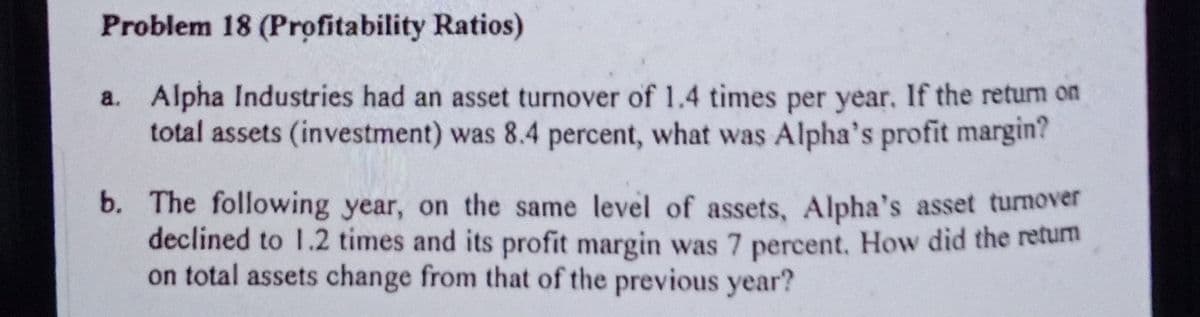

Problem 18 (Profitability Ratios) a. Alpha Industries had an asset turnover of 1.4 times per year. If the retun on total assets (investment) was 8.4 percent, what was Alpha's profit margin? b. The following year, on the same level of assets, Alpha's asset turnover declined to 1.2 times and its profit margin was 7 percent. How did the retui on total assets change from that of the previous year?

Problem 18 (Profitability Ratios) a. Alpha Industries had an asset turnover of 1.4 times per year. If the retun on total assets (investment) was 8.4 percent, what was Alpha's profit margin? b. The following year, on the same level of assets, Alpha's asset turnover declined to 1.2 times and its profit margin was 7 percent. How did the retui on total assets change from that of the previous year?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 19E

Related questions

Question

Transcribed Image Text:Problem 18 (Profitability Ratios)

a. Alpha Industries had an asset turnover of 1.4 times per year. If the retum on

total assets (investment) was 8.4 percent, what was Alpha's profit margin?

b. The following year, on the same level of assets, Alpha's asset turnover

declined to 1.2 times and its profit margin was 7 percent. How did the retum

on total assets change from that of the previous year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT