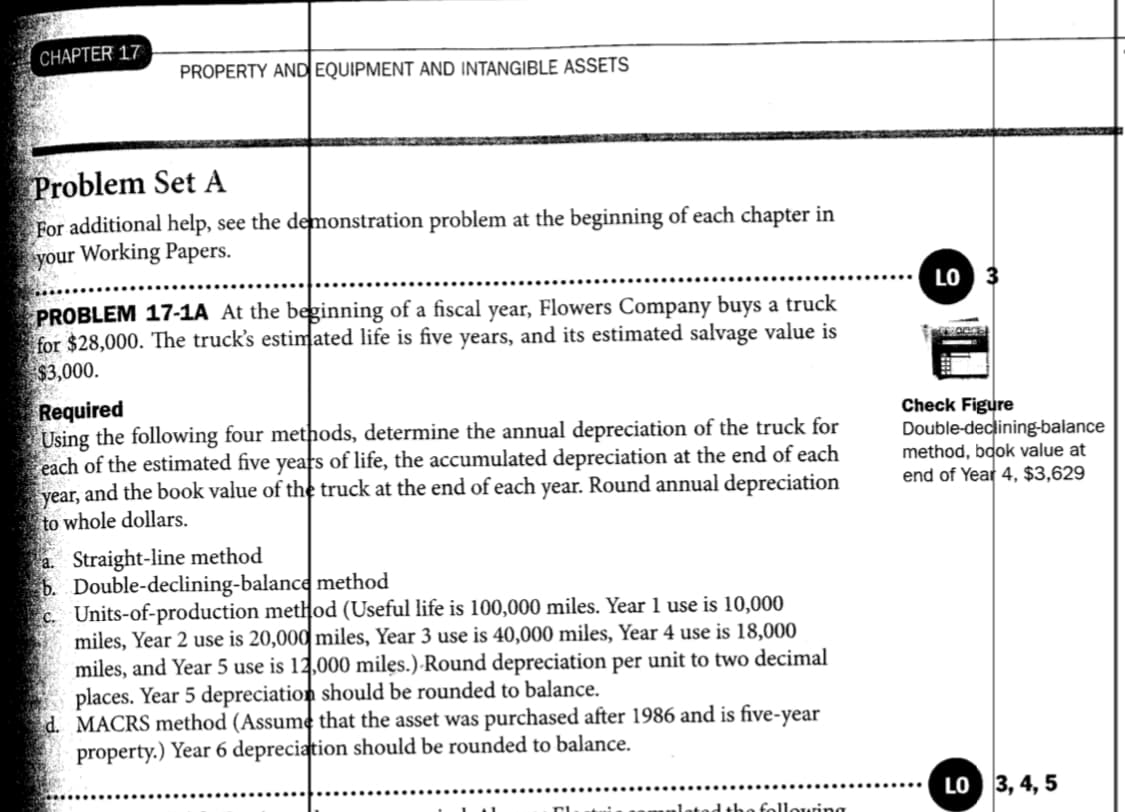

PROBLEM 17-1A At the beginning of a fiscal year, Flowers Company buys a truck for $28,000. The truck's estimated life is five years, and its estimated salvage value is $3,000. Required Using the following four methods, determine the annual depreciation of the truck for each of the estimated five years of life, the accumulated depreciation at the end of each and the book value of the truck at the end of each year. Round annual depreciation year, to whole dollars. a. Straight-line method b. Double-declining-balance method c. Units-of-production method (Useful life is 100,000 miles. Year1 use is 10,000 miles, Year 2 use is 20,000 miles, Year 3 use is 40,000 miles, Year 4 use is 18,000 miles, and Year 5 use is 12,000 milęs.) Round depreciation per unit to two decimal places. Year 5 depreciation should be rounded to balance. d. MACRS method (Assume that the asset was purchased after 1986 and is five-year property.) Year 6 depreciation should be rounded to balance.

PROBLEM 17-1A At the beginning of a fiscal year, Flowers Company buys a truck for $28,000. The truck's estimated life is five years, and its estimated salvage value is $3,000. Required Using the following four methods, determine the annual depreciation of the truck for each of the estimated five years of life, the accumulated depreciation at the end of each and the book value of the truck at the end of each year. Round annual depreciation year, to whole dollars. a. Straight-line method b. Double-declining-balance method c. Units-of-production method (Useful life is 100,000 miles. Year1 use is 10,000 miles, Year 2 use is 20,000 miles, Year 3 use is 40,000 miles, Year 4 use is 18,000 miles, and Year 5 use is 12,000 milęs.) Round depreciation per unit to two decimal places. Year 5 depreciation should be rounded to balance. d. MACRS method (Assume that the asset was purchased after 1986 and is five-year property.) Year 6 depreciation should be rounded to balance.

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 3CE

Related questions

Question

Can you help solve this. Please

Transcribed Image Text:CHAPTER 17

PROPERTY AND EQUIPMENT AND INTANGIBLE ASSETS

Problem Set A

For additional help, see the demonstration problem at the beginning of each chapter in

your Working Papers.

LO

PROBLEM 17-1A At the beginning of a fiscal year, Flowers Company buys a truck

for $28,000. The truck's estimated life is five years, and its estimated salvage value is

$3,000.

Required

Using the following four methods, determine the annual depreciation of the truck for

each of the estimated five years of life, the accumulated depreciation at the end of each

year, and the book value of the truck at the end of each year. Round annual depreciation

to whole dollars.

Check Figure

Double-declining-balance

method, bok value at

end of Year 4, $3,629

a. Straight-line method

b. Double-declining-balance method

Units-of-production method (Useful life is 100,000 miles. Year 1 use is 10,000

miles, Year 2 use is 20,000 miles, Year 3 use is 40,000 miles, Year 4 use is 18,000

miles, and Year 5 use is 12,000 miles.) Round depreciation per unit to two decimal

places. Year 5 depreciation should be rounded to balance.

d. MACRS method (Assume that the asset was purchased after 1986 and is five-year

property.) Year 6 depreciation should be rounded to balance.

LO 3, 4, 5

alatod the follouring

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning