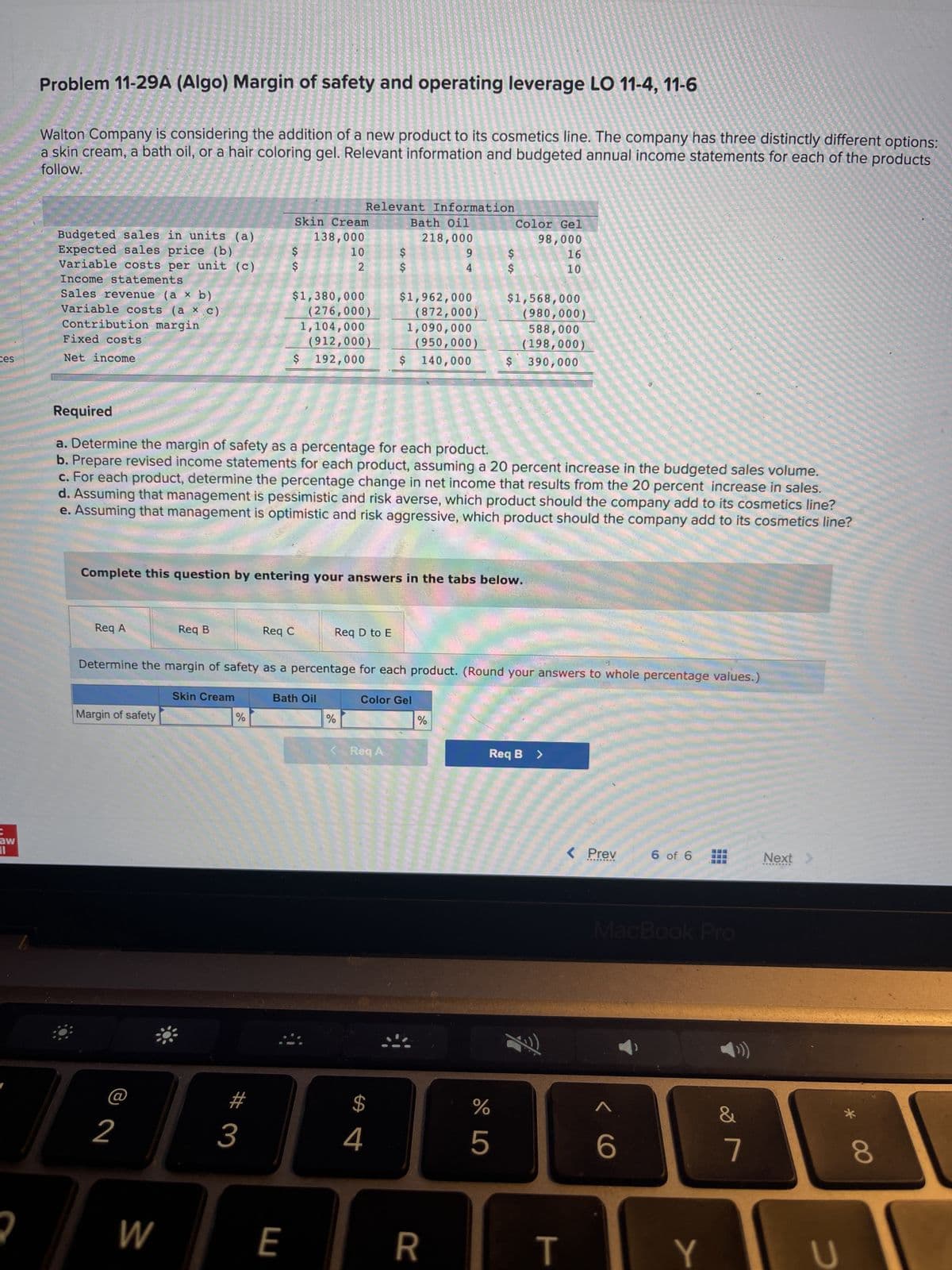

Problem 11-29A (Algo) Margin of safety and operating leverage LO 11-4, 11-6 Walton Company is considering the addition of a new product to its cosmetics line. The company has three distinctly different options= a skin cream, a bath oil, or a hair coloring gel. Relevant information and budgeted annual income statements for each of the products follow. Budgeted sales in units (a) Expected sales price (b) Variable costs per unit (c) Income statements Sales revenue (a x b) Variable costs (a x c) Contribution margin Fixed costs Net income Req A $ $ Req B Margin of safety Skin Cream 138,000 $1,380,000 (276,000) 10 2 1,104,000 Req C Relevant Information Bath Oil 218,000 (912,000) $ 192,000 Bath Oil Req D to E % $ $ Required a. Determine the margin of safety as a percentage for each product. b. Prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume. c. For each product, determine the percentage change in net income that results from the 20 percent increase in sales. d. Assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line? e. Assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line? Complete this question by entering your answers in the tabs below. $1,962,000 (872,000) 9 4 1,090,000 < Req A (950,000) $ 140,000 Color Gel Color Gel 98,000 Determine the margin of safety as a percentage for each product. (Round your answers to whole percentage values.) Skin Cream $ $ % $1,568,000 (980,000) 588,000 (198,000) $ 390,000 16 10 Req B >

Problem 11-29A (Algo) Margin of safety and operating leverage LO 11-4, 11-6 Walton Company is considering the addition of a new product to its cosmetics line. The company has three distinctly different options= a skin cream, a bath oil, or a hair coloring gel. Relevant information and budgeted annual income statements for each of the products follow. Budgeted sales in units (a) Expected sales price (b) Variable costs per unit (c) Income statements Sales revenue (a x b) Variable costs (a x c) Contribution margin Fixed costs Net income Req A $ $ Req B Margin of safety Skin Cream 138,000 $1,380,000 (276,000) 10 2 1,104,000 Req C Relevant Information Bath Oil 218,000 (912,000) $ 192,000 Bath Oil Req D to E % $ $ Required a. Determine the margin of safety as a percentage for each product. b. Prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume. c. For each product, determine the percentage change in net income that results from the 20 percent increase in sales. d. Assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line? e. Assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line? Complete this question by entering your answers in the tabs below. $1,962,000 (872,000) 9 4 1,090,000 < Req A (950,000) $ 140,000 Color Gel Color Gel 98,000 Determine the margin of safety as a percentage for each product. (Round your answers to whole percentage values.) Skin Cream $ $ % $1,568,000 (980,000) 588,000 (198,000) $ 390,000 16 10 Req B >

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 7CE: Refer to Cornerstone Exercise 8.6. Required: 1. Calculate the total budgeted cost of units produced...

Related questions

Question

100%

Transcribed Image Text:ces

aw

19

2

Problem 11-29A (Algo) Margin of safety and operating leverage LO 11-4, 11-6

Walton Company is considering the addition of a new product to its cosmetics line. The company has three distinctly different options:

a skin cream, a bath oil, or a hair coloring gel. Relevant information and budgeted annual income statements for each of the products

follow.

Budgeted sales in units (a)

Expected sales price (b)

Variable costs per unit (c)

Income statements

Sales revenue (a x b)

Variable costs (ax c)

Contribution margin

Fixed costs

Net income

Req A

Margin of safety

Determine the margin of safety as

2

Req B

W

Skin Cream

%

#

3

Required

a. Determine the margin of safety as a percentage for each product.

b. Prepare revised income statements for each product, assuming a 20 percent increase in the budgeted sales volume.

c. For each product, determine the percentage change in net income that results from the 20 percent increase in sales.

d. Assuming that management is pessimistic and risk averse, which product should the company add to its cosmetics line?

e. Assuming that management is optimistic and risk aggressive, which product should the company add to its cosmetics line?

Req C

Skin Cream

138,000

Complete this question by entering your answers in the tabs below.

$1,380,000

(276,000)

1,104,000

(912,000)

$ 192,000

E

10

2

Relevant Information

Bath Oil

218,000

Bath Oil

Req D to E

%

$

$

< Req A

$1,962,000

(872,000)

$

4

1,090,000

9

4

(950,000)

$ 140,000

Color Gel

percentage for each product. (Round your answers to whole percentage values.)

%

$

R

Color Gel

98,000

16

10

$1,568,000

(980,000)

588,000

(198,000)

$ 390,000

%

5

Req B >

T

< Prev

*********

6 of 6

< C

MacBook Pro

IT

Y

&

7

Next >

*********

U

*

8

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning