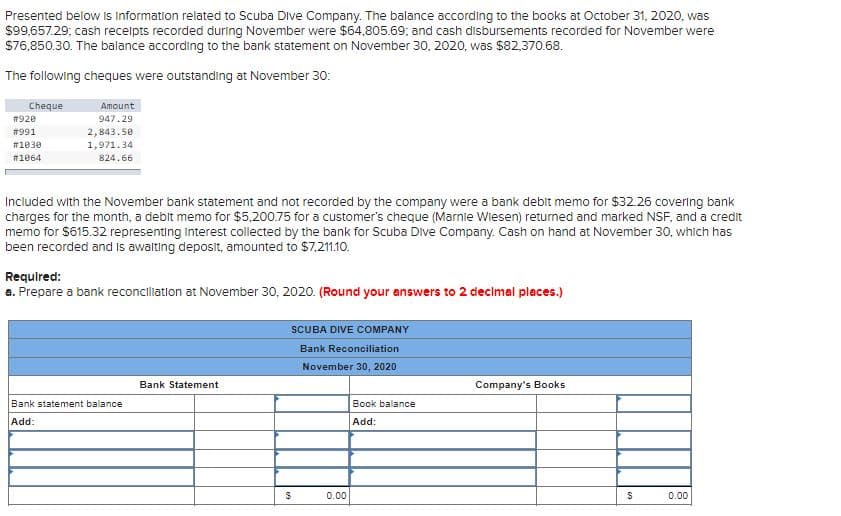

Presented below Is Information related to Scuba Dive Company. The balance according to the books at October 31, 2020, was $99,657.29; cash recelpts recorded during November were $64,805.69; and cash disbursements recorded for November were S76,850.30. The balance according to the bank statement on November 30, 2020, was $82,370.68. The following cheques were outstanding at November 30: Cheque T920 Amount 947.29 #991 2,843.50 #1030 1,971.34 #1064 824.66 Included with the November bank statement and not recorded by the company were a bank deblt memo for $32.26 covering bank charges for the month, a deblt memo for $5,200.75 for a customer's cheque (Marnie Wiesen) returned and marked NSF, and a credit memo for $615.32 representing Interest collected by the bank for Scuba Dive Company. Cash on hand at November 30, which has been recorded and Is awalting deposit, amounted to $7,211.10.

Presented below Is Information related to Scuba Dive Company. The balance according to the books at October 31, 2020, was $99,657.29; cash recelpts recorded during November were $64,805.69; and cash disbursements recorded for November were S76,850.30. The balance according to the bank statement on November 30, 2020, was $82,370.68. The following cheques were outstanding at November 30: Cheque T920 Amount 947.29 #991 2,843.50 #1030 1,971.34 #1064 824.66 Included with the November bank statement and not recorded by the company were a bank deblt memo for $32.26 covering bank charges for the month, a deblt memo for $5,200.75 for a customer's cheque (Marnie Wiesen) returned and marked NSF, and a credit memo for $615.32 representing Interest collected by the bank for Scuba Dive Company. Cash on hand at November 30, which has been recorded and Is awalting deposit, amounted to $7,211.10.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 16P

Related questions

Question

Only 4b question photo please. Thank you!

Transcribed Image Text:Presented below is information related to Scuba Dive Company. The balance according to the books at October 31, 2020, was

$99,657.29; cash recelpts recorded during November were $64,805.69; and cash disbursements recorded for November were

S76,850.30. The balance according to the bank statement on November 30, 2020, was $82,370.68.

The following cheques were outstanding at November 30:

Cheque

Amount

#920

947.29

2,843.50

1,971.34

#991

#1030

#1064

824.66

Included with the November bank statement and not recorded by the company were a bank debit memo for $32.26 covering bank

charges for the month, a debit memo for $5,200.75 for a customer's cheque (Marnie Wlesen) returned and marked NSF, and a credit

memo for $615.32 representing Interest collected by the bank for Scuba Dive Company. Cash on hand at November 30, which has

been recorded and is awalting deposit, amounted to $7,21.10.

Requlred:

a. Prepare a bank reconciliation at November 30, 2020. (Round your answers to 2 decimal places.)

SCUBA DIVE COMPANY

Bank Reconciliation

November 30, 2020

Bank Statement

Company's Books

Bank statement balance

Book balance

Add:

Add:

0.00

0.00

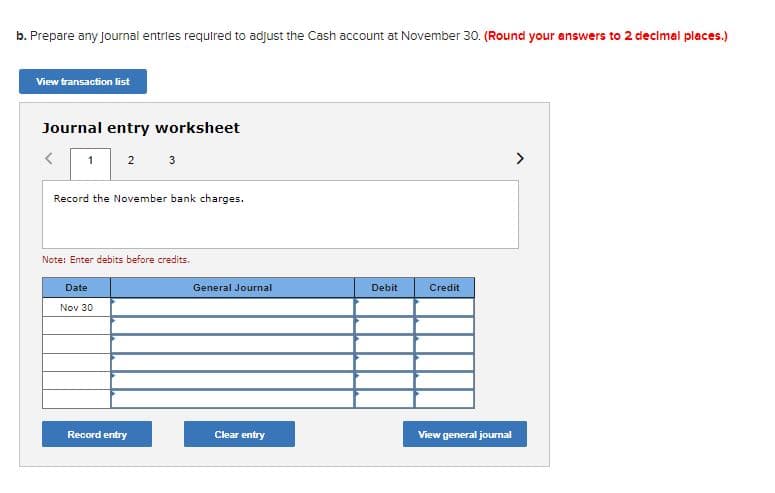

Transcribed Image Text:b. Prepare any Journal entries required to adjust the Cash account at November 30. (Round your answers to 2 decimal places.)

View transaction list

Journal entry worksheet

2

3

>

Record the November bank charges.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Nov 30

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT