Prepare journal entries to record the transactions in 2018 and 2019. a. Using only the information provided (ignore other operating expenses), p statements for 2018 and 2019. p. Was 2018 really as profitable as indicated by its income statement? c. Was 2019 quite as bad as indicated by its income statement?

Prepare journal entries to record the transactions in 2018 and 2019. a. Using only the information provided (ignore other operating expenses), p statements for 2018 and 2019. p. Was 2018 really as profitable as indicated by its income statement? c. Was 2019 quite as bad as indicated by its income statement?

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 5QD

Related questions

Question

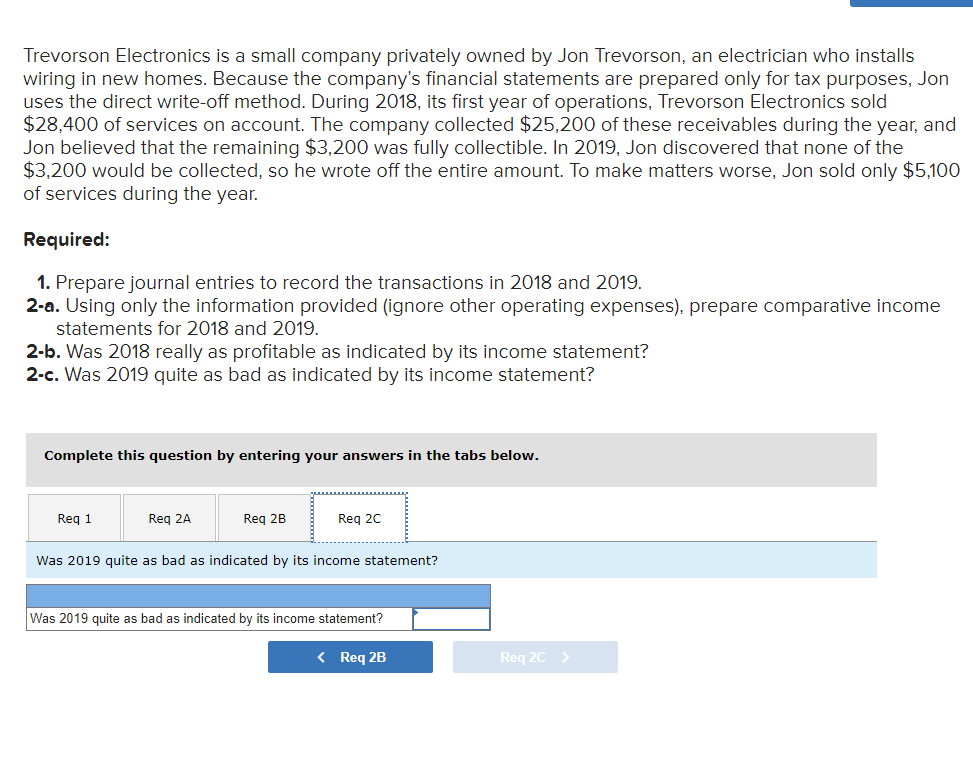

Transcribed Image Text:Trevorson Electronics is a small company privately owned by Jon Trevorson, an electrician who installs

wiring in new homes. Because the company's financial statements are prepared only for tax purposes, Jon

uses the direct write-off method. During 2018, its first year of operations, Trevorson Electronics sold

$28,400 of services on account. The company collected $25,200 of these receivables during the year, and

Jon believed that the remaining $3,200 was fully collectible. In 2019, Jon discovered that none of the

$3,200 would be collected, so he wrote off the entire amount. To make matters worse, Jon sold only $5,100

of services during the year.

Required:

1. Prepare journal entries to record the transactions in 2018 and 2019.

2-a. Using only the information provided (ignore other operating expenses), prepare comparative income

statements for 2018 and 2019.

2-b. Was 2018 really as profitable as indicated by its income statement?

2-c. Was 2019 quite as bad as indicated by its income statement?

Complete this question by entering your answers in the tabs below.

Reg 1

Reg 2A

Reg 2B

Reg 20

Was 2019 quite as bad as indicated by its income statement?

Was 2019 quite as bad as indicated by its income statement?

< Req 2B

Req 20 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT