Problem 3: Galore Company ventured into construction of a condominium in Makati which is rated as the largest state-of- the-art structure. The entity's board of directors decided that instead of selling the condominium, the entity would hold this property for purposes of earning rentals by letting out space to business executives in the area. The construction of the condominium was completed and the property was placed in service on January 1 2019. The cost of the construction was P50,000,000. The useful life of the condominium is 25 years and its residual value is P5,000,000. An independent valuation expert provided the following fair value at each subsequent year-end: December 31, 2019 December 31, 2020 December 31, 2021 55,000,000 53,000,000 60,000,000 Required: Prepare all indicated entries for 2019, 2020 and 2021 assuming the investment property is accounted for under the cost model and fair value model.

Problem 3: Galore Company ventured into construction of a condominium in Makati which is rated as the largest state-of- the-art structure. The entity's board of directors decided that instead of selling the condominium, the entity would hold this property for purposes of earning rentals by letting out space to business executives in the area. The construction of the condominium was completed and the property was placed in service on January 1 2019. The cost of the construction was P50,000,000. The useful life of the condominium is 25 years and its residual value is P5,000,000. An independent valuation expert provided the following fair value at each subsequent year-end: December 31, 2019 December 31, 2020 December 31, 2021 55,000,000 53,000,000 60,000,000 Required: Prepare all indicated entries for 2019, 2020 and 2021 assuming the investment property is accounted for under the cost model and fair value model.

Chapter17: Property Transactions: §1231 And Recapture Provisions

Section: Chapter Questions

Problem 40P

Related questions

Question

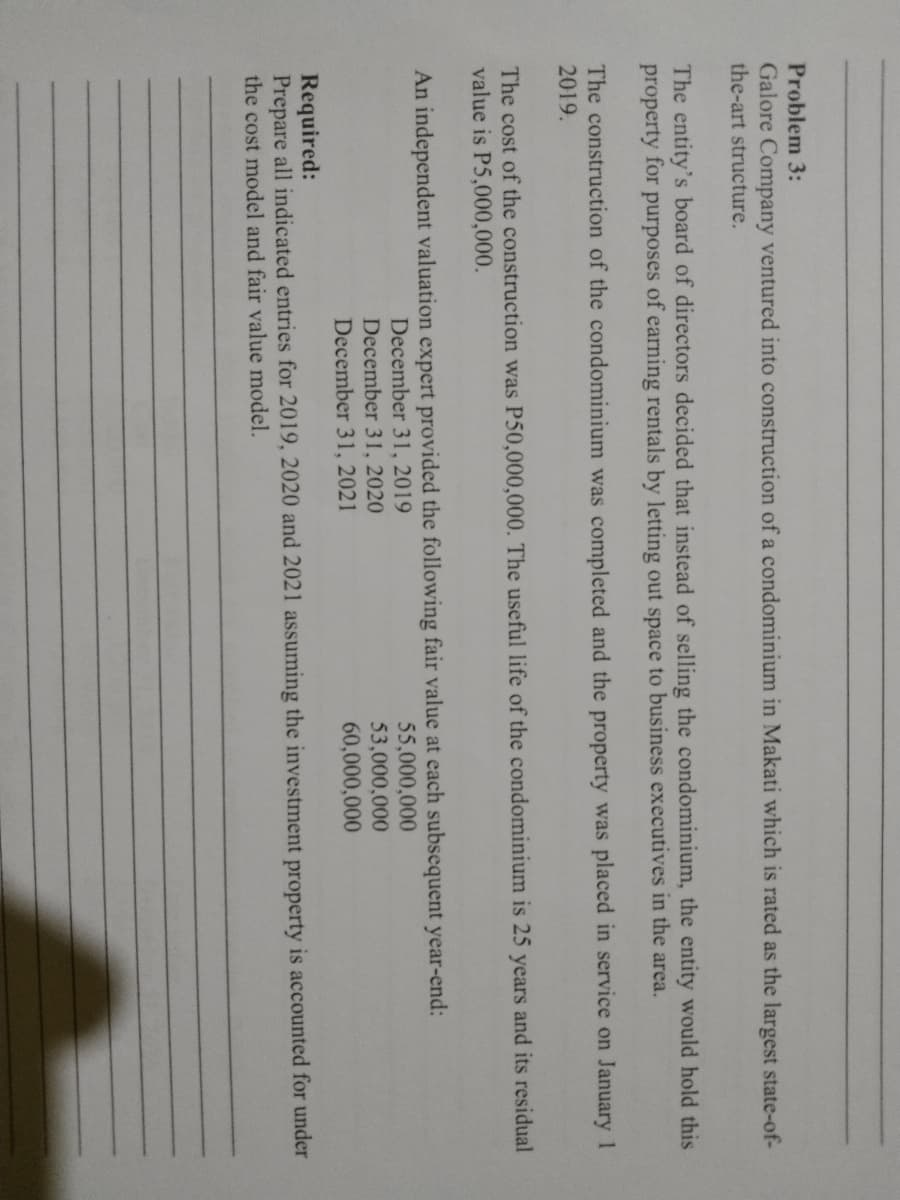

Transcribed Image Text:Problem 3:

Galore Company ventured into construction of a condominium in Makati which is rated as the largest state-of-

the-art structure.

The entity's board of directors decided that instead of selling the condominium, the entity would hold this

of earning rentals by letting out space to business executives in the area.

property for

purposes

The construction of the condominium was completed and the property was placed in service on January 1

2019.

The cost of the construction was P50,000,000. The useful life of the condominium is 25 years and its residual

value is P5,000,000.

An independent valuation expert provided the following fair value at each subsequent year-end:

55,000,000

53,000,000

60,000,000

December 31, 2019

December 31, 2020

December 31, 2021

Required:

Prepare all indicated entries for 2019, 2020 and 2021 assuming the investment property is accounted for under

the cost model and fair value model.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage