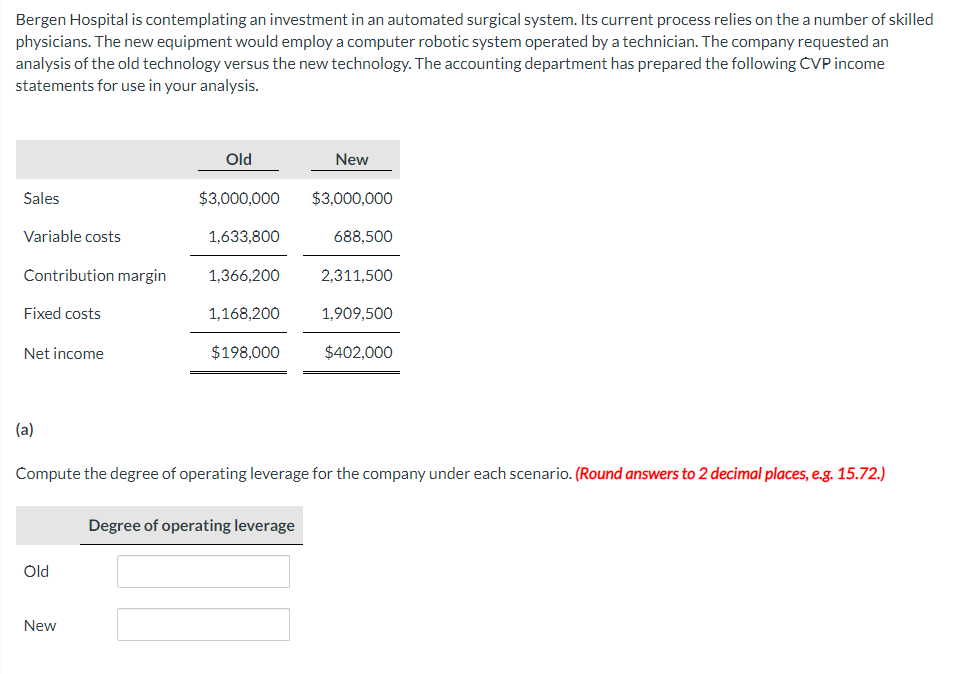

Bergen Hospital is contemplating an investment in an automated surgical system. Its current process relies on the a number of skilled physicians. The new equipment would employ a computer robotic system operated by a technician. The company requested an analysis of the old technology versus the new technology. The accounting department has prepared the following CVP income statements for use in your analysis. Old New Sales $3,000,000 $3,000,000 Variable costs 1,633,800 688,500 Contribution margin 1,366,200 2,311,500 Fixed costs 1,168,200 1,909,500 Net income $198,000 $402,000 (a) Compute the degree of operating leverage for the company under each scenario. (Round answers to 2 decimal places, e.g. 15.72.) Degree of operating leverage Old New

Bergen Hospital is contemplating an investment in an automated surgical system. Its current process relies on the a number of skilled physicians. The new equipment would employ a computer robotic system operated by a technician. The company requested an analysis of the old technology versus the new technology. The accounting department has prepared the following CVP income statements for use in your analysis. Old New Sales $3,000,000 $3,000,000 Variable costs 1,633,800 688,500 Contribution margin 1,366,200 2,311,500 Fixed costs 1,168,200 1,909,500 Net income $198,000 $402,000 (a) Compute the degree of operating leverage for the company under each scenario. (Round answers to 2 decimal places, e.g. 15.72.) Degree of operating leverage Old New

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter3: Cost Behavior

Section: Chapter Questions

Problem 17E: Deepa Dalal opened a free-standing radiology clinic. She had anticipated that the costs for the...

Related questions

Question

Transcribed Image Text:Bergen Hospital is contemplating an investment in an automated surgical system. Its current process relies on the a number of skilled

physicians. The new equipment would employ a computer robotic system operated by a technician. The company requested an

analysis of the old technology versus the new technology. The accounting department has prepared the following CVP income

statements for use in your analysis.

Old

New

Sales

$3,000,000

$3,000,000

Variable costs

1,633,800

688,500

Contribution margin

1,366,200

2,311,500

Fixed costs

1,168,200

1,909,500

Net income

$198,000

$402,000

(a)

Compute the degree of operating leverage for the company under each scenario. (Round answers to 2 decimal places, e.g. 15.72.)

Degree of operating leverage

Old

New

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning