Princess Cruise Company (PCC) purchased a ship from Mitsubishi Heavy Industry for 520 million yen payable in one year. The current spot rate is ¥125 per dollar and the one-year forward rate is 111 per dollar. The annual interest rate is 6 percent in Japan and 9 percent in the United States. PCC can also buy a one-year call option on yen at the strike price of $0.0080 per yen for a premium of 0.0140 cents per yen. Note: A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your final answer in whole dollars not in millions. Required: a. Compute the future dollar costs of meeting this obligation using the money market and forward hedges. b. Assuming that the forward exchange rate is the best predictor of the future spot rate, compute the expected future dollar cost of meeting this obligation when the option hedge is used. c. At what future spot rate do you think PCC may be indifferent between the option and forward hedge?

Princess Cruise Company (PCC) purchased a ship from Mitsubishi Heavy Industry for 520 million yen payable in one year. The current spot rate is ¥125 per dollar and the one-year forward rate is 111 per dollar. The annual interest rate is 6 percent in Japan and 9 percent in the United States. PCC can also buy a one-year call option on yen at the strike price of $0.0080 per yen for a premium of 0.0140 cents per yen. Note: A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your final answer in whole dollars not in millions. Required: a. Compute the future dollar costs of meeting this obligation using the money market and forward hedges. b. Assuming that the forward exchange rate is the best predictor of the future spot rate, compute the expected future dollar cost of meeting this obligation when the option hedge is used. c. At what future spot rate do you think PCC may be indifferent between the option and forward hedge?

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 32QA

Related questions

Question

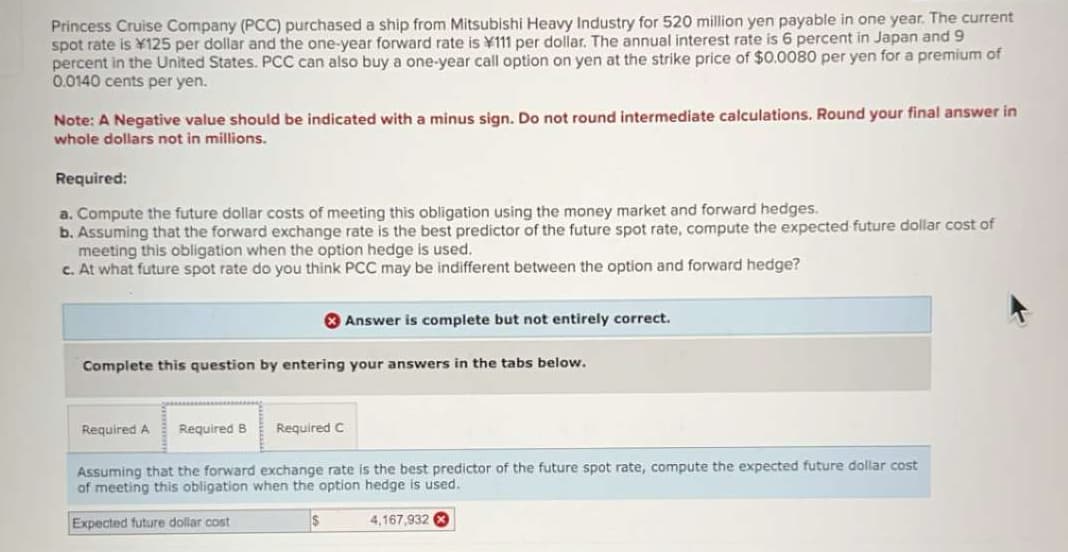

Transcribed Image Text:Princess Cruise Company (PCC) purchased a ship from Mitsubishi Heavy Industry for 520 million yen payable in one year. The current

spot rate is ¥125 per dollar and the one-year forward rate is ¥111 per dollar. The annual interest rate is 6 percent in Japan and 9

percent in the United States. PCC can also buy a one-year call option on yen at the strike price of $0.0080 per yen for a premium of

0.0140 cents per yen.

Note: A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your final answer in

whole dollars not in millions.

Required:

a. Compute the future dollar costs of meeting this obligation using the money market and forward hedges.

b. Assuming that the forward exchange rate is the best predictor of the future spot rate, compute the expected future dollar cost of

meeting this obligation when the option hedge is used.

c. At what future spot rate do you think PCC may be indifferent between the option and forward hedge?

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Assuming that the forward exchange rate is the best predictor of the future spot rate, compute the expected future dollar cost

of meeting this obligation when the option hedge is used.

Expected future dollar cost

4,167,932

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 7 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning