The required loss allowance at Dec. 31, 2020 is

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 11EB: Outpost Designs uses the balance sheet aging method to account for uncollectible debt on...

Related questions

Question

100%

The required loss allowance at Dec. 31, 2020 is?

Please include solutions. Thank you!

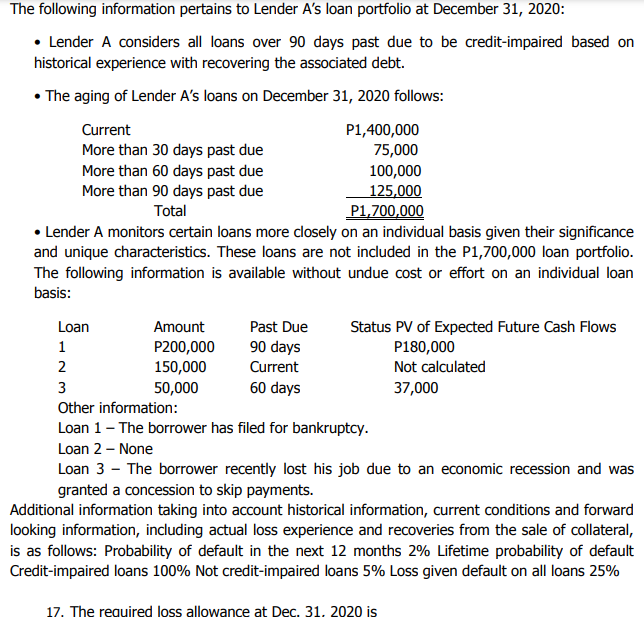

Transcribed Image Text:The following information pertains to Lender A's loan portfolio at December 31, 2020:

• Lender A considers all loans over 90 days past due to be credit-impaired based on

historical experience with recovering the associated debt.

• The aging of Lender A's loans on December 31, 2020 follows:

Current

P1,400,000

More than 30 days past due

More than 60 days past due

More than 90 days past due

75,000

100,000

125,000

Total

P1,700,000

• Lender A monitors certain loans more closely on an individual basis given their significance

and unique characteristics. These loans are not included in the P1,700,000 loan portfolio.

The following information is available without undue cost or effort on an individual loan

basis:

Loan

Amount

Past Due

Status PV of Expected Future Cash Flows

P200,000

150,000

1

90 days

P180,000

Current

Not calculated

3

50,000

60 days

37,000

Other information:

Loan 1- The borrower has filed for bankruptcy.

Loan 2 – None

Loan 3 - The borrower recently lost his job due to an economic recession and was

granted a concession to skip payments.

Additional information taking into account historical information, current conditions and forward

looking information, including actual loss experience and recoveries from the sale of collateral,

is as follows: Probability of default in the next 12 months 2% Lifetime probability of default

Credit-impaired loans 100% Not credit-impaired loans 5% Loss given default on all loans 25%

17. The required loss allowance at Dec. 31, 2020 is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning