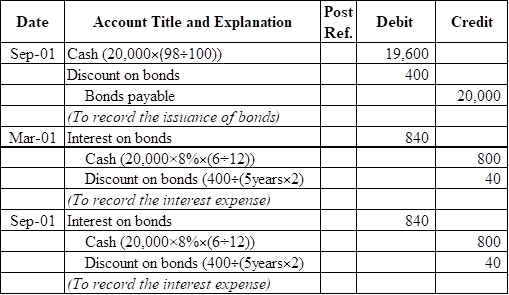

Post Ref. Date Account Title and Explanation Debit Credit Sep-01 Cash (20,000×(98÷100)) Discount on bonds Bonds payable (To record the issuance of bonds) Mar-01 Interest on bonds 19,600 400 20,000 840 Cash (20,000x8%x(6÷12)) Discount on bonds (400÷(5yearsx2) |(To record the interest expense) 800 40 Sep-01 Interest on bonds 840 Cash (20,000x8%x(6+12)) Discount on bonds (400+(5yearsx2) (To record the interest expense) 800 40

Based on Question No. 1, I want answer of Question No. 2

- On September 1, Deutsch Limited issues 8%, 5-year bonds payable with a maturity value of OR 20,000. The bonds sell at 98 and pay interest on March 1 and September Deutsch amortize bond discount by the straight-line method.

Required:

Journalize the issuance of the bonds on September 1, and the semiannual interest payment on March 1 and September 1.

Answer:

Bonds: Bonds are a kind of interest-bearing notes payable, usually issued by companies, universities, and governmental organizations. It is a debt instrument used for the purpose of raising a fund of the corporations or governmental agencies. If selling price of the bond is equal to its face value, it is called as par on bond. If the selling price of the bond is lesser than the face value, it is known as a discount on bond. If the selling price of the bond is greater than the face value, it is known as premium on bond.

2. What are the two categories of liabilities reported on the

Trending now

This is a popular solution!

Step by step

Solved in 2 steps