Prepare journal entries from January 1, 2019 to July 31, 2023.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 25P

Related questions

Question

100%

please answer these problems.thank you

Transcribed Image Text:Prepare journal entries from January 1, 2019 to July 31, 2023.

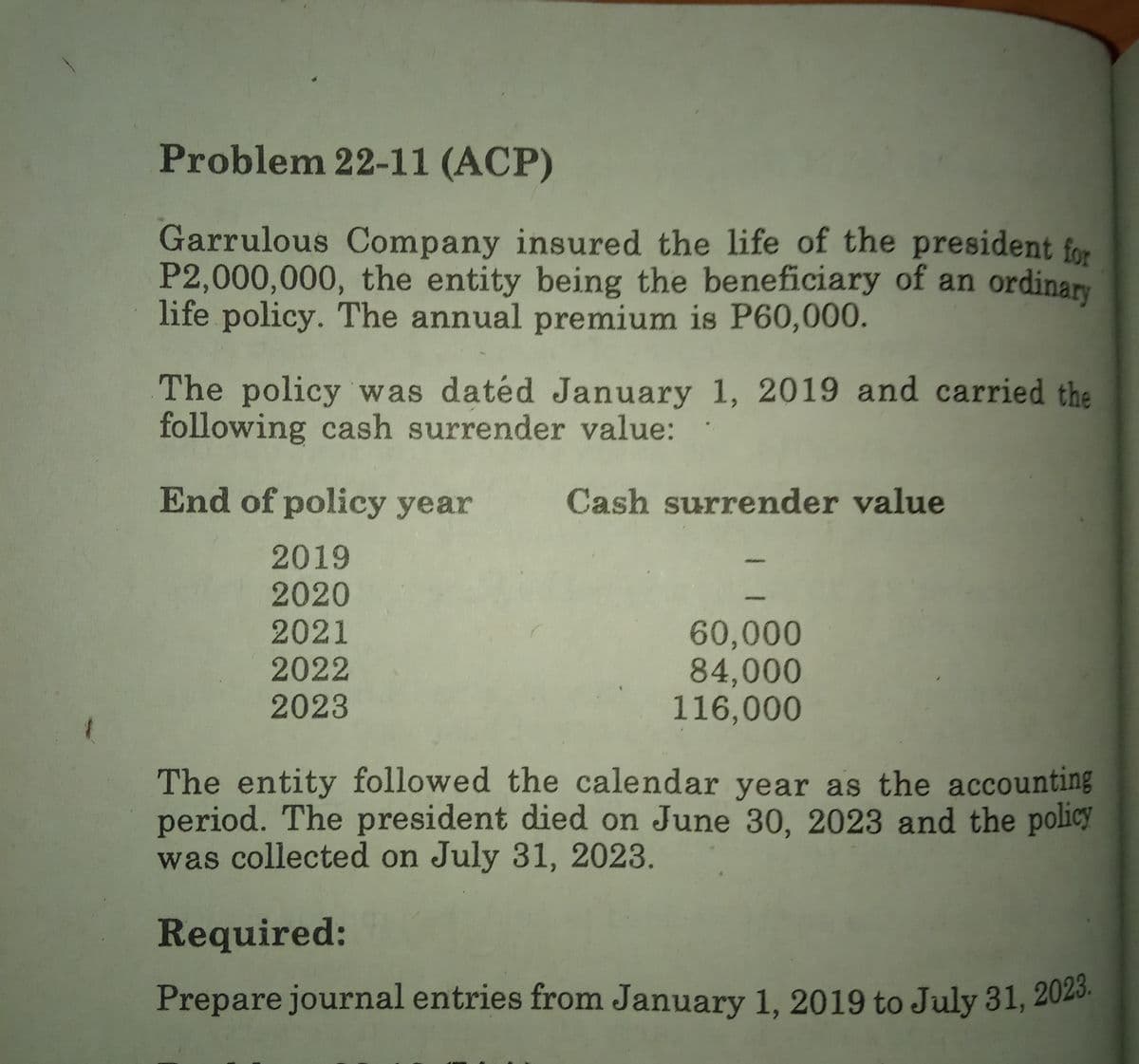

Problem 22-11 (ACP)

Garrulous Company insured the life of the president for

P2,000,000, the entity being the beneficiary of an ordinary

life policy. The annual premium is P60,000.

The policy was datéd January 1, 2019 and carried the

following cash surrender value:

End of policy year

Cash surrender value

2019

2020

2021

2022

2023

60,000

84,000

116,000

The entity followed the calendar year as the accounting

period. The president died on June 30, 2023 and the policy

was collected on July 31, 2023.

Required:

Prepare journal entries from January 1, 2019 to July 31, 2023.

Transcribed Image Text:2. Indicate the classification of the assets that are excluded

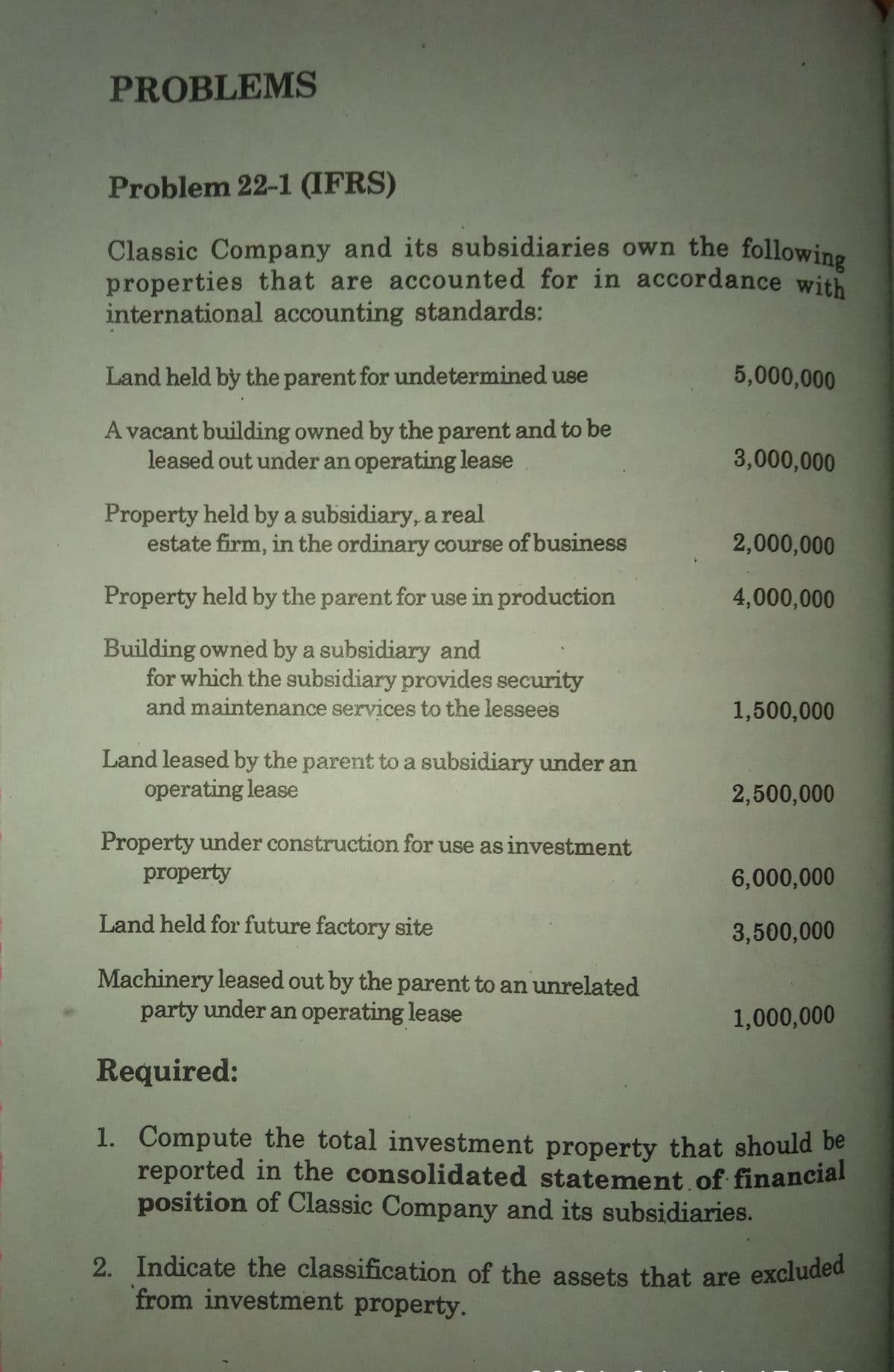

PROBLEMS

Problem 22-1 (IFRS)

Classic Company and its subsidiaries own the following

properties that are accounted for in accordance with

international accounting standards:

Land held by the parent for undetermined use

5,000,000

A vacant building owned by the parent and to be

leased out under an operating lease

3,000,000

Property held by a subsidiary, a real

estate firm, in the ordinary course of business

2,000,000

Property held by the parent for use in production

4,000,000

Building owned by a subsidiary and

for which the subsidiary provides security

and maintenance services to the lessees

1,500,000

Land leased by the parent to a subsidiary under an

operating lease

2,500,000

Property under construction for use as investment

property

6,000,000

Land held for future factory site

3,500,000

Machinery leased out by the parent to an unrelated

party under an operating lease

1,000,000

Required:

1. Compute the total investment property that should be

reported in the consolidated statement of financial

position of Classic Company and its subsidiaries.

from investment property.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College