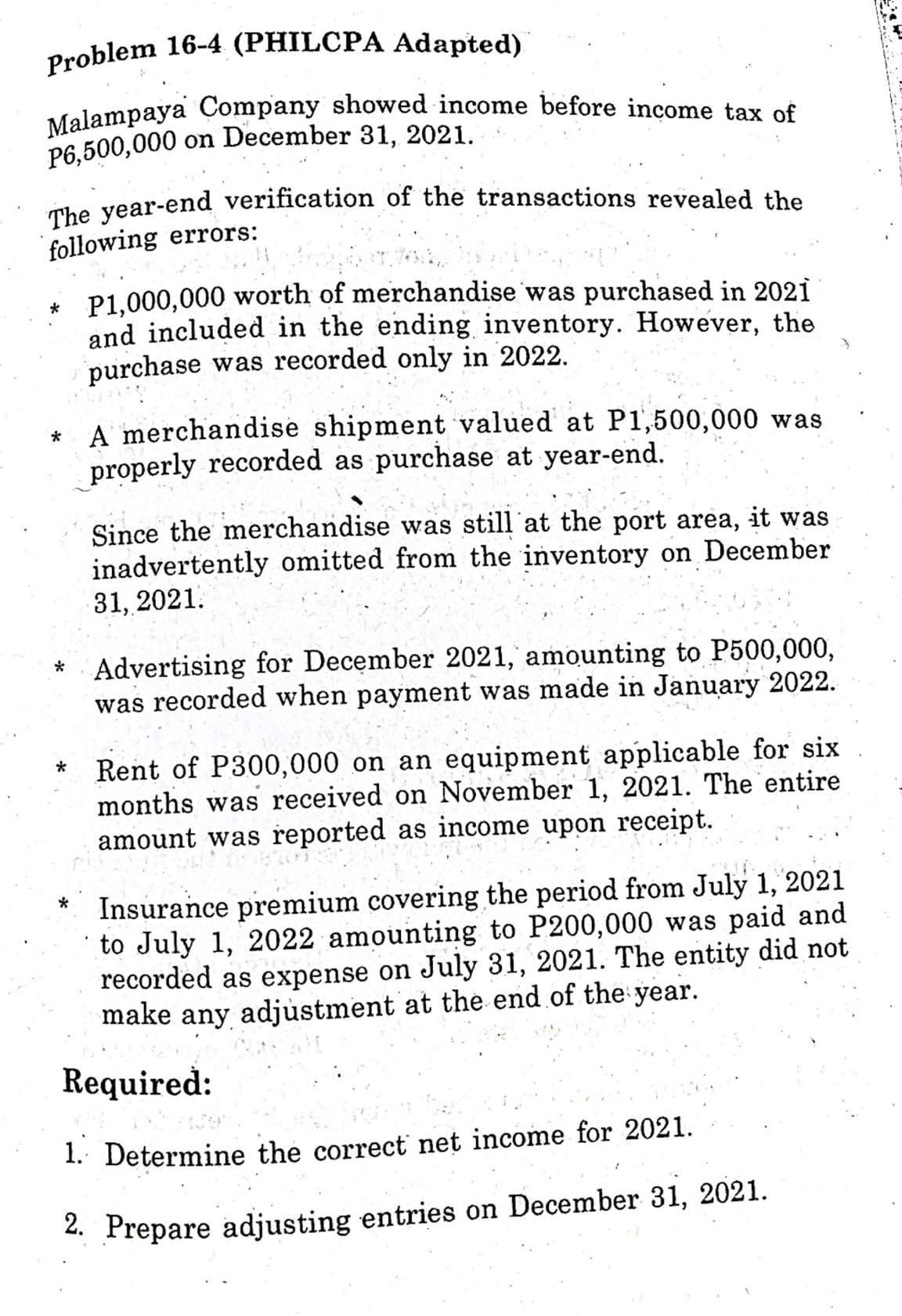

Problem 16-4 (PHILCPA Adapted) Malampaya Company showed income before income tax of P6,500,000 on December 31, 2021. The year-end verification of the transactions revealed the following errors: * P1,000,000 worth of merchandise was purchased in 2021 and included in the ending inventory. However, the purchase was recorded only in 2022. * A merchandise shipment valued at P1,500,000 was properly recorded as purchase at year-end. Since the merchandise was still at the port area, it was inadvertently omitted from the inventory on December 31, 2021. Advertising for December 2021, amounting to P500,000, was recorded when payment was made in January 2022. * Rent of P300,000 on an equipment applicable for six months was received on November 1, 2021. The entire amount was reported as income upon receipt. Insurance premium covering the period from July 1, 2021 to July 1, 2022 amounting to P200,000 was paid and recorded as expense on July 31, 2021. The entity did not make any adjustment at the end of the year. Required: 1. Determine the correct net income for 2021. 2. Prepare adjusting entries on December 31, 2021.

Problem 16-4 (PHILCPA Adapted) Malampaya Company showed income before income tax of P6,500,000 on December 31, 2021. The year-end verification of the transactions revealed the following errors: * P1,000,000 worth of merchandise was purchased in 2021 and included in the ending inventory. However, the purchase was recorded only in 2022. * A merchandise shipment valued at P1,500,000 was properly recorded as purchase at year-end. Since the merchandise was still at the port area, it was inadvertently omitted from the inventory on December 31, 2021. Advertising for December 2021, amounting to P500,000, was recorded when payment was made in January 2022. * Rent of P300,000 on an equipment applicable for six months was received on November 1, 2021. The entire amount was reported as income upon receipt. Insurance premium covering the period from July 1, 2021 to July 1, 2022 amounting to P200,000 was paid and recorded as expense on July 31, 2021. The entity did not make any adjustment at the end of the year. Required: 1. Determine the correct net income for 2021. 2. Prepare adjusting entries on December 31, 2021.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 76APSA

Related questions

Question

Transcribed Image Text:Problem 16-4 (PHILCPA Adapted)

Malampaya Company showed income before income tax of

P6,500,000 on December 31, 2021.

The year-end verification of the transactions revealed the

following errors:

* P1,000,000 worth of merchandise was purchased in 2021

and included in the ending inventory. However, the

purchase was recorded only in 2022.

A merchandise shipment valued at P1,500,000 was

properly recorded as purchase at year-end.

Since the merchandise was still at the port area, it was

inadvertently omitted from the inventory on December

31, 2021.

*Advertising for December 2021, amounting to P500,000,

was recorded when payment was made in January 2022.

*

Rent of P300,000 on an equipment applicable for six

months was received on November 1, 2021. The entire

amount was reported as income upon receipt.

Insurance premium covering the period from July 1, 2021

to July 1, 2022 amounting to P200,000 was paid and

recorded as expense on July 31, 2021. The entity did not

make any adjustment at the end of the year.

Required:

1. Determine the correct net income for 2021.

2. Prepare adjusting entries on December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College