The following items appear on the balance sheet of a company with a one year operating cycle. Identify each item as a curent lablit a long-term lability, or not a liability. tem Classification Cument labty 1 terest payabie (duen 0 day) 2Uneamed revenues (to be eamed over next 3 months) 3 Employne Unon Dues Payable 4 Pension labty to be paid to employees retrng in 2 to 5 years s Wamanty lisbility 6 months of coverage) 6. FICA-Soc Security Taxes Payable 7. FICA-Medicare Taxes Payable 8 Prepsid insurance (6 months of coverage) sSales texes payable 10 Pension lablty do be tuy pad to retired employees in neat 11 months)

The following items appear on the balance sheet of a company with a one year operating cycle. Identify each item as a curent lablit a long-term lability, or not a liability. tem Classification Cument labty 1 terest payabie (duen 0 day) 2Uneamed revenues (to be eamed over next 3 months) 3 Employne Unon Dues Payable 4 Pension labty to be paid to employees retrng in 2 to 5 years s Wamanty lisbility 6 months of coverage) 6. FICA-Soc Security Taxes Payable 7. FICA-Medicare Taxes Payable 8 Prepsid insurance (6 months of coverage) sSales texes payable 10 Pension lablty do be tuy pad to retired employees in neat 11 months)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 3RE: Cee Co.s fiscal year begins April 1. At the beginning of its fiscal year, Cee Co. estimates that...

Related questions

Question

5

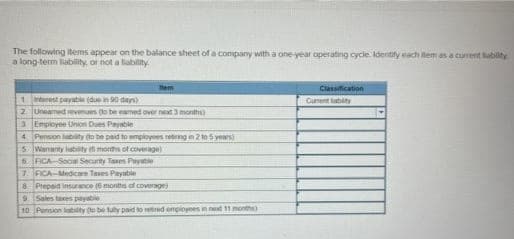

Transcribed Image Text:The following Iitems appear on the balance sheet of a company with a one year operating cycle. Identity each item as a current labity

a long-term lability, or not a liability.

Hem

Classification

1 rterest payable (due in 90 days)

2Uneamed revenues (to be eamed over next 3 months)

3 Employee Union Dues Paysble

4 Pension labty (to be paid to employees retirng in 2 to 5 years)

Curent labity

5 Wananty lisbility 6 morths of coverage)

6. FICA Socal Security Taxes Payatle

7. FICA-Medicare Taxes Payable

8 Prepaid imsurance (6 months of coverage)

s iSales taxes payable

10 Pension liabilty (to be tuy paid to retired employees in next 11 months)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College