PROBLEM 1: TRUE OR FALSE If credit risk has not increased significantly since initial recognition, an entity may recognize a loss allowance equal to 12-month expected credit losses. The effect of direct origination cost is a decrease in the 1.

PROBLEM 1: TRUE OR FALSE If credit risk has not increased significantly since initial recognition, an entity may recognize a loss allowance equal to 12-month expected credit losses. The effect of direct origination cost is a decrease in the 1.

Chapter1: Taking Risks And Making Profits Within The Dynamic Business Environment

Section: Chapter Questions

Problem 1CE

Related questions

Question

With explanation please

Transcribed Image Text:PROBLEMS

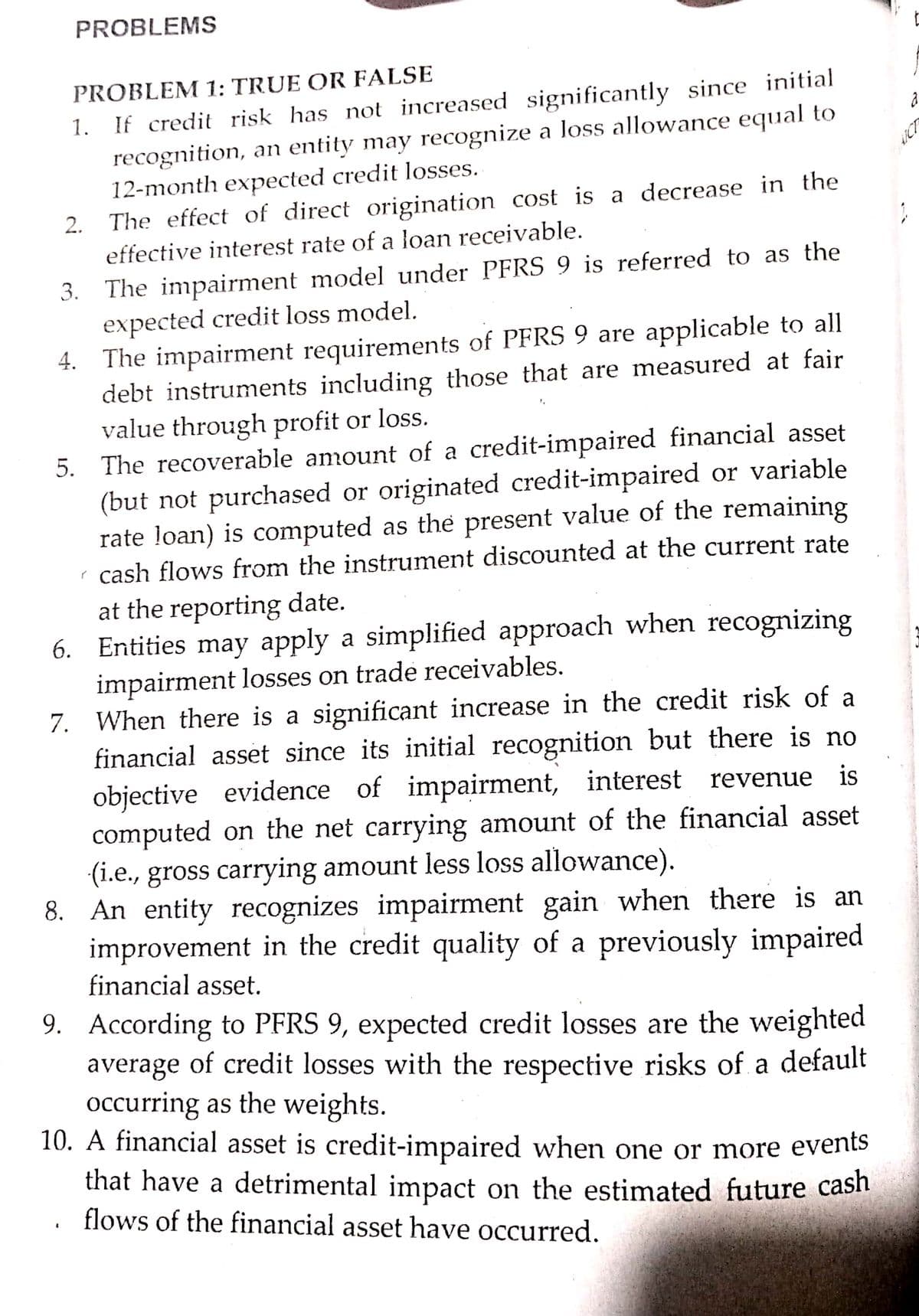

PROBLEM 1: TRUE OR FALSE

1. If credit risk has not increased significantly since initial

recognition, an entity may recognize a loss allowance equal to

12-month expected credit losses.

2. The effect of direct origination cost is a decrease in the

effective interest rate of a loan receivable.

3. The impairment model under PFRS 9 is referred to as the

expected credit loss model.

4. The impairment requirements of PFRS 9 are applicable to all

debt instruments including those that are measured at fair

value through profit or loss.

5. The recoverable amount of a credit-impaired financial asset

(but not purchased or originated credit-impaired or variable

rate loan) is computed as the present value of the remaining

r cash flows from the instrument discounted at the current rate

at the reporting date.

6. Entities may apply a simplified approach when recognizing

impairment losses on trade receivables.

7. When there is a significant increase in the credit risk of a

financial asset since its initial recognition but there is no

objective evidence of impairment, interest revenue is

computed on the net carrying amount of the financial asset

(i.e., gross carrying amount less loss allowance).

8. An entity recognizes impairment gain when there is an

improvement in the credit quality of a previously impaired

financial asset.

9. According to PFRS 9, expected credit losses are the weighted

average of credit losses with the respective risks of a default

Occurring as the weights.

10. A financial asset is credit-impaired when one or more events

that have a detrimental impact on the estimated future cash

flows of the financial asset have occurred.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Understanding Business

Management

ISBN:

9781259929434

Author:

William Nickels

Publisher:

McGraw-Hill Education

Management (14th Edition)

Management

ISBN:

9780134527604

Author:

Stephen P. Robbins, Mary A. Coulter

Publisher:

PEARSON

Spreadsheet Modeling & Decision Analysis: A Pract…

Management

ISBN:

9781305947412

Author:

Cliff Ragsdale

Publisher:

Cengage Learning

Management Information Systems: Managing The Digi…

Management

ISBN:

9780135191798

Author:

Kenneth C. Laudon, Jane P. Laudon

Publisher:

PEARSON

Business Essentials (12th Edition) (What's New in…

Management

ISBN:

9780134728391

Author:

Ronald J. Ebert, Ricky W. Griffin

Publisher:

PEARSON

Fundamentals of Management (10th Edition)

Management

ISBN:

9780134237473

Author:

Stephen P. Robbins, Mary A. Coulter, David A. De Cenzo

Publisher:

PEARSON