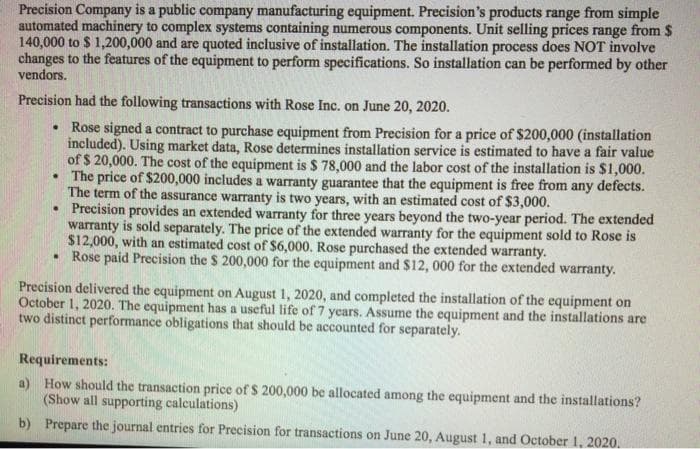

Precision Company is a public company manufacturing equipment. Precision's products range from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $ 140,000 to $ 1,200,000 and are quoted inclusive of installation. The installation process does NOT involve changes to the features of the equipment to perform specifications. So installation can be performed by other vendors. Precision had the following transactions with Rose Inc. on June 20, 2020. • Rose signed a contract to purchase equipment from Precision for a price of $200,000 (installation included). Using market data, Rose determines installation service is estimated to have a fair value of $ 20,000. The cost of the equipment is $ 78,000 and the labor cost of the installation is $1,000. • The price of $200,000 includes a warranty guarantee that the equipment is free from any defects. The term of the assurance warranty is two years, with an estimated cost of $3,000. • Precision provides an extended warranty for three years beyond the two-year period. The extended warranty is sold separately. The price of the extended warranty for the equipment sold to Rose is $12,000, with an estimated cost of $6,000. Rose purchased the extended warranty. • Rose paid Precision the $ 200,000 for the equipment and $12, 000 for the extended warranty.

Precision Company is a public company manufacturing equipment. Precision's products range from simple automated machinery to complex systems containing numerous components. Unit selling prices range from $ 140,000 to $ 1,200,000 and are quoted inclusive of installation. The installation process does NOT involve changes to the features of the equipment to perform specifications. So installation can be performed by other vendors. Precision had the following transactions with Rose Inc. on June 20, 2020. • Rose signed a contract to purchase equipment from Precision for a price of $200,000 (installation included). Using market data, Rose determines installation service is estimated to have a fair value of $ 20,000. The cost of the equipment is $ 78,000 and the labor cost of the installation is $1,000. • The price of $200,000 includes a warranty guarantee that the equipment is free from any defects. The term of the assurance warranty is two years, with an estimated cost of $3,000. • Precision provides an extended warranty for three years beyond the two-year period. The extended warranty is sold separately. The price of the extended warranty for the equipment sold to Rose is $12,000, with an estimated cost of $6,000. Rose purchased the extended warranty. • Rose paid Precision the $ 200,000 for the equipment and $12, 000 for the extended warranty.

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 7DQ

Related questions

Question

Transcribed Image Text:Precision Company is a public company manufacturing equipment, Precision's products range from simple

automated machinery to complex systems containing numerous components. Unit selling prices range from $

140,000 to $ 1,200,000 and are quoted inclusive of installation. The installation process does NOT involve

changes to the features of the equipment to perform specifications. So installation can be performed by other

vendors.

Precision had the following transactions with Rose Inc. on June 20, 2020.

• Rose signed a contract to purchase equipment from Precision for a price of $200,000 (installation

included). Using market data, Rose determines installation service is estimated to have a fair value

of $ 20,000. The cost of the equipment is $ 78,000 and the labor cost of the installation is $1,000.

• The price of $200,000 includes a warranty guarantee that the equipment is free from any defects.

The term of the assurance warranty is two years, with an estimated cost of $3,000.

• Precision provides an extended warranty for three years beyond the two-year period. The extended

warranty is sold separately. The price of the extended warranty for the equipment sold to Rose is

$12,000, with an estimated cost of $6,000. Rose purchased the extended warranty.

• Rose paid Precision the $ 200,000 for the equipment and $12, 000 for the extended warranty.

Precision delivered the equipment on August 1, 2020, and completed the installation of the equipment on

October 1, 2020. The equipment has a useful life of 7 years. Assume the equipment and the installations are

two distinct performance obligations that should be accounted for separately.

Requirements:

a) How should the transaction price of $ 200,000 be allocated among the equipment and the installations?

(Show all supporting calculations)

b) Prepare the journal entries for Precision for transactions on June 20, August 1, and October 1, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning