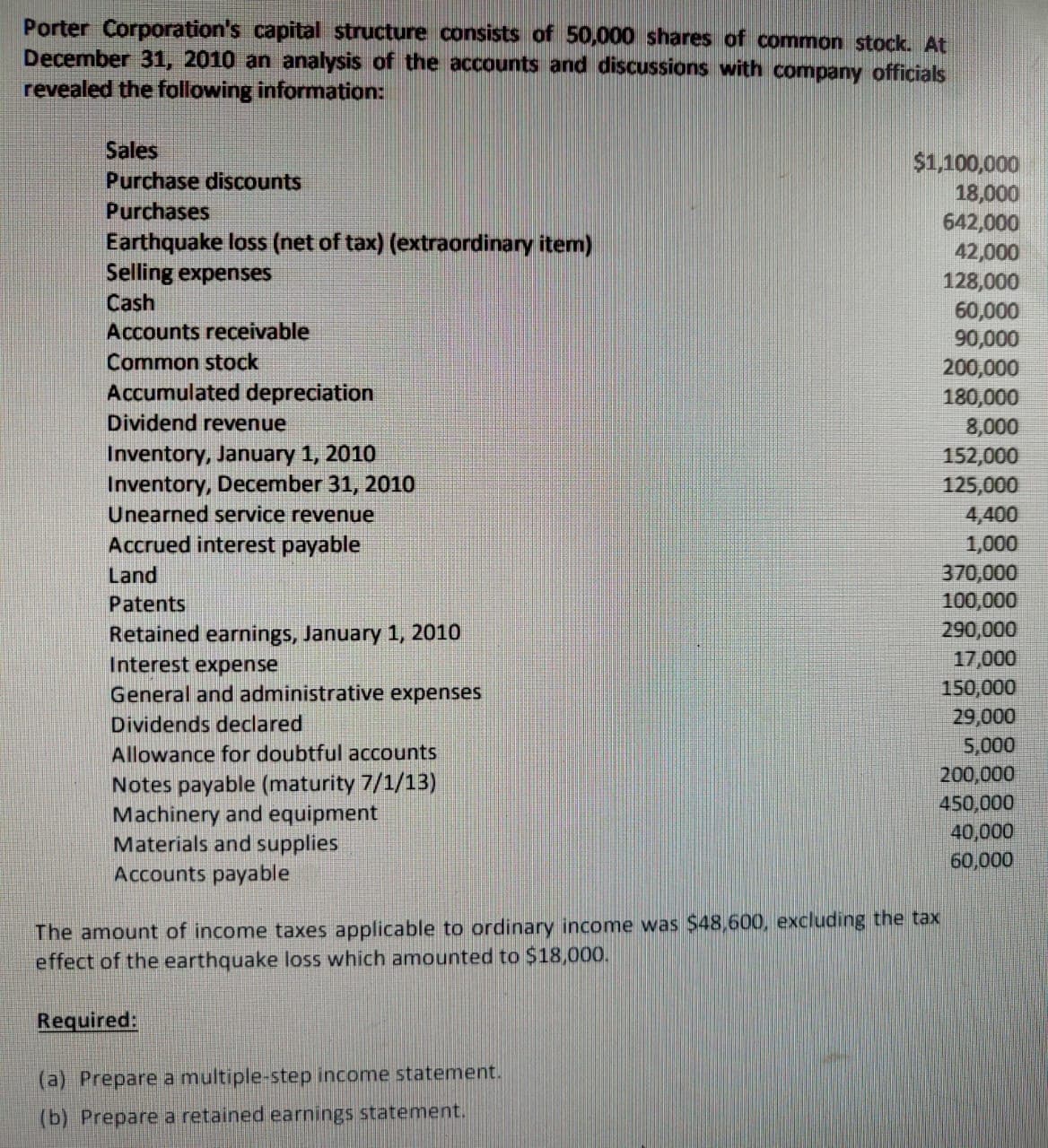

Porter Corporation's capital structure consists of 50,000 shares of common stock. At December 31, 2010 an analysis of the accounts and discussions with company officials revealed the following information: Sales Purchase discounts Purchases Earthquake loss (net of tax) (extraordinary item) Selling expenses Cash Accounts receivable Common stock Accumulated depreciation Dividend revenue Inventory, January 1, 2010 Inventory, December 31, 2010 Unearned service revenue Accrued interest payable Land Patents Retained earnings, January 1, 2010 Interest expense General and administrative expenses Dividends declared Allowance for doubtful accounts Notes payable (maturity 7/1/13) Machinery and equipment Materials and supplies Accounts payable Required: $1,100,000 18,000 642,000 42,000 128,000 60,000 90,000 200,000 180,000 8,000 152,000 125,000 4,400 1,000 The amount of income taxes applicable to ordinary income was $48,600, excluding the tax effect of the earthquake loss which amounted to $18,000. (a) Prepare a multiple-step income statement. (b) Prepare a retained earnings statement. 370,000 100,000 290,000 17,000 150,000 29,000 5,000 200,000 450,000 40,000 60,000

Porter Corporation's capital structure consists of 50,000 shares of common stock. At December 31, 2010 an analysis of the accounts and discussions with company officials revealed the following information: Sales Purchase discounts Purchases Earthquake loss (net of tax) (extraordinary item) Selling expenses Cash Accounts receivable Common stock Accumulated depreciation Dividend revenue Inventory, January 1, 2010 Inventory, December 31, 2010 Unearned service revenue Accrued interest payable Land Patents Retained earnings, January 1, 2010 Interest expense General and administrative expenses Dividends declared Allowance for doubtful accounts Notes payable (maturity 7/1/13) Machinery and equipment Materials and supplies Accounts payable Required: $1,100,000 18,000 642,000 42,000 128,000 60,000 90,000 200,000 180,000 8,000 152,000 125,000 4,400 1,000 The amount of income taxes applicable to ordinary income was $48,600, excluding the tax effect of the earthquake loss which amounted to $18,000. (a) Prepare a multiple-step income statement. (b) Prepare a retained earnings statement. 370,000 100,000 290,000 17,000 150,000 29,000 5,000 200,000 450,000 40,000 60,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 26P

Related questions

Question

Transcribed Image Text:Porter Corporation's capital structure consists of 50,000 shares of common stock. At

December 31, 2010 an analysis of the accounts and discussions with company officials

revealed the following information:

Sales

Purchase discounts

Purchases

Earthquake loss (net of tax) (extraordinary item)

Selling expenses

Cash

Accounts receivable

Common stock

Accumulated depreciation

Dividend revenue

Inventory, January 1, 2010

Inventory, December 31, 2010

Unearned service revenue

Accrued interest payable

Land

Patents

Retained earnings, January 1, 2010

Interest expense

General and administrative expenses

Dividends declared

Allowance for doubtful accounts

Notes payable (maturity 7/1/13)

Machinery and equipment

Materials and supplies

Accounts payable

Required:

$1,100,000

18,000

642,000

The amount of income taxes applicable to ordinary income was $48,600, excluding the tax

effect of the earthquake loss which amounted to $18,000.

(a) Prepare a multiple-step income statement.

(b) Prepare a retained earnings statement.

42,000

128,000

60,000

90,000

200,000

180,000

8,000

152,000

125,000

4,400

1,000

370,000

100,000

290,000

17,000

150,000

29,000

5,000

200,000

450,000

40,000

60,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning