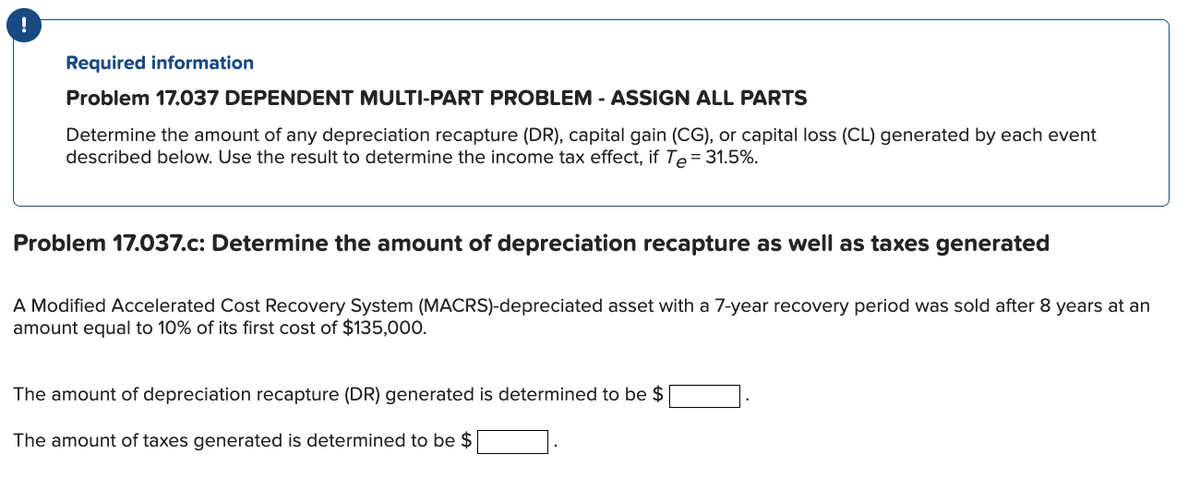

Required information Problem 17.037 DEPENDENT MULTI-PART PROBLEM - ASSIGN ALL PARTS Determine the amount of any depreciation recapture (DR), capital gain (CG), or capital loss (CL) generated by each event described below. Use the result to determine the income tax effect, if Te=31.5%. Problem 17.037.c: Determine the amount of depreciation recapture as well as taxes generated A Modified Accelerated Cost Recovery System (MACRS)-depreciated asset with a 7-year recovery period was sold after 8 years at an amount equal to 10% of its first cost of $135,000. The amount of depreciation recapture (DR) generated is determined to be $ The amount of taxes generated is determined to be $

Required information Problem 17.037 DEPENDENT MULTI-PART PROBLEM - ASSIGN ALL PARTS Determine the amount of any depreciation recapture (DR), capital gain (CG), or capital loss (CL) generated by each event described below. Use the result to determine the income tax effect, if Te=31.5%. Problem 17.037.c: Determine the amount of depreciation recapture as well as taxes generated A Modified Accelerated Cost Recovery System (MACRS)-depreciated asset with a 7-year recovery period was sold after 8 years at an amount equal to 10% of its first cost of $135,000. The amount of depreciation recapture (DR) generated is determined to be $ The amount of taxes generated is determined to be $

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter17: Long-term Investment Analysis

Section: Chapter Questions

Problem 1E: A firm has the opportunity to invest in a project having an initial outlay of $20,000. Net cash...

Related questions

Question

Solve it correctly not wrong

Transcribed Image Text:Required information

Problem 17.037 DEPENDENT MULTI-PART PROBLEM - ASSIGN ALL PARTS

Determine the amount of any depreciation recapture (DR), capital gain (CG), or capital loss (CL) generated by each event

described below. Use the result to determine the income tax effect, if Te= 31.5%.

Problem 17.037.c: Determine the amount of depreciation recapture as well as taxes generated

A Modified Accelerated Cost Recovery System (MACRS)-depreciated asset with a 7-year recovery period was sold after 8 years at an

amount equal to 10% of its first cost of $135,000.

The amount of depreciation recapture (DR) generated is determined to be $

The amount of taxes generated is determined to be $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning