Problem 2 (Comprehensive Variance Analysis; Journal Entries) Moda Mills, Inc., is a large producer of men's and women's clothing. The company uses standard costs for all of its products. The standard costs and actual costs for a recent period are given below for one of the company's product lines (per unit of product): Standard Cost Actual Cost Direct materials: Standard: 4.0 yards at P3.60 per yard... Actual: 4.4 yards at P3..35 per yard... P14.40 P14.74 Direct labor: Standard: 1.6 hours at P4.50 per hour.. Actual: 1.4 hours at P4.85 per Variable manufacturing overhead: Standard: 1.6 hours at P1.80 per hour..... Actual: 1.4 hours at P2.15 per Total cost per unit...... 7.20 hour.. 6.79 2.88 hour .. 3.01 P24.54 P24.48 360 Chapter 10 During the period, the company produced 4,800 units of product. A comparison of standard and actual costs for the period on a total cost basis is shown below: P117,792 117.504 P 288 Actual costs: 4,800 units at P24.54... Standard costs: 4,800 units at P24.48 .... Difference in cost - unfavorable .. .. There was no inventory of materials on hand to start the period. During the period, 21,120 yards of materials were purchased, all of which were used in production. Required: 1. For direct materials: a. Compute the price and quantity variances for the period. b. Prepare journal entries to record all activity relating to direct materials for the period. For direct labor: 2. Compute the rate and efficiency variances. b. Prepare a journal entry to record the incurrence of direct labor for the period. a. 3. Compute the variable manufacturing overhead spending and efficiency variances. 4. On seeing the P288 total cost variance, the company's president stated, "This variance of P288 is only 0.2 % of the P117,504 standard cost for the period. It's obvious that our costs are well under control." Do you agree? Explain. State possible causes of each variance that you have computed.. 5.

Problem 2 (Comprehensive Variance Analysis; Journal Entries) Moda Mills, Inc., is a large producer of men's and women's clothing. The company uses standard costs for all of its products. The standard costs and actual costs for a recent period are given below for one of the company's product lines (per unit of product): Standard Cost Actual Cost Direct materials: Standard: 4.0 yards at P3.60 per yard... Actual: 4.4 yards at P3..35 per yard... P14.40 P14.74 Direct labor: Standard: 1.6 hours at P4.50 per hour.. Actual: 1.4 hours at P4.85 per Variable manufacturing overhead: Standard: 1.6 hours at P1.80 per hour..... Actual: 1.4 hours at P2.15 per Total cost per unit...... 7.20 hour.. 6.79 2.88 hour .. 3.01 P24.54 P24.48 360 Chapter 10 During the period, the company produced 4,800 units of product. A comparison of standard and actual costs for the period on a total cost basis is shown below: P117,792 117.504 P 288 Actual costs: 4,800 units at P24.54... Standard costs: 4,800 units at P24.48 .... Difference in cost - unfavorable .. .. There was no inventory of materials on hand to start the period. During the period, 21,120 yards of materials were purchased, all of which were used in production. Required: 1. For direct materials: a. Compute the price and quantity variances for the period. b. Prepare journal entries to record all activity relating to direct materials for the period. For direct labor: 2. Compute the rate and efficiency variances. b. Prepare a journal entry to record the incurrence of direct labor for the period. a. 3. Compute the variable manufacturing overhead spending and efficiency variances. 4. On seeing the P288 total cost variance, the company's president stated, "This variance of P288 is only 0.2 % of the P117,504 standard cost for the period. It's obvious that our costs are well under control." Do you agree? Explain. State possible causes of each variance that you have computed.. 5.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 3PA: Direct materials, direct labor, and factory overhead cost variance analysis Mackinaw Inc. processes...

Related questions

Question

Please answer 4 and 5. Thank you .

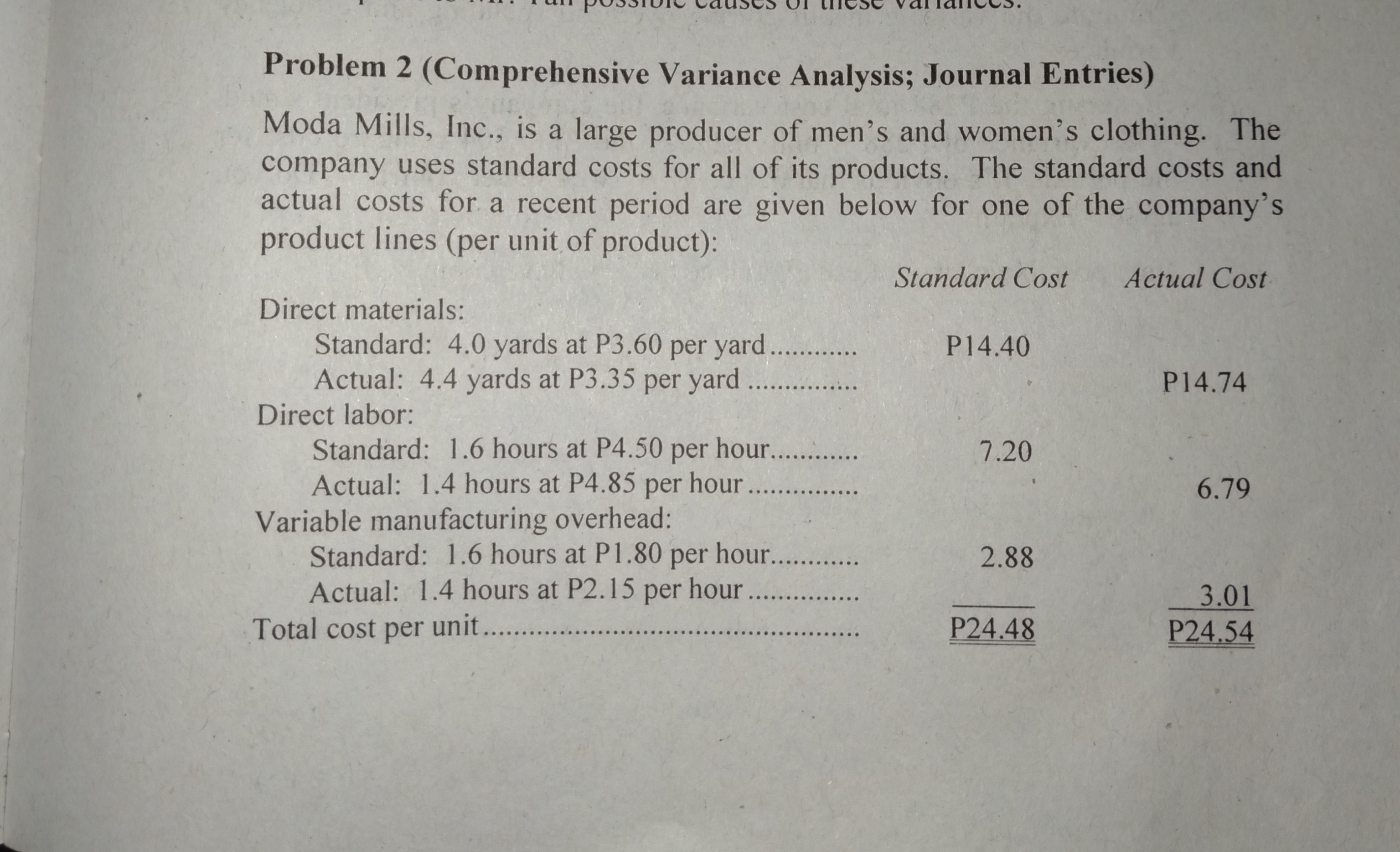

Transcribed Image Text:Problem 2 (Comprehensive Variance Analysis; Journal Entries)

Moda Mills, Inc., is a large producer of men's and women's clothing. The

company uses standard costs for all of its products. The standard costs and

actual costs for a recent period are given below for one of the company's

product lines (per unit of product):

Standard Cost

Actual Cost

Direct materials:

Standard: 4.0 yards at P3.60 per yard...

Actual: 4.4 yards at P3..35 per yard...

P14.40

P14.74

Direct labor:

Standard: 1.6 hours at P4.50 per hour..

Actual: 1.4 hours at P4.85 per

Variable manufacturing overhead:

Standard: 1.6 hours at P1.80 per hour.....

Actual: 1.4 hours at P2.15 per

Total cost per unit......

7.20

hour..

6.79

2.88

hour ..

3.01

P24.54

P24.48

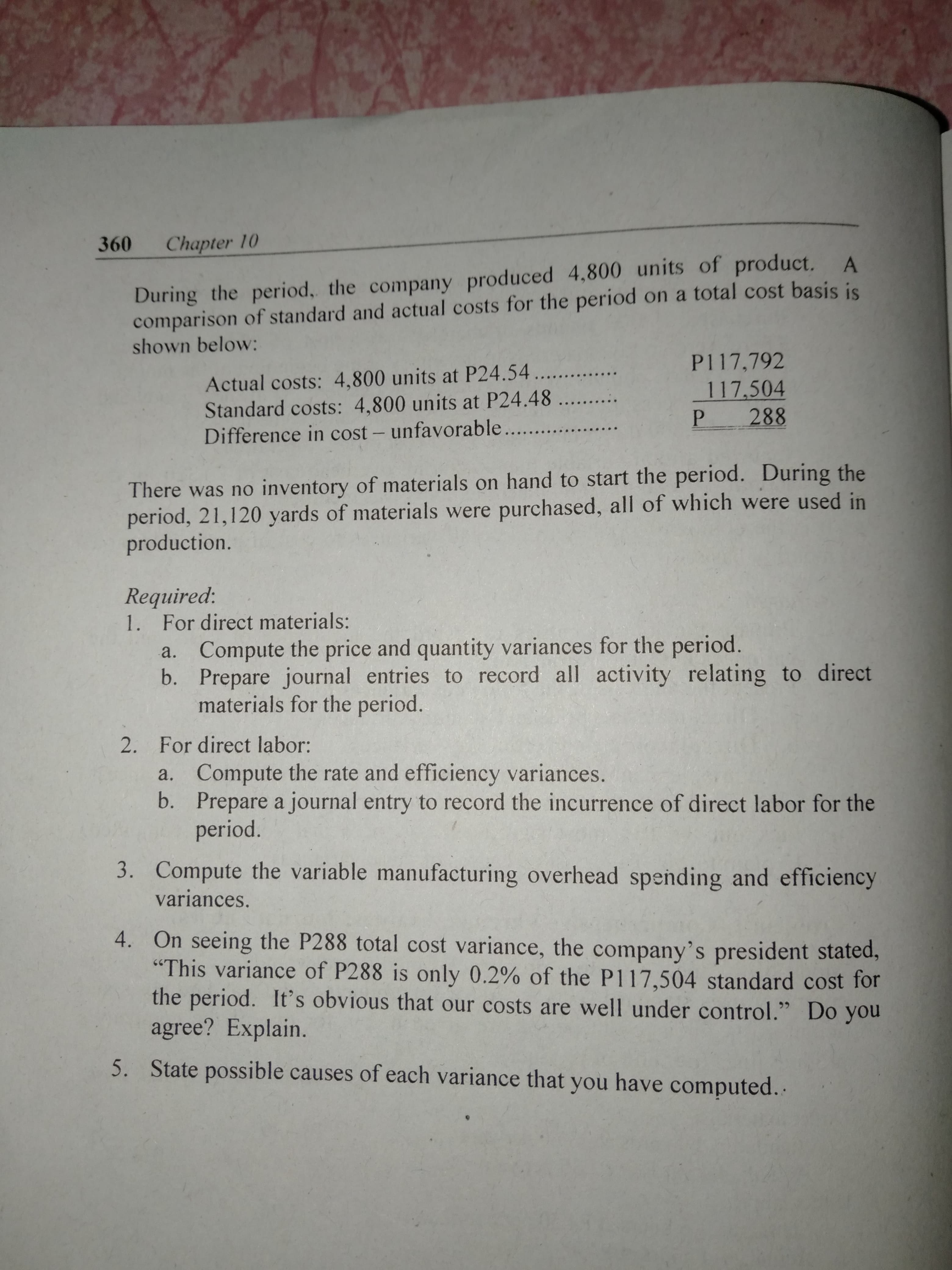

Transcribed Image Text:360 Chapter 10

During the period, the company produced 4,800 units of product. A

comparison of standard and actual costs for the period on a total cost basis is

shown below:

P117,792

117.504

P 288

Actual costs: 4,800 units at P24.54...

Standard costs: 4,800 units at P24.48 ....

Difference in cost - unfavorable .. ..

There was no inventory of materials on hand to start the period. During the

period, 21,120 yards of materials were purchased, all of which were used in

production.

Required:

1. For direct materials:

a. Compute the price and quantity variances for the period.

b. Prepare journal entries to record all activity relating to direct

materials for the period.

For direct labor:

2.

Compute the rate and efficiency variances.

b.

Prepare a journal entry to record the incurrence of direct labor for the

period.

a.

3. Compute the variable manufacturing overhead spending and efficiency

variances.

4. On seeing the P288 total cost variance, the company's president stated,

"This variance of P288 is only 0.2 % of the P117,504 standard cost for

the period. It's obvious that our costs are well under control." Do you

agree? Explain.

State possible causes of each variance that you have computed..

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning