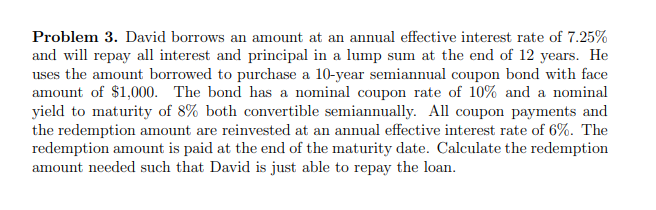

Problem 3. David borrows an amount at an annual effective interest rate of 7.25% and will repay all interest and principal in a lump sum at the end of 12 years. He uses the amount borrowed to purchase a 10-year semiannual coupon bond with face amount of $1,000. The bond has a nominal coupon rate of 10% and a nominal yield to maturity of 8% both convertible semiannually. All coupon payments and the redemption amount are reinvested at an annual effective interest rate of 6%. The redemption amount is paid at the end of the maturity date. Calculate the redemption amount needed such that David is just able to repay the loan.

Problem 3. David borrows an amount at an annual effective interest rate of 7.25% and will repay all interest and principal in a lump sum at the end of 12 years. He uses the amount borrowed to purchase a 10-year semiannual coupon bond with face amount of $1,000. The bond has a nominal coupon rate of 10% and a nominal yield to maturity of 8% both convertible semiannually. All coupon payments and the redemption amount are reinvested at an annual effective interest rate of 6%. The redemption amount is paid at the end of the maturity date. Calculate the redemption amount needed such that David is just able to repay the loan.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter10: Long-term Liabilities

Section: Chapter Questions

Problem 10.2E

Related questions

Question

Transcribed Image Text:Problem 3. David borrows an amount at an annual effective interest rate of 7.25%

and will repay all interest and principal in a lump sum at the end of 12 years. He

uses the amount borrowed to purchase a 10-year semiannual coupon bond with face

amount of $1,000. The bond has a nominal coupon rate of 10% and a nominal

yield to maturity of 8% both convertible semiannually. All coupon payments and

the redemption amount are reinvested at an annual effective interest rate of 6%. The

redemption amount is paid at the end of the maturity date. Calculate the redemption

amount needed such that David is just able to repay the loan.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College