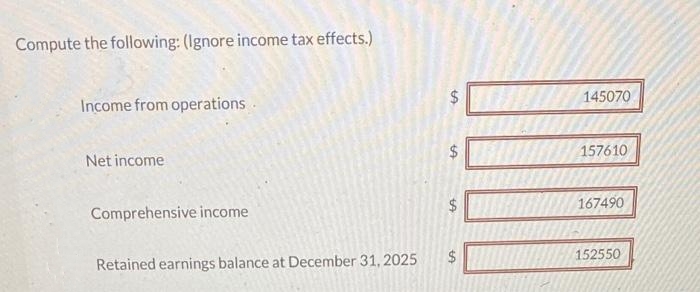

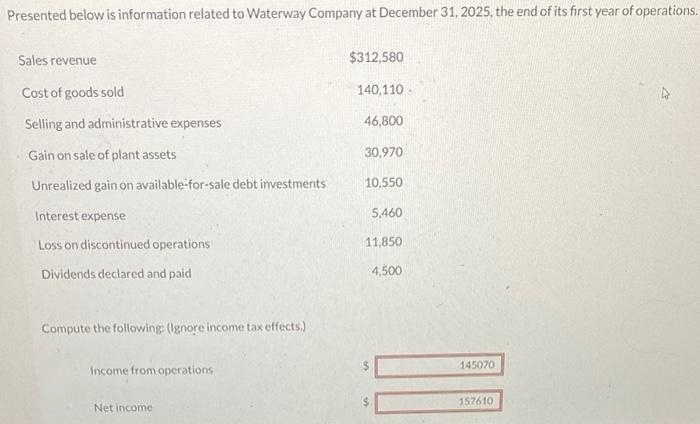

Presented below is information related to Waterway Company at December 31, 2025, the end of its first year of operations. Sales revenue Cost of goods sold Selling and administrative expenses Gain on sale of plant assets Unrealized gain on available-for-sale debt investments Interest expense Loss on discontinued operations Dividends declared and paid Compute the following: (Ignore income tax effects.) Income from operations Net income $312,580 140,110. 46,800 30,970 10,550 5,460 11,850 4,500 145070 157610

Q: Question 4) On November 1, Riedemann Marketing Co. was started with an initial investment in the…

A: Lets understand the basics. Statement of financial position gets prepared through various steps. (1)…

Q: This cannot be correct: I have options of this a. (i) only b. (ii) only c. (iii) only d. (i)…

A: As per the business combination standard (IFRS 3) only acquisition method will be used for…

Q: a. The loss on the cash sale of equipment was $5125(details in b). b.Sold equipment costing…

A: In accounting, the statement of cash flows is a financial statement that summarizes the cash inflows…

Q: No. Date Account Titles and Explanation Aug. 1, 2021 (a) Aug. 1, 2021 Aug. (b) 31, 2021 Aug. 31.…

A: A bondholder generally records a journal entry related to the accrued bond interest in its…

Q: Major medical complexes and their service providers continue to move toward advanced health…

A: Depreciation refers to decrease or reduction in the value of fixed assets as it assign the cost of…

Q: A Accounts Payable AA Losses due to fire B Accounts Receivable BB Merchandise Inventory E…

A: The adjusting journal entries are posted at the end of the accounting period to correct the account…

Q: At the beginning of Year 1. Copeland Drugstore purchased a new computer system for $210,000. It is…

A: Straight-line depreciation is an accounting method that distributes the expense of a fixed asset…

Q: A Accounts Payable AA Losses due to fire B Accounts Receivable BB Merchandise Inventory E…

A: Composite Journal entry - is a compound journal entry that is passed to record more than one entry…

Q: Dawls Corporation reported stockholders' equity on December 31 of the prior year as follows: Common…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Following are the transactions for Valdez Services. The company paid $500 cash for payment on a…

A: A journal entry is a process of recording or maintaining track of any financial or non-financial…

Q: Whitley Construction Company is in the home remodeling business. Whitley has three teams of highly…

A: First we need to calculate Pre-determined overhead rate. = Budgeted Overhead/ Direct Labor Hours.…

Q: Wildhorse Co. has delivery equipment that cost $54,600 and has been depreciated $23,500. Prepare a…

A: The question is based on the concept of Financial Accounting. Where any asset is disposed of at a…

Q: Conn Man's Shops, a national clothing chain, had sales of $370 million last year. The business has a…

A: The company makes sales to earn profit and the company needs funds to cope with the increase in…

Q: You work as a freelance accounting professional and have been recently engaged by the auditors of…

A: An income statement, also known as a profit and loss statement or P&L, is a financial statement…

Q: Problem 3: The December 30, presented below: BYRON COMPANY Unadjusted Trial Balance December 31,…

A: "Since you have asked multiple question, we will solve first question for you. If you want any…

Q: hich of the following statements regarding the acquisition method of accounting for business…

A: In business someone acquire the other company after the acquisition proper combination in the…

Q: A draw bench for precision forming and strengthening of carbon steel tubing has a cost of…

A: Business organization are required to charge the depreciation expense so as to shown the assets…

Q: Find the operating cash flow for the year for Monisan and Sons if it had sales revenue of…

A: Operating cash flow measures the amount of funds generated by a company's regular business…

Q: The Dakota Corporation had a 2021 taxable income of $20,000,000 from operations after all operating…

A: Answer:- Tax liability meaning:- The amount that a person, company or other entity owes to a…

Q: At the end of 20X6, Home Ltd. reported the following in shareholders' equity: Common shares, no par…

A: The company pays a dividend to the shareholders, the dividend is the distribution of profit between…

Q: PR 21-3A Break-even sales and cost-volume-profit chart OBJ. 3, 4 For the coming year, Cleves Company…

A: Contribution Margin :— It is the difference between sales and variable cost. Break Even Point…

Q: Brunswick Home Remodelers (BHM) uses a job order cost system. The following debits (credits)…

A: The overhead is applied to the production on the basis of predetermined overhead rate. The…

Q: ples. assets. Company, organized in 2020, has the following transactions related to intangible…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Daniel Perkins is the sole shareholder of Blue Inc., which is currently under protection of the U.S.…

A: Troubled Debt restructuring:- A debt restructuring is a concept where the lender / Creditor allows…

Q: The following are independent situations. Situation 1: Ivanhoe Cosmetics acquired 10% of the 215,000…

A: Journal entries are items of writing where you keep track of your thoughts and emotions on a certain…

Q: E21-24. Product Pricing: Two Products Assume Verbatim, a subsidiary of CMC Magnetics, manufactures…

A: The variable cost is the cost that varies with the change in units produced because the variable…

Q: Prepare a projected contribution margin income statement for Markham Farm assuming it purchases the…

A: MARGINAL COSTING INCOME STATEMENT Marginal Costing Income Statement is One of the Important Cost…

Q: Before the year began, Brookville Manufacturing estimated that manufacturing overhead for the year…

A: The overheads are the cost that are not related directly to the production of goods and services.…

Q: E Net sales $271,900 Loss on discontinued operations 23,000 Cost of goods sold 165,000 Interest…

A: An income statement that divides total revenue and costs into operational and non-operating…

Q: The following information was taken from the records of Sheridan Inc. for the year 2025: Income tax…

A: Income Statement - Income Statement includes income earned and expenses incurred during the…

Q: Which one pays more (for the same amount and same interest rate), a saving account with a simple…

A: Simple interest rate is the fixed rate of interest which remains unchanged during the invested…

Q: Len Donald started his own consulting firm, Donald Consulting, on June 1, 2025. The trial balance at…

A: 1. T-Accounts - T-Accounts are ledgers prepared for an individual ledger account. Ledgers are…

Q: Piscataway Plastics Company manufactures a highly specialized plastic that is used extensively in…

A: Working Note : Equivalent Units = No. of Units * Percentage of completion Cost per Equivalent Unit…

Q: Beverly Plastics produces a part used in precision machining. The part is produced in two…

A: Equivalent units of production means converting the work-in-progress of incomplete units into…

Q: Cash Land Long-term investments Merchandise inventory Notes receivable (due in 30 days). Notes…

A: The question is based on the concept of Financial Accounting. Current assets are those assets that…

Q: An investor bought 720 shares of a stock for Php 108.26 per share. If the broker's commission was…

A: Issue of shares is one of the important source of finance being used in business. Commission may…

Q: You consider the purchase of a copier for your business. The initial

A: Variable cost are the cost that changes with the change in the level of output, the variable cost…

Q: [The following information applies to the questions displayed below.]

A: Cash flow statement represents the cash inflow and cash outflow of the company that involves the…

Q: Required information [The following information applies to the questions displayed below] Shahia…

A: Working Note : Formula Straight Line Depreciation = (Cost of asset - Residual value) / Estimated…

Q: 1) calculate sales built (% change) as compared to last year, 2) Calculate gross margin % for this…

A: The calculations of the sales and Gross profit margin stated to be the process that involves the…

Q: A firm has projected sales in May, June, and July of $100, $200, and $300, respectively. The firm…

A: INTRODUCTION: Cash sales are when the buyer's payment obligation is met. Cash sales include cash,…

Q: are the transactions of a new company called Pose-for-Pics. August 1 M. Harris, the owner,…

A: Answer : Journal entries : Date Account title Debit Credit Aug.1 Cash $5750 Photography…

Q: The two cash flow transactions shown in the accompanying cash flow diagram are said to be equivalent…

A: Cash Flow: A company should disclose the total cash flow generated by them by classifying it into…

Q: compute the total carrying amount of Oriole's patents on its December 31, 2025, balance sheet.…

A: Patents refers to the rights that one have on their own unique invention and which ristrict others…

Q: 1. Calculate Computron’s market value ratios—that is, its price/earnings ratio and its market/book…

A: Analysis of Financial Performance The practice of assessing a company's financial statements and…

Q: [The following information applies to the questions displayed below.] Lansing Company's current-year…

A: Cash flow statement is a statement that is prepared to find out the cash comes in and goes out, by…

Q: The following information relates to the William Brown Company. Date December 31, 2021 December 31,…

A: "Last-In, First-Out" is an abbreviation for LIFO. It is a technique used in the computation of the…

Q: Purchase of furniture is a cash outflow from activity in a cash flow statement. A. operating B.…

A: INTRODUCTION: A cash flow statement shows how much money enters and leaves your organization in a…

Q: t-to-cost method to measure the completion of its performance obligations. Data relating to the…

A: A Construction Contract is a contract specifically negotiated for the construction of an asset or…

Q: Compute the contribution-margin ratio for the touring model.

A: CONTRIBUTION MARGIN Contribution Margin Per unit is the Difference between Selling Price Per Unit…

Please help me with all answers thanku

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- Comprehensive: Income Statement and Retained Earnings Milwaukee Manufacturing Company presents the following partial list of account balances, after adjustments, as of December 31, 2019: The following information is also available but is not reflected in the preceding accounts: a. The company sold Division E (a major component of the company) on August 2, 2019. During 2019, Division E had incurred a pretax loss from operations of 16,000. However, because the acquiring company could vertically integrate Division E into its facilities, Milwaukee Manufacturing was able to recognize a 42,000 pretax gain on the sale. b. On January 2, 2019, without warning, a foreign country expropriated a factory of Milwaukee Manufacturing which had been operating in that country. As a result of that expropriation, the company has incurred a pretax loss of 30,000. c. The common stock was outstanding for the entire year. A cash dividend of 1.20 per share was declared and paid in 2019. d. The 2019 income tax expense totals 31,050 and consists of the following: Required: 1. As supporting documents for Requirement 2, prepare separate supporting schedules for selling expenses and for general and administrative expenses (include depreciation expense where applicable in these schedules). 2. Prepare 2019 multiple-step income statement for Milwaukee Manufacturing. 3. Prepare a 2019 retained earnings statement. 4. Next Level What was Milwaukee Manufacturings return on common equity for 2019 if its average shareholders equity during 2019 was 500,000? What is your evaluation of this return on common equity if its target for 2019 was 15%? 5. Next Level Discuss how Milwaukee Manufacturings income statement in Requirement 2 might be different if it used IFRS.Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended December 31, 2019 and 2020, contained the following errors: In addition, on December 31, 2020, fully depreciated machinery was sold for 10,800 cash, but the sale was not recorded until 2021. There were no other errors during 2019 or 2020, and no corrections have been made for any of the errors. Refer to the information for Shannon Corporation above. Ignoring income taxes, what is the total effect of the errors on the amount of working capital (current assets minus current liabilities) at December 31, 2020? a. working capital overstated by 4,200 b. working capital understated by 5,800 c. working capital understated by 6,000 d. working capital understated by 9,800

- The comparative balance sheet of Prime Sports Gear, Inc., at December 31, the end of the fiscal year, is as follows: Additional data obtained from the records of Prime Sports Gear are as follows: a. Net income for 2013 was 121,610. b. Depreciation reported on income statement for 2013 was 46,500. c. Purchased 165,000 of new equipment, putting 90,000 cash down and issuing 75,000 of bonds for the balance. d. Old equipment originally costing 19,500, with accumulated depreciation of 7,950, was sold for 8,000. e. Retired 60,000 of bonds. f. Declared cash dividends of 64,000. g. Issued 1,500 shares of common stock at 27 cash per share. You have been asked to prepare a statement of cash flows for Prime Sports Gear for 2013. Review the worksheet called CASHFLOW that has been provided to assist you in preparing the statement. The worksheet has been designed so that as you make entries in columns D and F, column G will be automatically updated. For example, FORMULA1 should be entered as =B17+D17F17. Columns C and E are to be used to enter letter references for each of the debit and credit entries on the worksheet.Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.The comparative balance sheet of Prime Sports Gear, Inc., at December 31, the end of the fiscal year, is as follows: Additional data obtained from the records of Prime Sports Gear are as follows: a. Net income for 2013 was 121,610. b. Depreciation reported on income statement for 2013 was 46,500. c. Purchased 165,000 of new equipment, putting 90,000 cash down and issuing 75,000 of bonds for the balance. d. Old equipment originally costing 19,500, with accumulated depreciation of 7,950, was sold for 8,000. e. Retired 60,000 of bonds. f. Declared cash dividends of 64,000. g. Issued 1,500 shares of common stock at 27 cash per share. Open the file CASHFLOW from the website for this book at cengagebrain.com. First, enter the formulas. Then, complete the worksheet in the manner described next. According to the problem, cash increased from 39,600 to 67,210 during the year. This is a 27,610 increase. To record this increase on the worksheet, move to row 17. Since this is the first account you are analyzing, enter the letter a in column C. Then enter 27610 in column D (a debit since cash increased). This brings the year-end balance (column G) to 67,210, its proper balance. Now move to the bottom part of the statement where you see the categories Operating Activities, Investing Activities, and so on. The credit side of the entry has to be entered here. The proper space for this cash entry is on row 59. Enter the letter a in cell E59 and 27610 in cell F59. Notice the totals at the bottom of the page (row 60) now agree. The next account balance that changed is accounts receivable. It increased by 9,035. To enter this change on the worksheet, enter the letter b in cell C18 and 9035 in cell D18 (again, a debit since accounts receivable increased). This brings the year-end balance in column G to 121,250, its proper balance. The change in accounts receivable balance is an operating activity adjustment (as explained in your textbook). Enter the credit side of this entry in cells E34 and F34, and enter the explanation Increase in accounts receivable in cell A34. Note: Your textbook probably shows Net income as the first item under Operating Activities. We will get to that later. The sequence in which you enter items on this worksheet is not important. All other balance sheet accounts must be analyzed in the same manner, placing appropriate debit or credit entries in the top part of the worksheet to obtain the proper balances in column G, and then entering the second side of the entry in the appropriate row on the bottom part of the worksheet. You should use letter references to identify all entries. Also, you must enter a description of the entry in column A under the appropriate activity category. Although a sequence of analyzing the balance sheet from top to bottom is suggested here, this order is not necessary. As mentioned earlier, your textbook may specify a different sequence. Also, note that some accounts may have both debit and credit adjustments to them. The worksheet is not a substitute for a statement of cash flows, but it does provide you with all the numbers you need to properly prepare one. You will be done with your analysis when: a. The individual account balances at December 31, 2013, as shown on the worksheet (column G) equal those shown in the given problem data. b. The transaction column totals are equal (cells D60 and F60). c. The sum of the operating, investing, and financing activities (cell G59) equals the change in cash (cell D59 or F59). When you are finished, enter your name in cell A1. Save your completed file as CASHFLOW2. Print the worksheet when done. Also print your formulas. Check figure: Total credits at 12/31/2013 (cell G31), 860,460.

- Investing Activities and Depreciable Assets Verlando Company had the following account balances and information available for 2019: During 2019, Verlando recorded the following transactions affecting these accounts: a. Land with a carrying value of 35,000 was sold at a loss of 6,000. b. Land and equipment were purchased with cash during the period. c. Equipment with an original cost of 20,000 that had a book value of 4,000 was written off as obsolete. d. A building with an original cost of 60,000 and accumulated depreciation of 25,000 was sold at a 23,000 gain. e. Depreciation expense and amortization expense were recorded. f. Net income for the year was 60,000. g. A patent was acquired during the year in exchange for 1,200 shares of common stock with a par value of 1 per share and a market value of 26 per share. h. Additional marketable securities wefe purchased during the year. i. Verlando Company has no notes payable in the liabilities section of its balance sheet. Required: 1. Next Level Assuming that Verlando uses the indirect method to determine operating cash flows, what is the amount of depreciation expense and amortization expense that would be added back to net income: 2. Prepare the investing activities section of the statement of cash flows for the year ended December 31, 2019. 3. Prepare the disclosure for significant noncash transactions for the statement of cash flows for the year ended December 31, 2019.Presented below is information related to Blossom Company at December 31, 2020, the end of its first year of operations. Sales revenue $322,170 Cost of goods sold 138,320 Selling and administrative expenses 51,700 Gain on sale of plant assets 30,260 Unrealized gain on available-for-sale debt investments 9,200 Interest expense 5,820 Loss on discontinued operations 12,220 Dividends declared and paid 4,580 Compute the following: (a) Income from operations $enter a dollar amount (b) Net income $enter a dollar amount (c) Comprehensive income $enter a dollar amount (d) Retained earnings balance at December 31, 2020 $enter a dollar amountPresented below is information related to Sohar Inc at December 31, 2020. Sales Revenue OMR 585,000 Cost of goods sold 265,000 Selling and Administrative Expenses 72,000 Gain on sale of plant 38,000 Unrealized gain on sale of Investments 16,000 Interest Expenses 9,000 Loss on discontinued operation 17,000 Allocation to non-controlling interest 49,000 Dividend declared and paid 8,000 Compute the following: (a) Income from operation, (b) net income, (c) net income attributed to controlling shareholders, (d) Comprehensive income, (e) retained earning balance.