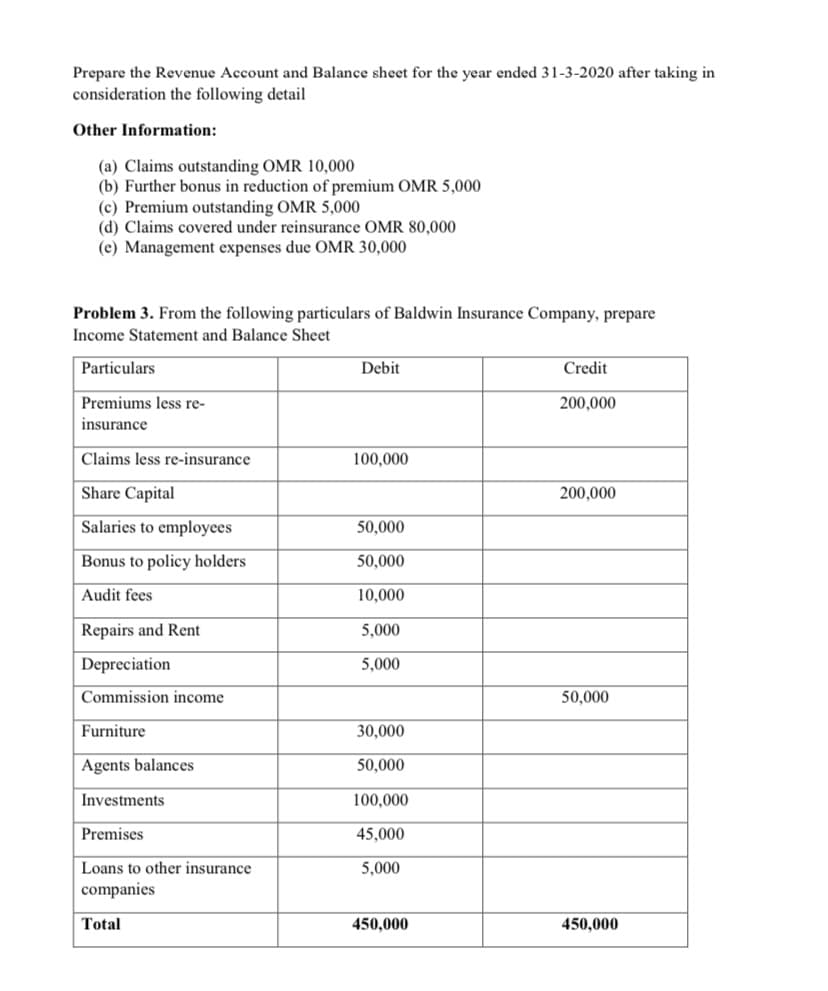

Prepare the Revenue Account and Balance sheet for the year ended 31-3-2020 after taking in consideration the following detail Other Information: (a) Claims outstanding OMR 10,000 (b) Further bonus in reduction of premium OMR 5,000 (c) Premium outstanding OMR 5,000 (d) Claims covered under reinsurance OMR 80,000 (e) Management expenses due OMR 30,000 Problem 3. From the following particulars of Baldwin Insurance Company, prepare Income Statement and Balance Sheet Particulars Debit Credit Premiums less re- 200,000 insurance Claims less re-insurance 100,000 Share Capital 200,000 Salaries to employees 50,000 Bonus to policy holders 50,000 Audit fees 10,000 Repairs and Rent 5,000 Depreciation 5,000 Commission income 50,000 Furniture 30,000 Agents balances 50,000 Investments 100,000 Premises 45,000 Loans to other insurance 5,000 companies Total 450,000 450,000

Prepare the Revenue Account and Balance sheet for the year ended 31-3-2020 after taking in consideration the following detail Other Information: (a) Claims outstanding OMR 10,000 (b) Further bonus in reduction of premium OMR 5,000 (c) Premium outstanding OMR 5,000 (d) Claims covered under reinsurance OMR 80,000 (e) Management expenses due OMR 30,000 Problem 3. From the following particulars of Baldwin Insurance Company, prepare Income Statement and Balance Sheet Particulars Debit Credit Premiums less re- 200,000 insurance Claims less re-insurance 100,000 Share Capital 200,000 Salaries to employees 50,000 Bonus to policy holders 50,000 Audit fees 10,000 Repairs and Rent 5,000 Depreciation 5,000 Commission income 50,000 Furniture 30,000 Agents balances 50,000 Investments 100,000 Premises 45,000 Loans to other insurance 5,000 companies Total 450,000 450,000

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 11Q: If the Prepaid Insurance account had a balance of $12,000, representing one years policy premium,...

Related questions

Question

Transcribed Image Text:Prepare the Revenue Account and Balance sheet for the year ended 31-3-2020 after taking in

consideration the following detail

Other Information:

(a) Claims outstanding OMR 10,000

(b) Further bonus in reduction of premium OMR 5,000

(c) Premium outstanding OMR 5,000

(d) Claims covered under reinsurance OMR 80,000

(e) Management expenses due OMR 30,000

Problem 3. From the following particulars of Baldwin Insurance Company, prepare

Income Statement and Balance Sheet

Particulars

Debit

Credit

Premiums less re-

200,000

insurance

Claims less re-insurance

100,000

Share Capital

200,000

Salaries to employees

50,000

Bonus to policy holders

50,000

Audit fees

10,000

Repairs and Rent

5,000

Depreciation

5,000

Commission income

50,000

Furniture

30,000

|Agents balances

50,000

Investments

100,000

Premises

45,000

Loans to other insurance

5,000

companies

Total

450,000

450,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning