Problem #10 Share Dividends and Share Splits On Jan. 1, 2019, the records of Matuguinas Corporation showed the following balances: Ordinary Shares, P1 par Share Premium-Ordinary Retained Earnings P 80,000 920,000 760,000 On Jan. 15, 2019, the board of directors declared a 3% share dividend; the stock's market price was P50 per share, On Nov. 4, 2019, the board of directors declared a for-1 share split; the stock's market price was P90 per share. Required: 1. How many shares of stock were outstanding on Jan. 1, Mar. 31, and Dec. 31 2016 assuming no other events related to shareholders' equity occurred? 2. What effect did the share dividends have on total shareholders' equity? 3. Prepare the entries for these two events. 4. Why would a corporation declare a share split? 5. What would the second entry have been if the corporation had declared a 100% share dividend instead of a 2-for-1 share split?

Problem #10 Share Dividends and Share Splits On Jan. 1, 2019, the records of Matuguinas Corporation showed the following balances: Ordinary Shares, P1 par Share Premium-Ordinary Retained Earnings P 80,000 920,000 760,000 On Jan. 15, 2019, the board of directors declared a 3% share dividend; the stock's market price was P50 per share, On Nov. 4, 2019, the board of directors declared a for-1 share split; the stock's market price was P90 per share. Required: 1. How many shares of stock were outstanding on Jan. 1, Mar. 31, and Dec. 31 2016 assuming no other events related to shareholders' equity occurred? 2. What effect did the share dividends have on total shareholders' equity? 3. Prepare the entries for these two events. 4. Why would a corporation declare a share split? 5. What would the second entry have been if the corporation had declared a 100% share dividend instead of a 2-for-1 share split?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 85PSA: Common Dividends Fusion Payroll Service began 2019 with 1,200,000 authorized and 375,000 issued and...

Related questions

Question

Hello please answer number 2,4 and 5. Thanks.

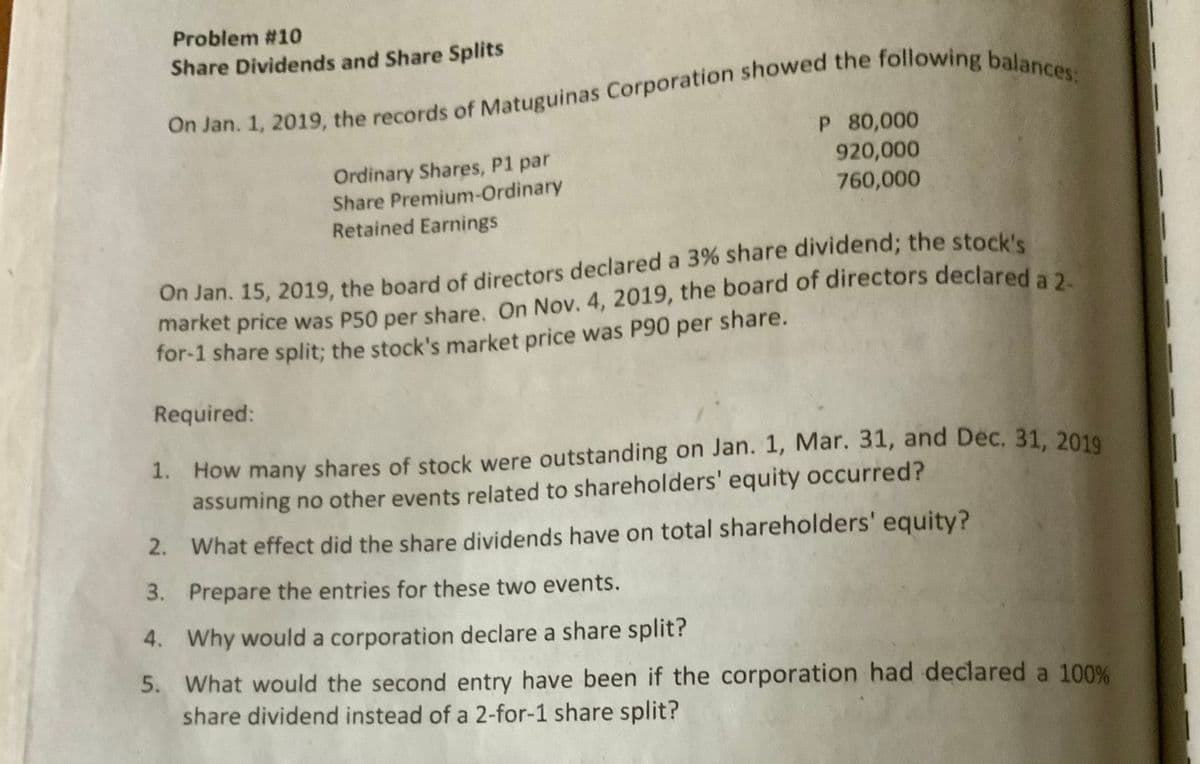

Transcribed Image Text:Problem #10

Share Dividends and Share Splits

Ordinary Shares, P1 par

Share Premium-Ordinary

P 80,000

920,000

760,000

Retained Earnings

On Jan. 15, 2019, the board of directors declared a 3% share dividend; the stock's

market price was P50 per share. On Nov. 4, 2019, the board of directors declared a

for-1 share split; the stock's market price was P90 per share.

Required:

1. How many shares of stock were outstanding on Jan. 1, Mar. 31, and Dec, 31, 2010

assuming no other events related to shareholders' equity occurred?

2. What effect did the share dividends have on total shareholders' equity?

3. Prepare the entries for these two events.

4. Why would a corporation declare a share split?

5. What would the second entry have been if the corporation had declared a 100%

share dividend instead of a 2-for-1 share split?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning