include label. Thank you so much. Question 1: How much is the amount of "Cost of Goods Sold" to be reported in the 2015 Statement of comprehensive income assuming the company’s policy is to charge loss on inventory write-down to COST OF GOODS SOLD and charge loss on inventory write-down to OTHER EXPENSE, respectively. Question 2: How much is the amount of "Cost of Goods Sold" to be reported in the 2016 Statement of comprehensive income?

Please refer to the picture below for the information. Please show the complete solution and kinldy include label. Thank you so much. Question 1: How much is the amount of "Cost of Goods Sold" to be reported in the 2015 Statement of comprehensive income assuming the company’s policy is to charge loss on inventory write-down to COST OF GOODS SOLD and charge loss on inventory write-down to OTHER EXPENSE, respectively. Question 2: How much is the amount of "Cost of Goods Sold" to be reported in the 2016 Statement of comprehensive income?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 12P: Dollar-Value LIFO Kwestel Company adopted the dollar-value LIFO method for inventory valuation at...

Related questions

Question

100%

Please refer to the picture below for the information. Please show the complete solution and kinldy include label. Thank you so much.

Question 1: How much is the amount of "Cost of Goods Sold" to be reported in the 2015 Statement of comprehensive income assuming the company’s policy is to charge loss on inventory write-down to COST OF GOODS SOLD and charge loss on inventory write-down to OTHER EXPENSE, respectively.

Question 2: How much is the amount of "Cost of Goods Sold" to be reported in the 2016 Statement of comprehensive income?

Transcribed Image Text:Johann Company provided the following information for 2015 and 2016:

2015

2016

Beginning inventory - at cost

Beginning inventory - at net realizable value

Purchases

200,000

140,000

800,000

60,000

10,000

300,000

180,000

300,000

180,000

900,000

40,000

Transportation In

Purchase discount lost

Ending inventory - at cost

Ending inventory - at net realizable value

400,000

380,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning