Open, post to and balance the Appropriation Account for the year ended 31 July 2020.

Q: Enter the amount (if any) of each year's carryover utilized in 2020. Amount of Carryover Year…

A: (a) The table below shows the each year carryover utilized:

Q: On January 1, 2021, Ape

A: Bonds are priced by discounting future cash flows. Future cash flows include coupons and par value…

Q: Instructions (a) Determine the pension expense to be reported on the income statement for 2021. (b)…

A:

Q: Required: Record the amortization expense for 2019.

A: Amortization of the intangible assets : Intangible assets to need to depreciate like tangible…

Q: What amount should be recognized as pretax revaluation surplus on January 1, 2019?

A:

Q: REQUIRED: Prepare all indicated entries for 2018, 2018, and 2020.

A: Journal entry is part of book keeping.

Q: What total amount of current assets should be reported by the entity on December 31, 2019

A: Assets: Assets are the resources of an organization used in the business operations to generate…

Q: Made an adjustment for the cost of the insurance that expired in 2020.

A: Adjustments are made at the end of the year in order to make the necessary corrections and recording…

Q: ement of revenues, ex

A: The balance sheet and the expenditures are shown as,

Q: epare journal entries for the current year in connection with the grant

A: Step 1 Journal is the part of book keeping.

Q: Calculate the amount of revenue to be recognized in 2020 and 2021. Calculate the construction costs…

A: Step 1 Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for…

Q: depreciation expense

A: Depreciation expense = (Cost or last fair value - Residual value)/Useful life in years

Q: How much is the total carrying amount of the property as of June 30, 2021? Show the solutions…

A: Depreciation Cost The purpose of using the depreciation method to know the actual cost of the assets…

Q: The entry to record the retirement in May 2019 would ar):

A: Answer: Option a

Q: b. The January 7, 2020, collection from Lomas Industries. Amount

A: T account: T account is a T-shaped appearance of the journal entries related to a specific account…

Q: Required: Prepare the relevant journal entries for the year 2021 and 2022

A: Lanier Corporation has acquired Plant and Machinery and is following revaluation model of…

Q: Provide your comment about the accounting treatment for additional investment made by Ruby on 31st…

A: Additional investment made by the owner into the business increase the overall capital of the…

Q: Determine the accumulated amount of $60,200.00 invested for the period of January 20,2019 to…

A: Formula: Interest amount = Principal amount x interest rate x Time period.

Q: Required: Prepare a statement of revenues, expenditures, and changes in fund balance for the Muscat…

A: The statement prepared by the government organizations to determine the excess or deficit of…

Q: Compute for the premiums expense for the year ended: A. December 31, 2020 B. December 31, 2021

A: At the time of selling products, companies offers various discounts and premiums to its customers…

Q: What is the loss on repayment of the grant on January 1, 2022? What is the depreciation of the…

A: The solutions are as per your requirement which relate to the situation number 2 Depreciation is a…

Q: How much should PINK report as current assets on December 31, 2021?

A: Current assets are those assets which are already in cash or can be converted into cash into short…

Q: On December 31, 2020, the pre-closing trial balance of Agency GHI shows the following totals:…

A: Total Assets = Current Assets + Property, Plant and Equipment = P600,000 + P800,000 = P1,400,000

Q: For a no-year appropriation, could the agency start a new obligation starting on October 24, 2014?…

A: No- year appropriation is an appropriation which are used for obligations over an indefinite time…

Q: On Jan. 1, 2020, the entity started the preparation of its building construction. On the same date,…

A: The question is on IAS 23- Borrowing cost IAS 23 Borrowing Costs requires that borrowing costs…

Q: appropriate journal entry

A: The subscription received in December 2020 for 2021 is an unearned revenue which is to be treated as…

Q: Calculate Sapna's chargeable income for 2019

A: Base salary of Sapna = ($42,000 / 12 )*11 = $38,500 Free meals = 15 * 48 weeks (Feb - Dec) = $720…

Q: On December 31, 2020, an entity paid P200,000 contribution to a defined contribution plan. Of this…

A: Note: P150,000 paid in exchange for services performed by the employees in December 2019 should be…

Q: Prepare journal entries from January 1, 2019 to July 31, 2023.

A: “Since you have posted a many question, we will solve first question for you. To get the remaining…

Q: Omni Consumer Products Ltd. ("Omni") revealed the following information for the years er December…

A: Accounts receivable turnover ratio states the effectiveness of the company in collecting the…

Q: Prepare the journal entries related to the patent from January 1, 2020 to December 31, 2022. Prepare…

A: An intangible asset is an non monetary asset with following three critical attributes:…

Q: Compute the amount of accumulated depreciation on each bus at December 31, 2020. (I

A: Methods of Depreciation: Depreciation refers to the reduction in the monetary value of a fixed asset…

Q: Prepare the journal entries required in 2021, if any, to record construction costs, revenues, and…

A: The percentage of completion method is a method of recognizing revenues for contracts that span over…

Q: The Department of Budget and Management (DBM), upon approval and issuance of the General…

A: The given information is of Agency X.

Q: en of the following year? Select the correct response: Appropriations Vouchers payable. Reserve for…

A: All temporary nature of account are closed at the end of the financial year. say for example Income,…

Q: Calculate the depreciation expense by sum-of-the-years'-digits for 2021.

A: Depreciation: Depreciation refers to the reduction in the monetary value of a fixed asset due to its…

Q: What amount will be charged to profit or loss for the year ended 30th September 2021 in respect of…

A: Research and development costs are those costs which has been incurred by the company in order to…

Q: What amount will be presented on the balance sheet for fiscal 2020?

A: The present scenario is defined under Define Benefit Plans of Post employment Benefits para in IAS…

Q: Prepare the Property, Plant and Equipment note as it would appear in the financial statements of The…

A: The assets which are held for more than a year, and are used for the revenue generation are known as…

Q: The required loss allowance at Dec. 31, 2020 is

A:

Q: what is the carrying value of the property at December 31, 2020?

A: In fair value method of investment property, the investment property would be valued at its fair…

Q: A) Prepare an amortization schedule for the lessor for 2021 and 2022. B) Prepare the journal entries…

A: A lease is an agreement describing the terms under which one business agrees to rent an asset or…

Q: Compute the total carrying amount of Larkspur' patents on its December 31, 2019, balance sheet.…

A:

Q: Find the actual time and approximate time from October 5,2020 to June 30,2021.

A: Start Date : 5-Oct-2020 End Date : 30-Jun-2021 Calculation Oct 2020 = 26 days Nov 2020 = 30 days…

Q: Provide the required adjusting entries at the end of 2011, assuming that the December 31, 2011,…

A: Inventory recording can be done in various ways which is chosen by the business according to the…

Q: s of P2,000,000 are due on December 31, 2019. The lea

A: To find the balance of assets in Dec 31, 2022 as,

Step by step

Solved in 2 steps

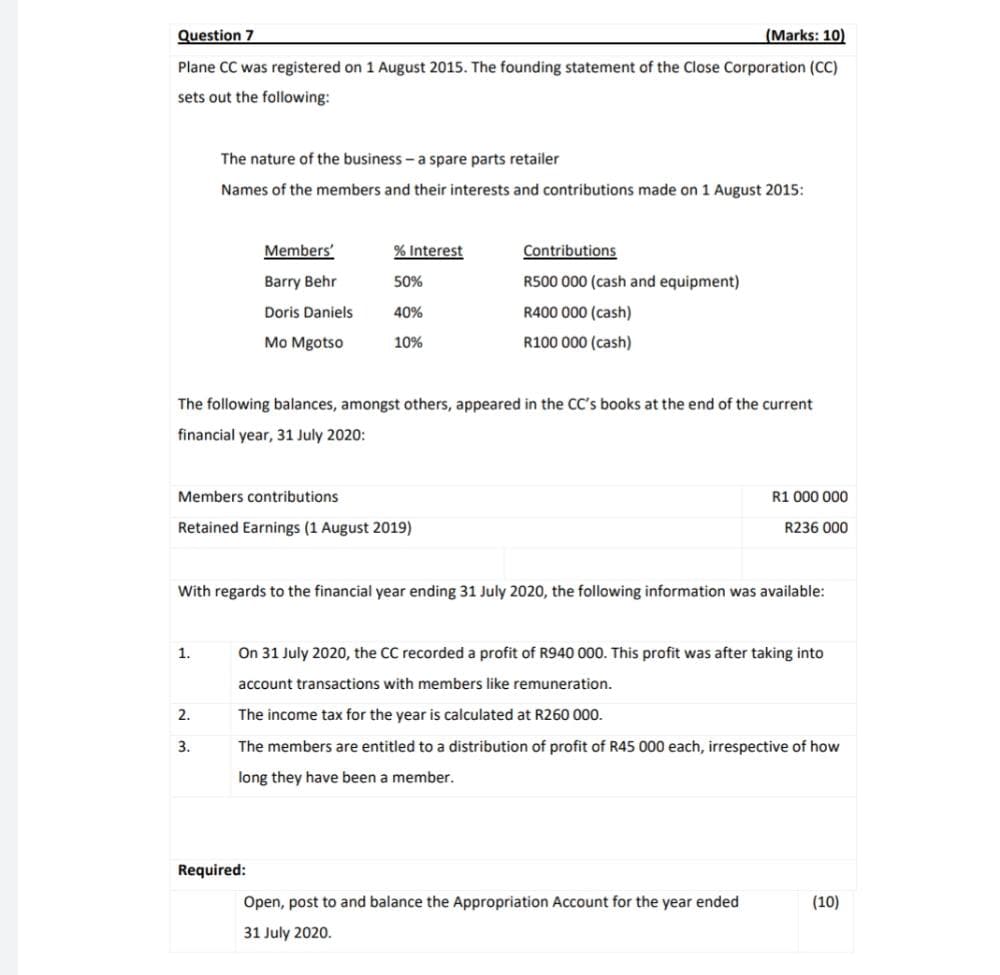

- Plane CC was registered on 1 August 2015. The founding statement of the Close Corporation (CC)sets out the following:The nature of the business – a spare parts retailerNames of the members and their interests and contributions made on 1 August 2015:Members’ % Interest ContributionsBarry Behr 50% R500 000 (cash and equipment)Doris Daniels 40% R400 000 (cash)Mo Mgotso 10% R100 000 (cash)The following balances, amongst others, appeared in the CC’s books at the end of the currentfinancial year, 31 July 2020:Members contributions R1 000 000Retained Earnings (1 August 2019) R236 000With regards to the financial year ending 31 July 2020, the following information was available:1. On 31 July 2020, the CC recorded a profit of R940 000. This profit was after taking intoaccount transactions with members like remuneration.2. The income tax for the year is calculated at R260 000. 3. The members are entitled to a distribution of profit of R45 000 each, irrespective of howlong they have been a…Plane CC was registered on 1 August 2015. The founding statement of the Close Corporation (CC) sets out the following: The nature of the business – a spare parts retailerNames of the members and their interests and contributions made on 1 August 2015: (see attatched 6.JPG The following balances, amongst others, appeared in the CC’s books at the end of the current financial year, 31 July 2020: Members contributions R1 000 000 Retained Earnings (1 August 2019) R236 000 With regards to the financial year ending 31 July 2020, the following information was available: On 31 July 2020, the CC recorded a profit of R940 000. This profit was after taking into account transactions with members like remuneration. The income tax for the year is calculated at R260 000. The members are entitled to a distribution of profit of R45 000 each, irrespective of how long they have been a member. Required: Open, post to and balance the Appropriation Account for…A7X Ltd. is a guitar manufacturing, repair, and retail business. A7X Ltd. engaged in the following transactions during November 2020: Nov 5 Issued new shares to the owner for $20,000 cash. Nov 8 Sold two “ZV Custom” guitars in store to a customer on account at a price of $3,000 each. Nov 12 Collected a $50,000 advance payment from a customer for repairs to be completed in December. Nov 15 Purchased a new piece of woodworking equipment for $12,000 by signing a promissory note. Nov 27 Collected $6,000 cash from the customer who bought the guitars on Nov 8. Nov 28 Promised a supplier, Schecter Guitars, that A7X Ltd. would order 50 guitars for $800 each in December. Required: For each of the above activities, indicate the appropriate journal entry that the company should record at the given dates, or, if applicable, indicate if no journal entry should be recorded. Nov 5: Nov 8: Nov 12: Nov 15:…

- FIND & FOUND LTD, currently trades in Products CCT. The company is currently enjoying a tax holiday. Below is the company’s trial balance. Trial Balance of FIND & FOUND LTD as at year ending 31/12/2016 DR CR GH¢ GH¢ 10% Debentures (2030 – 2035) - 8,600 Bad debts 720 - Bank 9,000 - Building repairs and maintenance 1,440 Carriage inward 1,080 Carriage outwards 1,620 Sale / Purchases 84,000 144,000 Donations received - 864 Trade Debtors/ Creditors 21,600 9,720 Discount 720 936 Electricity company of Ghana (ECG) - 1,080 Electricity Expense 1,440 - Income Surplus 1/1 - 64,440 Investment income - 1,080 Long term Investment-cost 90,000 - Motor Vehicle (Accumulated Depreciation) - 4,320 Motor Vehicle (Cost) 18,000 - Office Equipment (Accumulated Depreciation) - 2,160 Opening Stock 4,320 Office Equipment…Nairobi Ltd Trial Balance As at 31st December 2020 Dr. Cr. Kshs'000 Kshs'000 Sales 500 Furniture-at cost 35 Salaries 80 Buildings-at Cost 100 Accounts Receivable 120 Cash and Cash Equivalent 443 Machinery-at Cost 122 Accounts Payable 105 Salaries Payable 42 Long-term Loans 100 Ordinary Share Capital 150 Stock(Inventories) on 31.12.2020 94 Retained Earnings 157 Cost of Sales 60 1,054 1,054 Additional information (i) Machinery is to be depreciated at 10% p.a.…Ex5.22The following transactions of Larson Services Inc. occurred during August 2019, its first month ofoperations.Aug. 1 Issued common stock for $3,000 cash1 Borrowed $10,000 cash from the bank1 Paid $8,000 cash for a used truck4 Paid $600 for a one–year truck insurance policy effective August 1 (record as an asset)5 Collected $2,000 fees from a client for work to be performed at a later date7 Billed a client $5,000 for services performed today9 Paid $250 for supplies purchased and used today12 Purchased $500 of supplies on credit (record as an asset)15 Collected $1,000 of the amount billed August 716 Paid $200 for advertising in The News during the first two weeks of August20 Paid $250 of the amount owing for supplies purchased on August 1225 Paid the following expenses: rent for August, $350; salaries,$2,150; telephone, $50; truck operating, $25028 Called clients about payment of the balances owing from August 729 Billed a client $6,000 for services performed today, including $1,500…

- The ABC Company had the following transactions in 2021, the first year of its operations: 1. Issued 10 shares of stock at $6 per share; 2. Borrowed $100; 3. Purchased building for $100; 4. Purchased inventory on credit for $60; 5. Paid supplier $40; 6. Company president sold 2 shares of ABC stock from his personal holding; 7. As a favor to the company president, Robert Redford displayed the company logo in his movie; 8. Sold merchandise for $80 on credit; 9. Cost of the merchandise sold in (8) is $50; 10. Salary paid to managers, $5; 11. Use of building (useful life = 18 years, salvage value = $10); 12. Interest expense on loan @ 5%; 13. Dividends declared and paid, $5. Questions: Prepare: (1) an income statement, (2) a statement of retained earnings, (3) a balance sheet, and (4) a statement of cash flows for the first year of the ABC Company. please answer complete6) Treetop company has the gross profit of RO 125,600, selling expenses of RO 45,100, administration expenses of RO 24,700 and dividend revenue of RO 3,500 during the year 2019. Calculate the income from operations of the business. a. RO 55,800 b. RO 73,300 c. RO 59,300 d. RO 69,800Please present the solution in good accounting form. Thank you! 4. How much revenue (franchise revenue, service revenue and sales revenue – machinery and equipment) should be recognized on February 4, 2020?A. P 94, 591.50 C. P 190, 000.00B. P 133, 000.00 D. P417, 591.50 5. How much continuing franchise revenue be recognized on December 31, 2020 assuming the sales of P 4,987,500 was generated for the first year of operations?A. Zero C. P 190, 000.00B. P 49, 875.00 D. P417, 591.50

- The Independent Institute of Education (Pty) Ltd 2022Page 4 of 7Q.2.2Jacob Nkono started a new business called Nkono’s Trading on 1 June 2021.Nkono’s Trading uses the perpetual inventory system.Jacob Nkono had the following funds available for the business, R100 000 in the business’s bank account of which R50 000 was from his personal funds and R50 000 was from a bank loan obtained.He entered into the following transactions during June 2021:June 2- Purchased merchandise via EFT, R20 000June 8- Purchased computer equipment on credit, R15 000June 21- Withdraw R3 000 cash for the petty cash.June 30- Paid R5 000 off the bank loan.Calculate Jacob’s equity in his business on 30 June 2021 by showing the effect of all transactions on the accounting equation.Ignore VAT.4. Assume one year later (2019) the company KY Jeweller’s Ltd has been formed and the owners are desirous of companying several financial transactions and possible outcomes to assist in guiding their decision-making process. They have asked each student from your accounting course to prepare the company’s journal entries and statement of owner’s equity. The company’s charter authorizes 1,000,000 shares of common stock and 100,000 shares of preferred stock and the following are the transactions for consideration: KY Jewelers purchased a piece of land from the original owner. In payment for the land, KY Jewelers issues ___________ of common stock with $1.00 par value. (Show Calculation) The land has been appraised at a market value of ______________ (Show Calculation) Please refer to table below for land value under the category Name # of shares issued Value of land A, P, I, E, V 300,000 $1,200,000PLEASE SHOW SOLUTIONS IN GOOD ACCOUNTING FORM. 6. On January 01, 2020 Kit Company, Inc. establishes a branch in Bauang. During the year, Kit Inc. transfers cash and merchandise to the branch worth P15,000 and P45,000 respectively. Freight was paid by the home office worth P1,500 included in the cost of merchandise. The home office also incurred P5,700 expenses of which 30 percent was allocated to the branch. On December 31, 2020, the branch incurred a loss of P4,000. What is the balance of the branch account as per home office books?