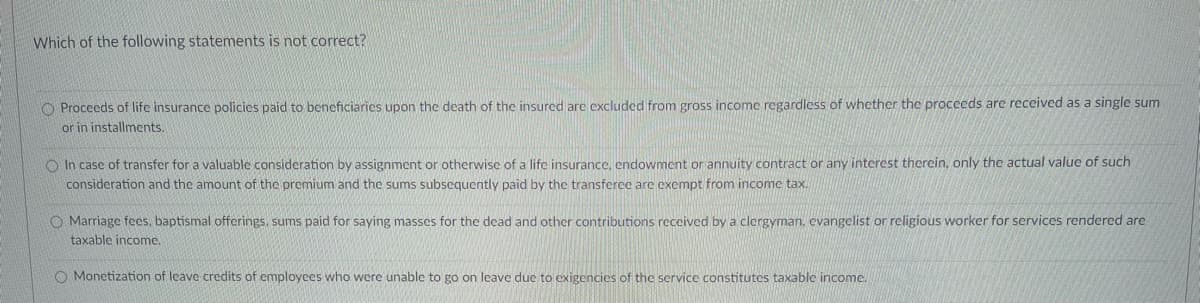

Which of the following statements is not correct?

Chapter2: Gross Income And Exclusions

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

Transcribed Image Text:Which of the following statements is not correct?

Proceeds of life insurance policies paid to beneficiaries upon the death of the insured are excluded from gross income regardless of whether the proceeds are received as a single sum

or in installments.

In case of transfer for a valuable consideration by assignment or otherwise of a life insurance, endowment or annuity contract or any interest therein, only the actual value of such

consideration and the amount of the premium and the sums subsequently paid by the transferee are exempt from income tax.

O Marriage fees, baptismal offerings, sums paid for saying masses for the dead and other contributions received by a clergyman. evangelist or religious worker for services rendered are

taxable income.

O Monetization of leave credits of employees who were unable to go on leave due to exigencies of the service constitutes taxable income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning