Problem 16.028: Calculate BV for different years using the MACRS method An automated assembly robot that cost $368,000 has a depreciable ife of 5 years with a $90,000 salvage value. The MACRS (Modified Accelerated Cost Recovery System) depreciation rates for years 12, 3, and 6 are 20.00%, 32.00%, 19.20%, and 5.76%. respectively. What is the book value at the end of year 3? Year 5? Year 6? The book value at the end of year 3 is $[ The book value at the end of year 5 is $ The book value at the end of year 6 is $

Problem 16.028: Calculate BV for different years using the MACRS method An automated assembly robot that cost $368,000 has a depreciable ife of 5 years with a $90,000 salvage value. The MACRS (Modified Accelerated Cost Recovery System) depreciation rates for years 12, 3, and 6 are 20.00%, 32.00%, 19.20%, and 5.76%. respectively. What is the book value at the end of year 3? Year 5? Year 6? The book value at the end of year 3 is $[ The book value at the end of year 5 is $ The book value at the end of year 6 is $

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter21: Costs And The Supply Of Goods

Section: Chapter Questions

Problem 17CQ

Related questions

Question

13

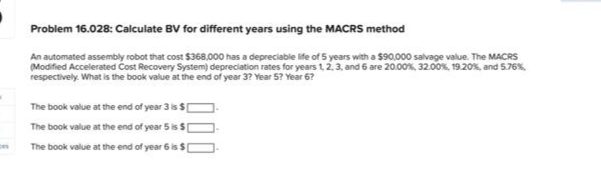

Transcribed Image Text:Problem 16.028: Calculate BV for different years using the MACRS method

An automated assembly robot that cost $368,000 has a depreciable ife of 5 years with a $90,000 salvage value. The MACRS

(Modified Accelerated Cost Recovery System) depreciation rates for years 12, 3, and 6 are 20.00%, 32.00%, 19.20%, and 5.76%,

respectively. What is the book value at the end of year 3? Year 5? Year 6?

The book value at the end of year 3 is $[

The book value at the end of year 5 is $

The book value at the end of year 6 is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning