Please select the option that best analyzes the RETURN ON EQUITY for our example company. Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, so they would accept the return on equity for the year, since it is LESS than their return they accept to earn. Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, and they are content as the example company provided a return EQUAL to their expected return. Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, so they would accept the return on equity for the year. Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, so they would NOT ACCEPT the return on equity for the year. since it it much lower than the required 5% return they expect to earn

Please select the option that best analyzes the RETURN ON EQUITY for our example company. Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, so they would accept the return on equity for the year, since it is LESS than their return they accept to earn. Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, and they are content as the example company provided a return EQUAL to their expected return. Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, so they would accept the return on equity for the year. Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, so they would NOT ACCEPT the return on equity for the year. since it it much lower than the required 5% return they expect to earn

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 19SP

Related questions

Question

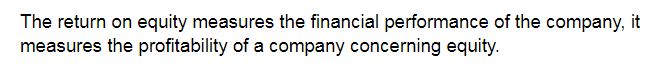

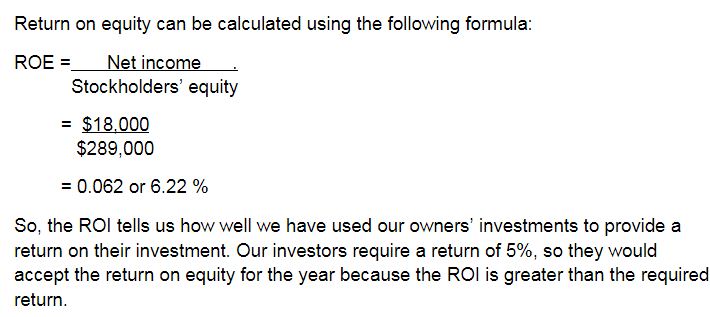

Please select the option that best analyzes the RETURN ON EQUITY for our example company.

Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, so they would accept the return on equity for the year, since it is LESS than their return they accept to earn.

Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, and they are content as the example company provided a return EQUAL to their expected return.

Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, so they would accept the return on equity for the year.

Return on equity tells us how well we have used our owners' investments to provide a return on their investment. Our investors require a return of 5%, so they would NOT ACCEPT the return on equity for the year. since it it much lower than the required 5% return they expect to earn.

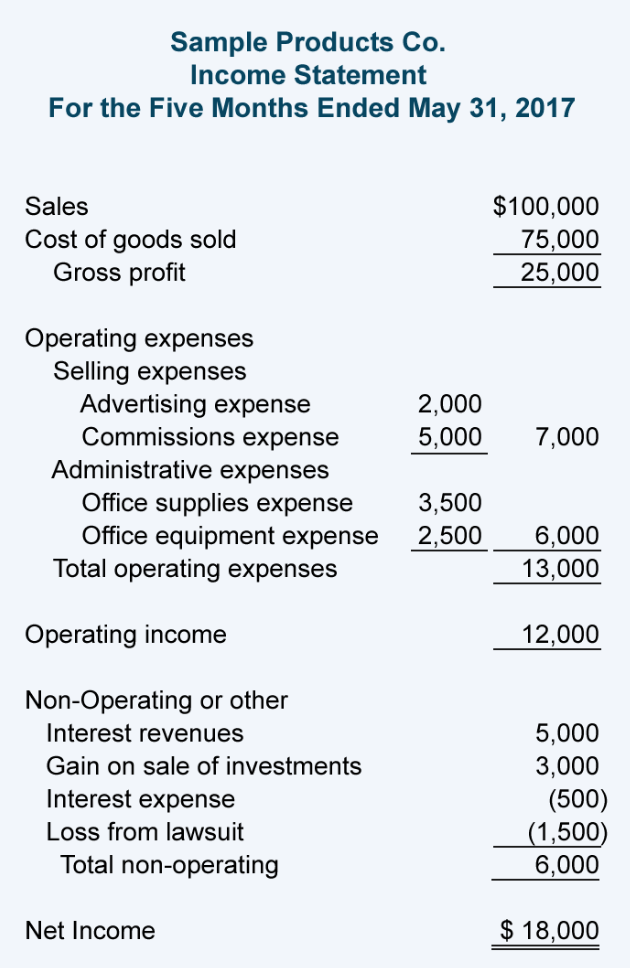

Transcribed Image Text:Sample Products Co.

Income Statement

For the Five Months Ended May 31, 2017

Sales

$100,000

Cost of goods sold

Gross profit

75,000

25,000

Operating expenses

Selling expenses

Advertising expense

Commissions expense

Administrative expenses

2,000

5,000

7,000

Office supplies expense

Office equipment expense

Total operating expenses

3,500

2,500

6,000

13,000

Operating income

12,000

Non-Operating or other

Interest revenues

5,000

Gain on sale of investments

3,000

Interest expense

(500)

(1,500)

6,000

Loss from lawsuit

Total non-operating

Net Income

$ 18,000

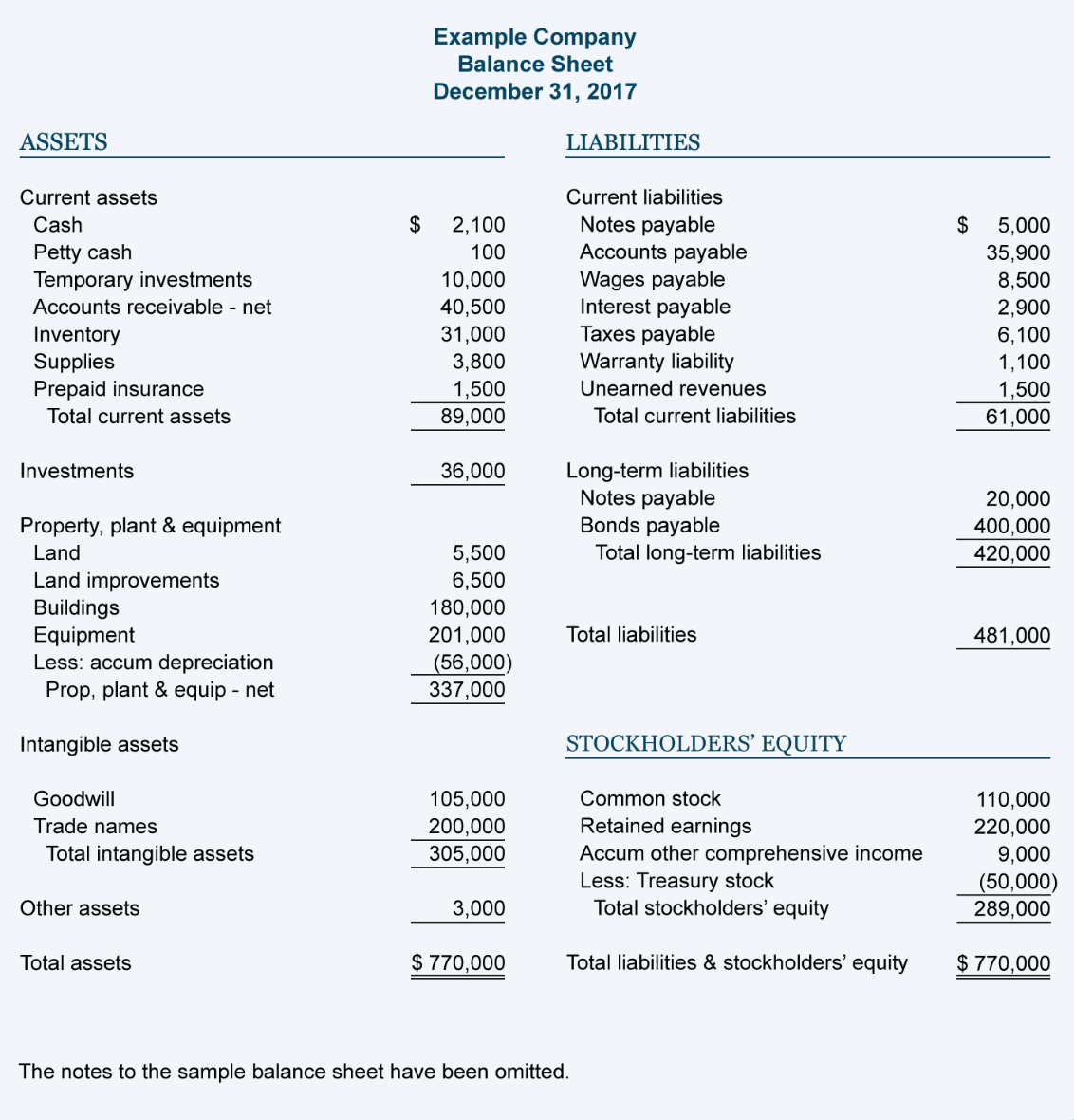

Transcribed Image Text:Example Company

Balance Sheet

December 31, 2017

ASSETS

LIABILITIES

Current assets

Current liabilities

Notes payable

Accounts payable

Wages payable

Interest payable

Taxes payable

Warranty liability

Unearned revenues

Cash

$

2,100

$

5,000

Petty cash

Temporary investments

100

35,900

10,000

8,500

2,900

Accounts receivable - net

40,500

Inventory

Supplies

Prepaid insurance

Total current assets

31,000

3,800

6,100

1,100

1,500

1,500

89,000

Total current liabilities

61,000

Long-term liabilities

Notes payable

Bonds payable

Total long-term liabilities

Investments

36,000

20,000

Property, plant & equipment

400,000

420,000

Land

5,500

Land improvements

Buildings

Equipment

Less: accum depreciation

Prop, plant & equip - net

6,500

180,000

201,000

(56,000)

337,000

Total liabilities

481,000

Intangible assets

STOCKHOLDERS’ EQUITY

105,000

200,000

305,000

Goodwill

Common stock

110,000

Retained earnings

Accum other comprehensive income

Less: Treasury stock

Total stockholders' equity

Trade names

220,000

9,000

(50,000)

289,000

Total intangible assets

Other assets

3,000

Total assets

$ 770,000

Total liabilities & stockholders' equity

$ 770,000

The notes to the sample balance sheet have been omitted.

Expert Solution

Step 1

Step 2

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning