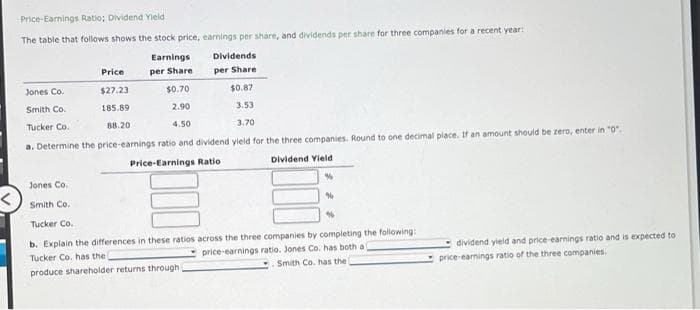

Price-Earnings Ratio: Dividend Yield The table that follows shows the stock price, earnings per share, and dividends per share for three companies for a recent year: Earnings Dividends per Share per Share Price $27.23 Jones Co. $0.70 $0.87 Smith Co. 185.89 2.90 3.53 Tucker Co. 88.20 4.50 3.70 a. Determine the price-earnings ratio and dividend yield for the three companies. Round to one decimal place. If an amount should be zero, enter in "0". Price-Earnings Ratio Dividend Yield Jones Co. % Smith Co. Tucker Co. b. Explain the differences in these ratios across the three Tucker Co. has the l companies by completing the following: ratio. Jones Co. has both a l price-earnings dividend yield and price-earnings ratio and is expected to price-earnings ratio of the three companies. produce shareholder returns through i Smith Co. has the l

Price-Earnings Ratio: Dividend Yield The table that follows shows the stock price, earnings per share, and dividends per share for three companies for a recent year: Earnings Dividends per Share per Share Price $27.23 Jones Co. $0.70 $0.87 Smith Co. 185.89 2.90 3.53 Tucker Co. 88.20 4.50 3.70 a. Determine the price-earnings ratio and dividend yield for the three companies. Round to one decimal place. If an amount should be zero, enter in "0". Price-Earnings Ratio Dividend Yield Jones Co. % Smith Co. Tucker Co. b. Explain the differences in these ratios across the three Tucker Co. has the l companies by completing the following: ratio. Jones Co. has both a l price-earnings dividend yield and price-earnings ratio and is expected to price-earnings ratio of the three companies. produce shareholder returns through i Smith Co. has the l

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 22E

Related questions

Question

Transcribed Image Text:Price-Earnings Ratio; Dividend Yield:

The table that follows shows the stock price, earnings per share, and dividends per share for three companies for a recent year:

Dividends

Earnings

per Share

per Share

Price

$27.23

Jones Co.

$0.70

$0.87

Smith Co.

185.89

2.90

3.53

Tucker Co.

88.20

4.50

3.70

a. Determine the price-earnings ratio and dividend yield for the three companies. Round to one decimal place. If an amount should be zero, enter in "0".

Price-Earnings Ratio

Dividend Yield

Jones Co.

Smith Co.

%

Tucker Co.

%

b. Explain the differences in these ratios across the three

Tucker Co. has the

companies by completing the following:

price-earnings ratio. Jones Co. has both al

dividend yield and price-earnings ratio and is expected to

price-earnings ratio of the three companies.

Smith Co. has the

produce shareholder returns through,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,