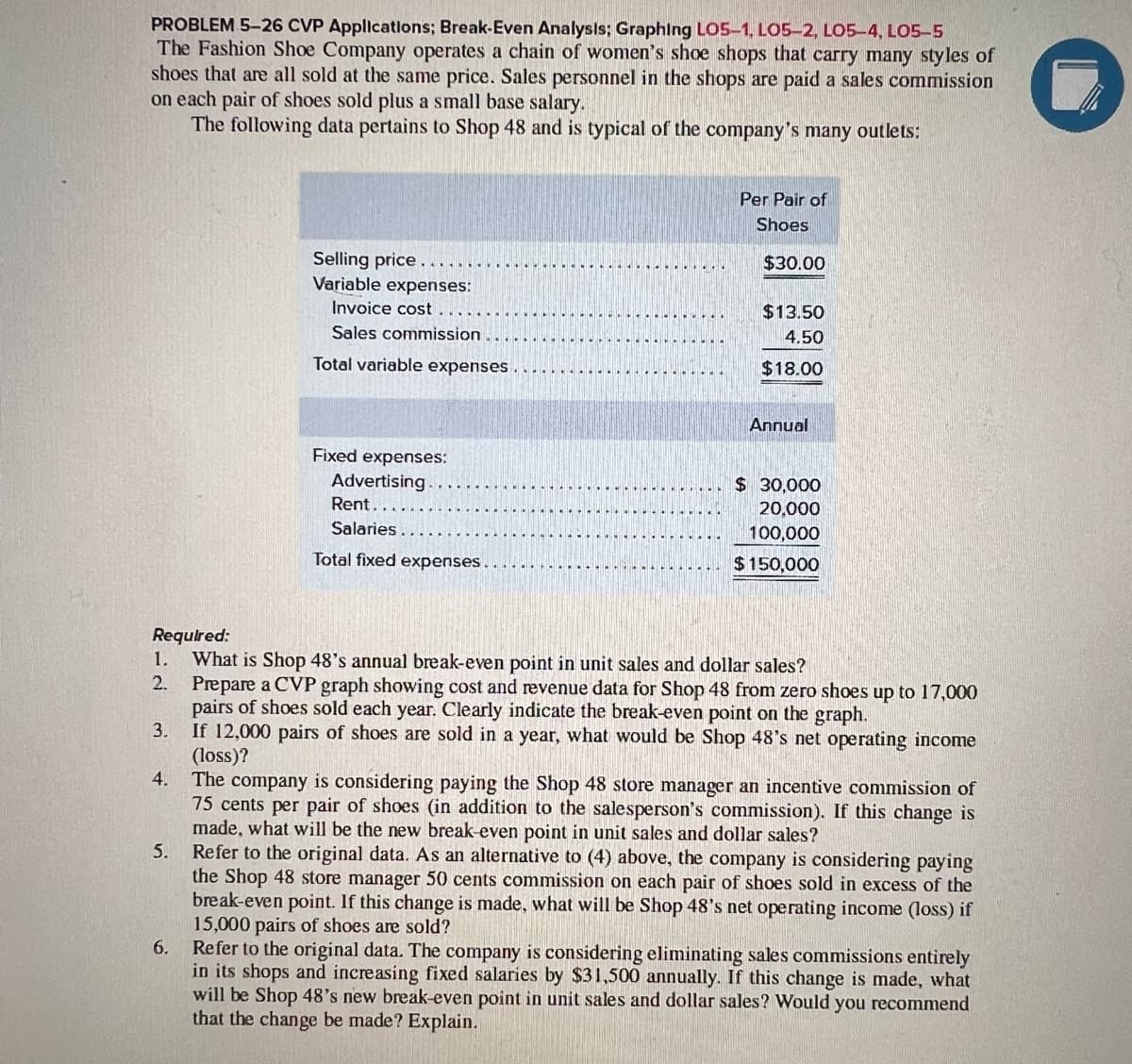

PROBLEM 5-26 CVP Applications; Break-Even Analysis; Graphing LO5-1, LO5-2, LO5-4, LO5-5 The Fashion Shoe Company operates a chain of women's shoe shops that carry many styles of shoes that are all sold at the same price. Sales personnel in the shops are paid a sales commission on each pair of shoes sold plus a small base salary. The following data pertains to Shop 48 and is typical of the company's many outlets: Selling price. Variable expenses: Invoice cost.. Sales commission Total variable expenses. 1. 2. Fixed expenses: Advertising.. Rent...... Salaries.... Total fixed expenses... **** Per Pair of Shoes $30.00 $13.50 4.50 $18.00 Annual $ 30,000 20,000 100,000 $150,000 Required: What is Shop 48's annual break-even point in unit sales and dollar sales? Prepare a CVP graph showing cost and revenue data for Shop 48 from zero shoes up to 17,000 pairs of shoes sold each year. Clearly indicate the break-even point on the graph. 3. If 12,000 pairs of shoes are sold in a year, what would be Shop 48's net operating income (loss)?

PROBLEM 5-26 CVP Applications; Break-Even Analysis; Graphing LO5-1, LO5-2, LO5-4, LO5-5 The Fashion Shoe Company operates a chain of women's shoe shops that carry many styles of shoes that are all sold at the same price. Sales personnel in the shops are paid a sales commission on each pair of shoes sold plus a small base salary. The following data pertains to Shop 48 and is typical of the company's many outlets: Selling price. Variable expenses: Invoice cost.. Sales commission Total variable expenses. 1. 2. Fixed expenses: Advertising.. Rent...... Salaries.... Total fixed expenses... **** Per Pair of Shoes $30.00 $13.50 4.50 $18.00 Annual $ 30,000 20,000 100,000 $150,000 Required: What is Shop 48's annual break-even point in unit sales and dollar sales? Prepare a CVP graph showing cost and revenue data for Shop 48 from zero shoes up to 17,000 pairs of shoes sold each year. Clearly indicate the break-even point on the graph. 3. If 12,000 pairs of shoes are sold in a year, what would be Shop 48's net operating income (loss)?

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter19: Cost-Volume-Profit Analysis

Section: Chapter Questions

Problem 19.24EX

Related questions

Question

Transcribed Image Text:PROBLEM 5-26 CVP Applications; Break-Even Analysis; Graphing LOS-1, LO5-2, LO5-4, LO5-5

The Fashion Shoe Company operates a chain of women's shoe shops that carry many styles of

shoes that are all sold at the same price. Sales personnel in the shops are paid a sales commission

on each pair of shoes sold plus a small base salary.

The following data pertains to Shop 48 and is typical of the company's many outlets:

1.

2.

4.

5.

Selling price..

Variable expenses:

Invoice cost

Sales commission

Total variable expenses.

6.

Fixed expenses:

Advertising

Rent..

Salaries

Total fixed expenses.

Per Pair of

Shoes

$30.00

Required:

What is Shop 48's annual break-even point in unit sales and dollar sales?

Prepare a CVP graph showing cost and revenue data for Shop 48 from zero shoes up to 17,000

pairs of shoes sold each year. Clearly indicate the break-even point on the graph.

3.

If 12,000 pairs of shoes are sold in a year, what would be Shop 48's net operating income

(loss)?

The company is considering paying the Shop 48 store manager an incentive commission of

75 cents per pair of shoes (in addition to the salesperson's commission). If this change is

made, what will be the new break-even point in unit sales and dollar sales?

Refer to the original data. As an alternative to (4) above, the company is considering paying

the Shop 48 store manager 50 cents commission on each pair of shoes sold in excess of the

break-even point. If this change is made, what will be Shop 48's net operating income (loss) if

15,000 pairs of shoes are sold?

Refer to the original data. The company is considering eliminating sales commissions entirely

in its shops and increasing fixed salaries by $31,500 annually. If this change is made, what

will be Shop 48's new break-even point in unit sales and dollar sales? Would you recommend

that the change be made? Explain.

$13.50

4.50

$18.00

Annual

$ 30,000

20,000

100,000

$150,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning