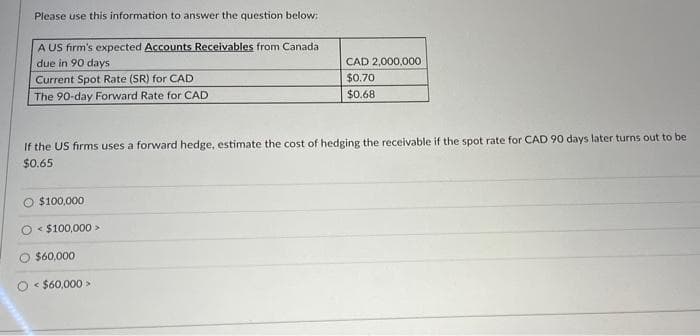

Please use this information to answer the question below: A US firm's expected Accounts Receivables from Canada due in 90 days Current Spot Rate (SR) for CAD The 90-day Forward Rate for CAD CAD 2,000,000 $0.70 $0.68 If the US firms uses a forward hedge, estimate the cost of hedging the receivable if the spot rate for CAD 90 days later turns out to be $0.65 O $100,000 O<$100,000 > $60,000 < $60,000 >

Q: Formulate this problem as a linear programming problem.

A: Let A1 be the number of type 1 trucks transported to City A Let A2 be the number of type 2 trucks…

Q: Oliver County Cars (OCC) is a large custom made car store located in Oliver County, New York. OCC…

A: The minimal length of time that must elapse between orders for a product in order to reduce the…

Q: Describe Lean Manufacturing and how it works.

A: Lean manufacturing is a production methodology that aims to minimize waste and maximize value. It…

Q: Create a project plan for the introduction and rollout of a data analytics program to an…

A: General outline of what such a project plan might include: Summary of the Business and Current…

Q: a. Determine order quantity and reorder points to minimise the total cost b.Determine the review…

A:

Q: In the past, Taylor Industries has used a fixed−time period inventory system that involved taking a…

A: ABC plan is an inventory technique that analysis the inventory value item based on their importance…

Q: Match the sources of cost advantage to the definitions provided. Remember to select a different…

A: Production is the process in which inputs are combined to have the required output. It includes a…

Q: The annual demand, ordering cost, and the annual inventory carrying cost rate for a certain item are…

A: a) Assume the discounts applied to all the units in the order: The average annual cost can be…

Q: Knowing the data processing logic behind the MRP system is crucial

A: MRP systems use a set of algorithms to generate the different schedule required which is based on…

Q: Lean management approaches have been proposed to help Pizza Hut develop and improve Produce a…

A: a) The term 'lean' was originated from the Japanese company of Toyota. In the beginning of the 20th…

Q: Weekly demand per store for a particular item at The Gap is normally distributed with mean 8 and…

A: Economic order quantity refers to the ideal order size that a company should choose to minimize the…

Q: Mixed Inventory Criteria: Identify and explain, which would be the best approach to have a mix of a…

A: A mix of JIT and Buffer Inventory Strategy can be termed as Mixed Inventory Strategy. JIT:- JIT…

Q: Show the MRP using the

A: An inventory management system that is completely operated digitally through a wide variety of…

Q: Discuss the techniques adopted in forecasting the sales of an organisation.

A: ANSWER : There are several techniques that organizations can adopt to forecast their sales. Few most…

Q: Director of “We Care” hospital, want to apply for accrediting their healthcare facility. He knows…

A: The term "accreditation" refers to the procedure by which a healthcare facility will show that it is…

Q: Why is logistics so important for successful supply chain management at Amazon? What type of…

A: ANSWER : Logistics is a critical component of supply chain management at Amazon because it enables…

Q: Draw Arrow Diagram WBS TO CLEAN

A: A work breakdown structure (WBS) is a tool used to break down complex tasks and activities into…

Q: Explain logistics distribution in your own words and why we use i

A: Here, first of all, I would explain the term logistics distribution or distribution logistics which…

Q: 1. The crossover point between two processes A and B can be stated as - [ ] a. variable costs of…

A: Variable costs (VC) are any expenditure that fluctuate or vary based on how much a business produces…

Q: (c) The indifferences in the number of times at bat for these players are small, and we will ignore…

A: An indifference curve is a chart showing various combinations of two goods or commodities that leave…

Q: Draw the table and explain the characteristic of small business。

A: Small businesses can be characterized by several key features, which include: Characteristic…

Q: Ggg(b) Should I sell my gas-guzzler? My 2001 Toyota Corolla is quite functional, but it only…

A: ANSWER : To determine if you should sell your gas-guzzling vehicle and purchase a newer, more…

Q: 2. Describe the difference(s) between a supervisor and a manager

A: Manager is a person who takes the decision, making planning, and identify the goals. Supervisor…

Q: Use the data points provided in the attached Excel file to calculate the following: 1. The Annual…

A: ABC classification of inventory is a method used to classify items in an inventory according to…

Q: Use MATCH to find the year index for the "Year" in cell B20, and use INDEX to find the salesperson's…

A: Index match is kind of enhanced vlookup giving two way lookup enablity. Handy combination of…

Q: Aceron Bhd produces three products A, B and C. The unit cost and selling prices are as shown below:…

A:

Q: In London stock exchange company with some of its assets are under lease contracts. Examine…

A: IFRS 16 is the specification of how an IFRS reporter may recognize, measure and disclose leases. To…

Q: a) Determine the economic order quantity. b) Consider that a service level of 85% (Z=1.036) is to be…

A:

Q: Is it accurate to say that certain aspects of organizational effectiveness are overlooked by lean…

A: Meaning of Lean Management- Lean management is a way to deal with dealing with an organization that…

Q: Each coffee table produced by Kevin Watson Designers nets the firm a profit of $8. Each bookcase…

A: Decision variables are stated below, Decision variables: X = number of coffee tables…

Q: Consider a manufacturing or service company of your choice, and make a list of the primary tasks…

A: Here, I would consider a manufacturing company, then, I would list out the primary tasks/main…

Q: The Budd Gear Co. specializes in heat-treating gears for automobile companies. At 8:00 a.m., when…

A: Scheduling: Deciding on the timing and sequence of tasks in order to satisfy production demands…

Q: Consider a firm like Zara that has developed production capabilities with very short replenishment…

A: As per the Q, here, we could see that the firm Zara has established manufacturing capabilities with…

Q: SWOT ANALYSIS: "ZAMBALES GOLF COURSE" FOLLOW THIS FORMAT

A: Zambales is a province located in the Philippines at the center of the Luzon region. This location…

Q: What is the net impact of the firm’s implementation of its value analysis and business process…

A: Business process reengineering is the process of designing core business processes to achieve the…

Q: At a small but growing airport, the local airline company is purchasing a new tractor for a…

A: To formulate: (a) The problem as a shortest path problem by drawing a network representation. (b)…

Q: Explain the picture of supply chain integration.

A: Supply chain management is all about managing supply chain activities effectively. All the…

Q: Consider the assignment problem having the following cost table. Task a. Assignee A B C D 1 9698 7 2…

A: Network presentation of the problem is

Q: tate the risk rating of the respective FIVE (5) risk exposures mentioned below Loss of physical…

A: ANSWER : The risk rating of the five risk exposures mentioned below can be different depending on…

Q: 1. You are to prepare an annotated bibliography consisting of three (3) academic journal articles,…

A: Mark A. Schulze, Ph.D., 2000, Perceptive Scientific Instruments, Inc, Linear Programming for…

Q: hy we apply power transformation on half logistic distribution? what the mean reasons?

A: Power transformation is an important tool for data analysis, particularly when the data is not…

Q: Calculate the total cost of each method.

A: The Least Total Cost method is a dynamic lot sizing technique that calculates the order quantity by…

Q: Provide an explanation of how the Spiral Model and the V Model are used in project management.

A: The spiral model, an approach to risk management which thus integrates the iterative development…

Q: In business parlance, what does it mean to have "several processes" in place? Could this idea be…

A: ANSWER : In business parlance, having "several processes" in place means that an organization has…

Q: Match the sources of cost advantage to the definitions provided. Remember to select a different…

A: The sources of cost advantage to the definitions provided are below with suitable.

Q: ) How much revenue has Tesco generated overall over the last recorded five years? Write the formula…

A: We are given a table of Tesco revenue by location between 2018 and 2022. Now, we have to write down…

Q: a) calculate the overall capacity for the system in units/hour

A:

Q: Four cleaning crews are available for a job that requires an area of 5000 square feet to be cleaned.…

A: Formulation of the mathematical programming model: Let x1, x2, x3, x4 be the number of square feet…

Q: Determine the average lead time for all four part styles (hours, 2 decimal points).

A:

Q: The recipe for a fruit smoothie requires 2 cups of fruit per 6 cups of yogurt to maintain a 1/3…

A: The capacity for quantitative reasoning is the capacity to use data and mathematics to address…

Please and the question in the image below:

Step by step

Solved in 2 steps

- Suppose that new uses are discovered for corn. Assume that nothing else haschanged. What do you expect to happen to the price of soybeans. Explain with a supply and demand diagram for soybeans. For a bonus point, what is the real-world basis for this question?Toyota is filling an order from a Korean industrial company for machinery worth 160,000,000 Won. The export sale is denominated in Korean Won and is on a one-year open account basis. The opportunity cost of funds for Kristo Asafo Tools Ltd is 8%. The Current spot rate between Won and Dollars is 800 Won/$. The forward Won sells at a discount of 12% per annum, but the finance staff of toyota Believes that the Won will drop only 9% in value over the next year. Toyota faces the following choices This question compares the cost of a money market hedge with a forward hedge, and considers both alternatives against the possibility of remaining unhedged.Wait one year to receive the won amount and exchange Won for dollars at that time.Sell the Won proceeds of the sale forward today.Borrow Won from a Seoul bond at 20% per annum against the expected future receipt of the Korean importer’s payment.What do you recommend and why?Kamal Fatehl production manager of Kennesaw Manufacturing, finds his profit at $22,400 (as shown in the statement below) inadequate for expanding his business. The bank is insisting on an improved profit picture prior to approval of a loan for some new equipment. Kamal would like to improve profit line to $32,400 so he can obtain the bank's approval for the loan. % of sales Sales 280,000 100% Cost of supply chain purchases 201,600 72% Other production costs 28,000 10% Fixed costs 28,000 10% Profit 22,400 8% Part 2 a) What percentage…

- Your father loans you Php12,000 to make it through your senior year. His repayment schedule requires payments of Php1401.95 at the end of year for the next 15 years. What interest rate? A. 7.0% B. 7.5% C. 8.0% D. 8.5%Assume that the Bank of Ecoville has the following balance sheet and the Fed has a 10% reserve requirement in place: Balance Sheet for Ecoville International Bank ASSETS LIABILITIES Cash $33,000 Demand Deposits $99,000 Loans 66,000 Now assume that the Fed lowers the reserve requirement to 8%. If the money multiplier is 5, how much money will ultimately be created by this event?Mehmat has a monthly budget of 440TL, which he likes to spend on books(b) and movie tickets (m). Draw the budget contraint curve by putting books on the x-axis. Explain the opportunity cost of the movie ticket. 22b + 11m = 440TL

- The government of Australia has embarked on various policies such as Job Keeperand the provision of subsidies to firms in order to reduce the severity of COVID 19 on theeconomy. Suppose the money supply expands such that the Reserve Bank predictsthat the economic expansion is not sustainable.Use two diagrams one for the money market and another for the goods and services(Aggregate Demand and Aggregate Supply model), to explain the policy that theReserve Bank can adopt in order to overcome the effect of increasing the money supplyon the economy.Assume that: the money supply increased from the equilibrium of AUD 40 billion to AUD 70billion Interest was reduced to the interest rate of 1.5% as part of the stimulus packagefor the nation to overcome the effects of COVID 19. But the equilibrium interestrate is 4% Assume that equilibrium real GDP is AUD 60 billion Assume that inflation during the COVID crisis was at an equilibrium price of CPI 65 Assume that to overcome the inflationary…1. Explain the meaning of the expected value of perfect information (EVPI) in this problem. Based on the results of (iii) and (iv), which investment would you choose? 2. Compute the coefficient of variation, the return-to-risk ratio (RTRR) for each investment. Based on (vii) and (viii), what investment would you choose? Compare the results of (vi) and (ix) and explain any differencesKrishna cables requires aluminium for its factory. The probability distributions of the daily usage rate and the lead time for procurement are given below. (These distributions are independent.) Daily Usage Rate in Tonnes: 2, 3, 4 Probability: 0.2, 0.6, 0.2 Lead time in days: 25, 35, 45 Probability: 0.2, 0.5, 0.3 The stockout cost is estimated at ₹8,000 per ton and the carrying cost is ₹2,000 per ton per year. Question.1) a) What is the optimal level of safety stock? b) What is the probability of stock out?

- Assume that Trinbago is a small country that produces wine and motor vehicles, where motor vehicles are capital intensive. Trinbago is also capital intensive, and the standard Heckscher -Ohlin H-O) assumptions hold. The other country in the model is Vincyland. Questions: (c) In autarky, according to Ohlin, how does Trinbago’s relative price of labour compare to Vincyland’s? (d) Show the necessary graphs to fully explain all requested effects. Ensure to label graphs and give brief explanations.You are given the following payoff table (in K million), about a cooking oil producer in Lusaka. The company is researching for its 2019 budget production levels. High Demand Average Demand Low Demand Produce 30,000 39 5 -13 Produce 20,000 28 12 9 Produce 12,000 13 4 -10 Probability ? 0.5 0.2 Required: a) Explain the meaning of 39 and -10 in the payoff table. b) What are the expected payoffs for each production level? (Note that you will have to determine the missing probability). c) What is the expected payoff under perfect information? d) How much should the company invest in further market research to obtain perfect informationBased on the following table. Bid Ask EURUSD 1M FWD 7.05 7.34 EURUSD 2M FWD 14.99 15.15 EURUSD 3M FWD 22.57 23.05 EURUSD 4M FWD 30.25 30.55 EURUSD 5M FWD 38.03 38.43 EURUSD 6M FWD 45.91 47.2 EUR/USD Spot 1.1411 1.1422 What is the average annualized forward premium/discount for the EUR if you use the 3M forward contract (Format for answer: X.XX% or –X.XX%)