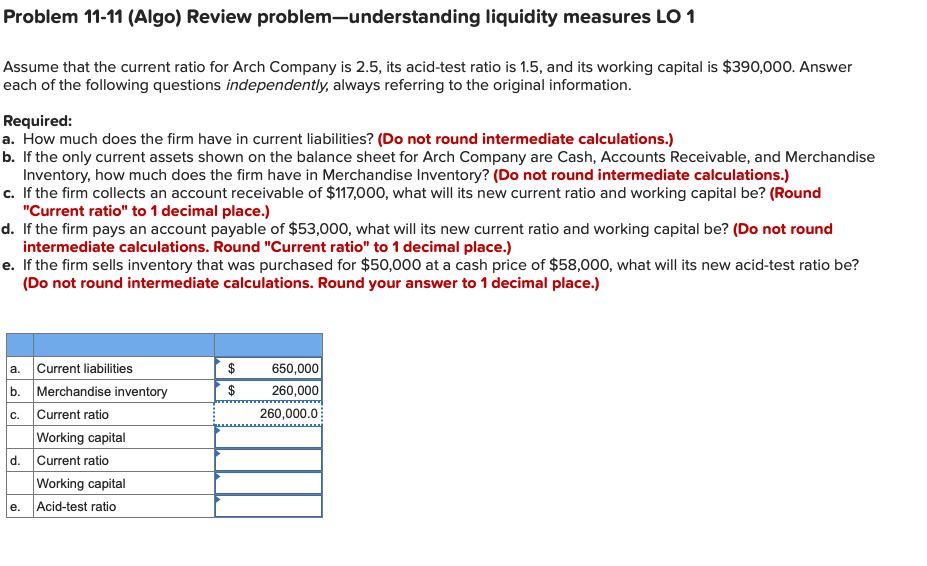

Problem 11-11 (Algo) Review problem-understanding liquidity measures LO 1 Assume that the current ratio for Arch Company is 2.5, its acid-test ratio is 1.5, and its working capital is $390,000. Answer each of the following questions independently, always referring to the original information. Required: a. How much does the firm have in current liabilities? (Do not round intermediate calculations.) b. If the only current assets shown on the balance sheet for Arch Company are Cash, Accounts Receivable, and Merchandise Inventory, how much does the firm have in Merchandise Inventory? (Do not round intermediate calculations.) c. If the firm collects an account receivable of $117,000, what will its new current ratio and working capital be? (Round "Current ratio" to 1 decimal place.) d. If the firm pays an account payable of $53,000, what will its new current ratio and working capital be? (Do not round intermediate calculations. Round "Current ratio" to 1 decimal place.) e. If the firm sells inventory that was purchased for $50,000 at a cash price of $58,000, what will its new acid-test ratio be? (Do not round intermediate calculations. Round your answer to 1 decimal place.) a. Current liabilities b. Merchandise inventory c. Current ratio Working capital d. Current ratio Working capital Acid-test ratio 650,000 $ 260,000 260,000.0 е.

Problem 11-11 (Algo) Review problem-understanding liquidity measures LO 1 Assume that the current ratio for Arch Company is 2.5, its acid-test ratio is 1.5, and its working capital is $390,000. Answer each of the following questions independently, always referring to the original information. Required: a. How much does the firm have in current liabilities? (Do not round intermediate calculations.) b. If the only current assets shown on the balance sheet for Arch Company are Cash, Accounts Receivable, and Merchandise Inventory, how much does the firm have in Merchandise Inventory? (Do not round intermediate calculations.) c. If the firm collects an account receivable of $117,000, what will its new current ratio and working capital be? (Round "Current ratio" to 1 decimal place.) d. If the firm pays an account payable of $53,000, what will its new current ratio and working capital be? (Do not round intermediate calculations. Round "Current ratio" to 1 decimal place.) e. If the firm sells inventory that was purchased for $50,000 at a cash price of $58,000, what will its new acid-test ratio be? (Do not round intermediate calculations. Round your answer to 1 decimal place.) a. Current liabilities b. Merchandise inventory c. Current ratio Working capital d. Current ratio Working capital Acid-test ratio 650,000 $ 260,000 260,000.0 е.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter24: Analysis Of Financial Statements

Section: Chapter Questions

Problem 2SEA

Related questions

Question

Transcribed Image Text:Problem 11-11 (Algo) Review problem-understanding liquidity measures LO 1

Assume that the current ratio for Arch Company is 2.5, its acid-test ratio is 1.5, and its working capital is $390,000. Answer

each of the following questions independently, always referring to the original information.

Required:

a. How much does the firm have in current liabilities? (Do not round intermediate calculations.)

b. If the only current assets shown on the balance sheet for Arch Company are Cash, Accounts Receivable, and Merchandise

Inventory, how much does the firm have in Merchandise Inventory? (Do not round intermediate calculations.)

c. If the firm collects an account receivable of $117,000, what will its new current ratio and working capital be? (Round

"Current ratio" to 1 decimal place.)

d. If the firm pays an account payable of $53,000, what will its new current ratio and working capital be? (Do not round

intermediate calculations. Round "Current ratio" to 1 decimal place.)

e. If the firm sells inventory that was purchased for $50,000 at a cash price of $58,000, what will its new acid-test ratio be?

(Do not round intermediate calculations. Round your answer to 1 decimal place.)

a. Current liabilities

b. Merchandise inventory

c. Current ratio

Working capital

d. Current ratio

Working capital

e. Acid-test ratio

650,000|

260,000

$

260,000.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning