Prepare a multiple-step income statement. (b) Calculate the gross profit rate and the profit margin and explain what each means. (c) Assume the marketing department has presented a plan to increase advertisingexpenses by $340 million. It expects this plan to result in an increase in both net sales and cost of goods sold of 25%. (Hint: Increase both sales revenue and sales returns and allowances by 25%.) Redo parts (a) and (b) and discuss whether this plan has merit. (Assume a tax rate of 34%, and round all amounts to whole dollars.)

Prepare a multiple-step income statement. (b) Calculate the gross profit rate and the profit margin and explain what each means. (c) Assume the marketing department has presented a plan to increase advertisingexpenses by $340 million. It expects this plan to result in an increase in both net sales and cost of goods sold of 25%. (Hint: Increase both sales revenue and sales returns and allowances by 25%.) Redo parts (a) and (b) and discuss whether this plan has merit. (Assume a tax rate of 34%, and round all amounts to whole dollars.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1RE: Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of...

Related questions

Question

(a) Prepare a multiple-step income statement.

(b) Calculate the gross profit rate and the profit margin and explain what each means.

(c) Assume the marketing department has presented a plan to increase advertisingexpenses by $340 million. It expects this plan to result in an increase in both net sales and cost of goods sold of 25%. (Hint: Increase both sales revenue and sales returns and allowances by 25%.) Redo parts (a) and (b) and discuss whether this plan has merit. (Assume a tax rate of 34%, and round all amounts to whole dollars.)

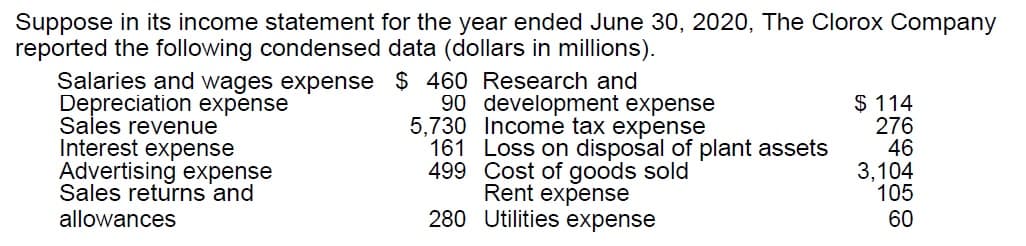

Transcribed Image Text:Suppose in its income statement for the year ended June 30, 2020, The Clorox Company

reported the following condensed data (dollars in millions).

Salaries and wages expense $ 460 Research and

Depreciation expense

Sales revenue

Interest expense

Advertising expense

Sales returns 'and

90 development expense

5,730 Income tax expense

161 Loss on disposal of plant assets

499 Cost of goods sold

Rent expense

280 Utilities expense

$ 114

276

46

3,104

105

60

allowances

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning