Problem #19 R. San Pedro Corporation has paid all required preference dividends through Dec. 31, 2014. Its outstanding shares consists of 10,000 shares of P125 par value ordinary shares and 4,000 shares of 6%, P125 par value preference shares. During five successive years, the corporation's dividend declarations were as follows: P85,000 52,500 7,500 2015 2016 2017 15,000 67,500 2018 2019 Compute the amount of dividends that would have been paid to each class of shares in each of the last five years assuming the preference shares is: a. Cumulative. b. Noncumulative.

Problem #19 R. San Pedro Corporation has paid all required preference dividends through Dec. 31, 2014. Its outstanding shares consists of 10,000 shares of P125 par value ordinary shares and 4,000 shares of 6%, P125 par value preference shares. During five successive years, the corporation's dividend declarations were as follows: P85,000 52,500 7,500 2015 2016 2017 15,000 67,500 2018 2019 Compute the amount of dividends that would have been paid to each class of shares in each of the last five years assuming the preference shares is: a. Cumulative. b. Noncumulative.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.6E

Related questions

Question

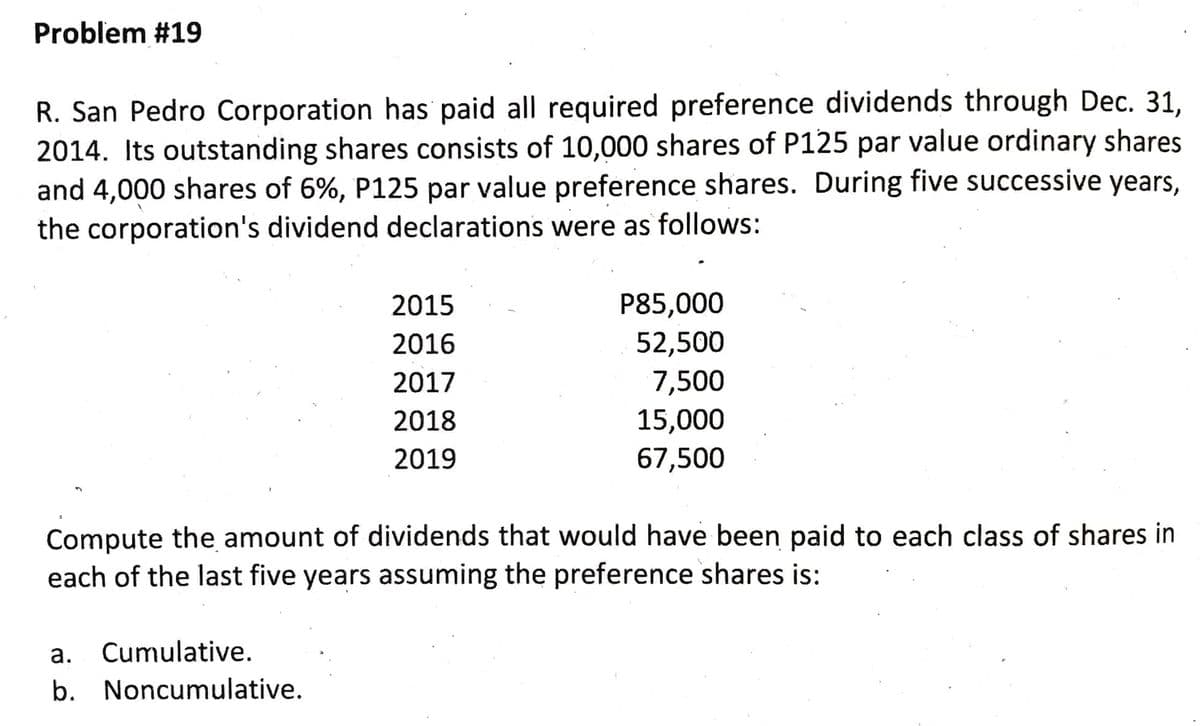

Transcribed Image Text:Problem #19

R. San Pedro Corporation has' paid all required preference dividends through Dec. 31,

2014. Its outstanding shares consists of 10,000 shares of P125 par value ordinary shares

and 4,000 shares of 6%, P125 par value preference shares. During five successive years,

the corporation's dividend declarations were as follows:

2015

P85,000

2016

52,500

2017

7,500

2018

15,000

2019

67,500

Compute the amount of dividends that would have been paid to each class of shares in

each of the last five years assuming the preference shares is:

a. Cumulative.

b. Noncumulative.

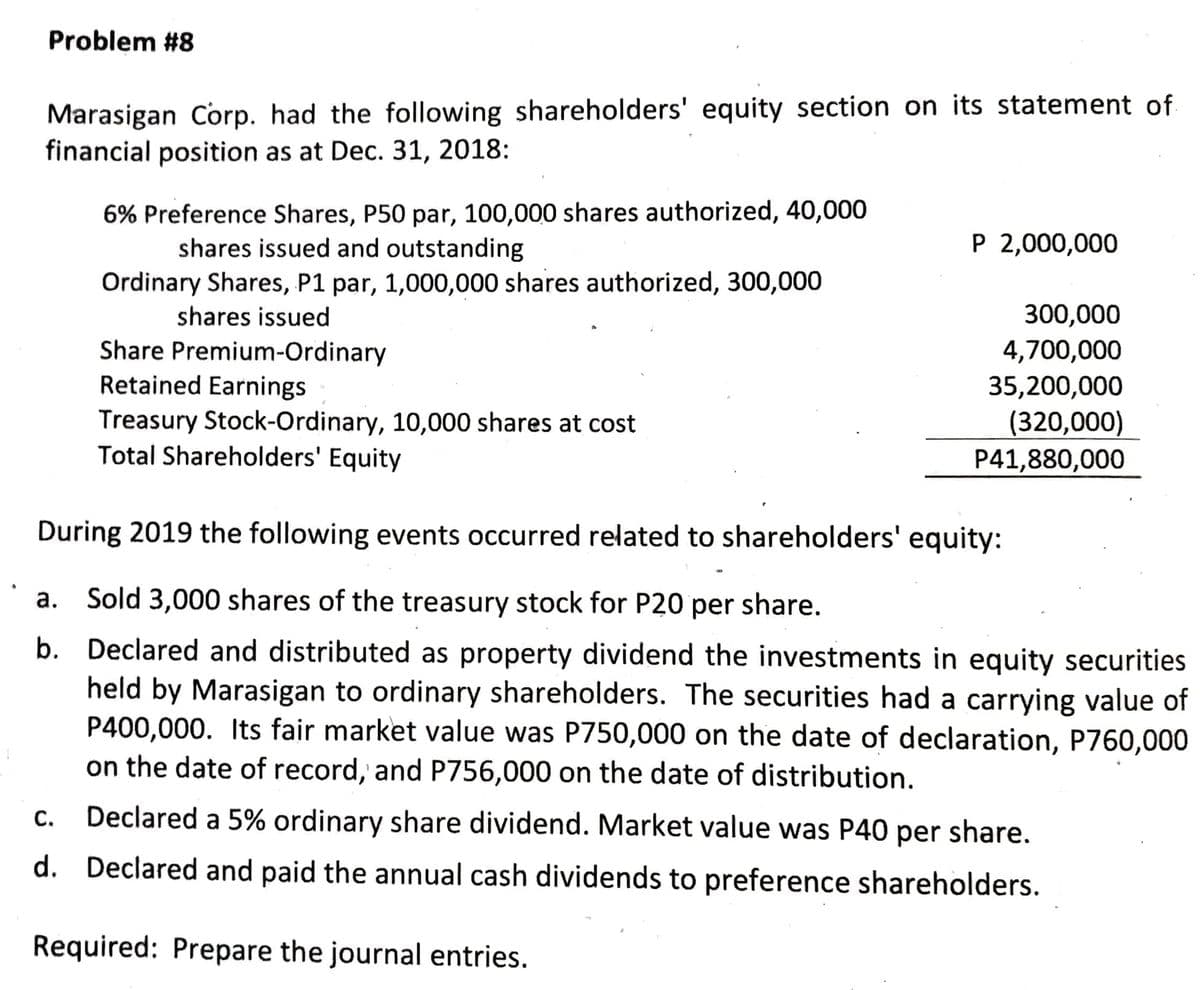

Transcribed Image Text:Problem #8

Marasigan Corp. had the following shareholders' equity section on its statement of

financial position as at Dec. 31, 2018:

6% Preference Shares, P50 par, 100,000 shares authorized, 40,000

shares issued and outstanding

P 2,000,000

Ordinary Shares, P1 par, 1,000,000 shares authorized, 300,000

shares issued

300,000

Share Premium-Ordinary

Retained Earnings

4,700,000

35,200,000

Treasury Stock-Ordinary, 10,000 shares at cost

Total Shareholders' Equity

(320,000)

P41,880,000

During 2019 the following events occurred related to shareholders' equity:

a. Sold 3,000 shares of the treasury stock for P20 per share.

b. Declared and distributed as property dividend the investments in equity securities

held by Marasigan to ordinary shareholders. The securities had a carrying value of

P400,000. Its fair market value was P750,000 on the date of declaration, P760,000

on the date of record, and P756,000 on the date of distribution.

С.

Declared a 5% ordinary share dividend. Market value was P40 per share.

d. Declared and paid the annual cash dividends to preference shareholders.

Required: Prepare the journal entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning